Bank failures, interest rate hikes, inflation, labor shortages—for business leaders, 2023 has been a very long year. No surprise that last month CEOs’ rating of current business conditions hit a multi-year low.

But that sentiment seems to be shifting. Chief executives we polled in our December CEO Confidence Index seem increasingly optimistic that the new year will bring a much-improved business environment.

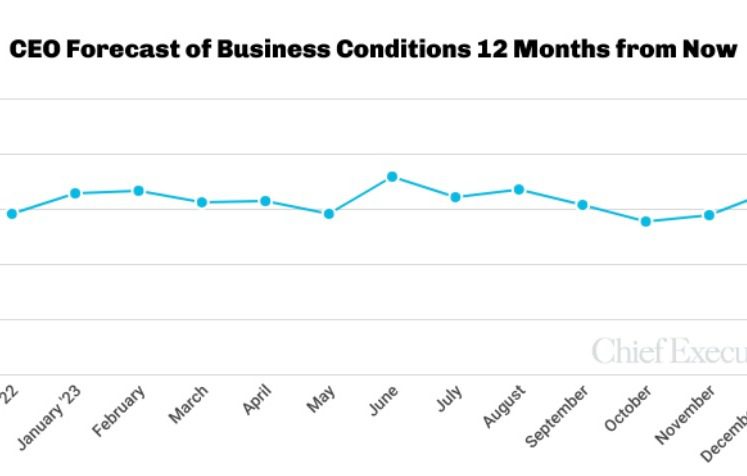

In a turn from earlier this quarter, the 167 CEOs polled December 5-7 as part of our monthly reading of CEO confidence in the economy boosted their outlook for 2024 by 7.5 percent this month from a month earlier. Their 6.3 out of 10 forecast for business conditions 12 months from now is one of the highest readings of the year.

This revived optimism extends beyond just forecasts for the future. CEOs’ rating of current business conditions also climbed by 7 percent from last month, to 6.1 out of 10, where 10 is Excellent and 1 is Poor, after hitting a multi-year low in November.

Driving the optimism: A sense that inflation appears to be under control, and the Fed will not likely need to raise interest rates in 2024 and may even begin trimming, setting the stage for a new cycle of growth.

“Order intake is increasing. Wage pressure isn’t as bad. Supply chain lead times are decreasing. Supply chain price increases have stabilized,” lists David Cox, CEO of the Bradbury Group, an industrial equipment manufacturer, as reasons to explain his optimistic view of future business conditions.

Thomas L. Doorley III, chairman and founder of Sage Group, agrees. “The economy is better fundamentally than the popular view. It is a mistake for investors (VC & PE) to be holding so much dry powder. And equally wrong for companies to not be investing in growth.”

Asked whether they believe conditions will improve or decline in the year to come, 42 percent of CEOs—the highest level this year—now forecast improving conditions 12 months out versus the 29 percent who forecast worsening conditions and the 29 percent who say the business climate will remain unchanged. That’s a sharp shift from just a couple months ago, when more CEOs were predicting worsening conditions than improving conditions in 2024.

THE YEAR AHEAD

Deeper in the numbers, a higher proportion of CEOs are also projecting growth over the next 12 months across profits, revenues, hiring and capex in December compared to the month prior, finishing the year with good news.

Some 63 percent of CEOs are now projecting profit growth over the next 12 months, compared to only 47 percent last month. The proportion is now back in line with Q3, before the dips in confidence and outlook in the fall.

More CEOs are also optimistic that revenues will increase by this time next year, with 73 percent forecasting improvements compared to only 56 last month.

The proportion of CEOs planning increases in capex over the next 12 months shot up in December, to 49 percent, after two months of consecutive drops—reaching the highest proportion since June. And after a 13 percent climb in November, the proportion of CEOs planning increases in hiring ticked up another 6 percent, to 44 percent.

Still, for many of those we polled, there was broad agreement that there are plenty of issues for business to contend with—including persistent inflation, a tight labor market, uncontrolled government spending, geopolitical turmoil and an unpredictable stock market—and those will all remain worries into the new year.

“While the pandemic has officially passed, we are seeing a number of businesses we deal with that continue to struggle with a significant talent drain, remote work schedules, and general inflation,” says John W. Gessert, President and Chief Executive Officer at American Plastic Toys Inc. “There seems to be a pandemic ‘hangover’ for any number of associated companies.” His rating of current and future conditions? Five out of 10 for both.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. See additional information about the Index and prior months data.