This year hasn’t been easy to navigate for business leaders, but Chief Executive’s latest CEO Confidence Index finds renewed hope among the country’s business chiefs. CEO confidence jumped more than 10 percent in the first week of October, to land at 5.7 on our 10-point scale, the second highest rating of the year since January’s 6.3/10.

CEOs’ outlook for the year ahead also improved, finally climbing out of “Weak” territory (where it spent most of the year) into “Good” territory—though just barely, at 6.0 out of 10, the exact “Good” marker on the scale. That’s an 8 percent jump since September (5.5) and a 6 percent improvement over current conditions.

Few CEOs provided rationale for their optimism in this month’s survey, though some cited the hope of lower interest rates and deregulation as top drivers, while others said their sector was simply performing well.

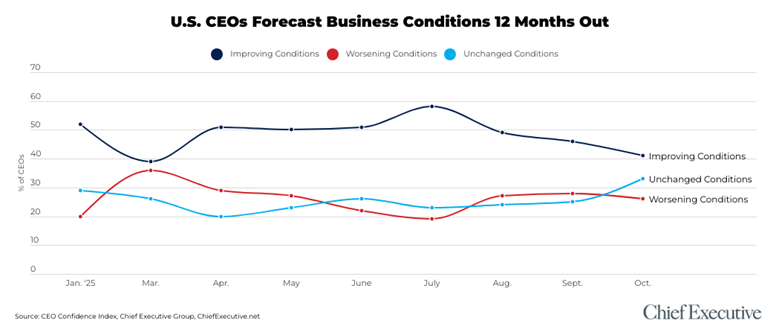

Still, just 41 percent of CEOs say they expect meaningful improvement in the year ahead, down from 46 percent in September. It is the lowest proportion since March, when the tariffs announcement sent confidence plummeting to multi-year lows. These findings suggest CEOs are more comfortable with where we are today than where they were just a month ago, but they’re also less convinced that business in the U.S. is on the cusp of a significant upswing.

“The impact of tariffs is having a dragging impact on manufacturing, with higher costs, while at the same time slowing growth,” said Marvin Cunningham, president of Long-Stanton Manufacturing, a nearly 200-year-old metal stamping family business in Ohio. “I have several customers that are in the process of liquidating as they cannot continue to do business at the current tariff levels. Losing their business will make it harder to achieve any growth next year, and we are projecting a +10 percent reduction in sales.”

Even among those who forecast improvements over the coming months, the general sentiment is that conditions will remain subdued. As one mid-market CEO in the construction industry put it: “Could be much better if not for the uncertainty Trump is causing.”

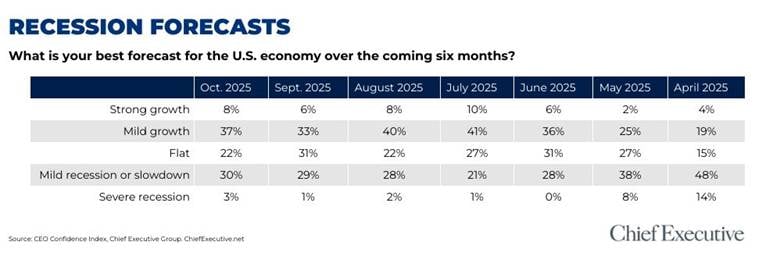

RECESSION FORECASTS

Recession fears have been a significant driver of sentiment in 2025. Those fears have subsided, giving way to growth forecasts. But while the proportion of CEOs expecting economic growth over the next six months continues to increase, from 39 percent in September to 45 percent, the proportion expecting a slowdown is also increasing, from 30 percent to 33 percent over the same period.

“Uncertainty coupled with fears of a market correction make it difficult to predict an upbeat forecast,” said one CEO in the technology space. “Still not clear what impact tariffs, government shutdown, lackluster job numbers, continued inflation, lack of immigrant workers and other factors will have.”

Several others noted that while the tariffs haven’t yet caused a significant contraction, as had been expected, they nevertheless anticipate these effects will transpire sooner rather than later. “Eventually product and capital investment costs will rise, and employment will stagnate,” said one CEO echoing others.

MID-MARKET OPTIMISM

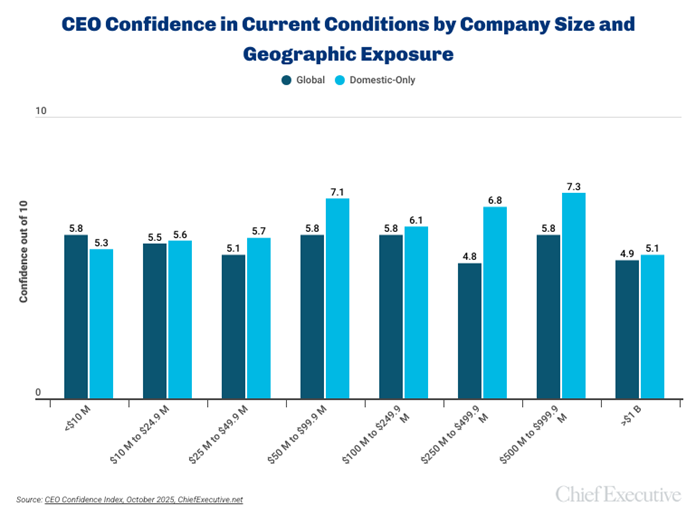

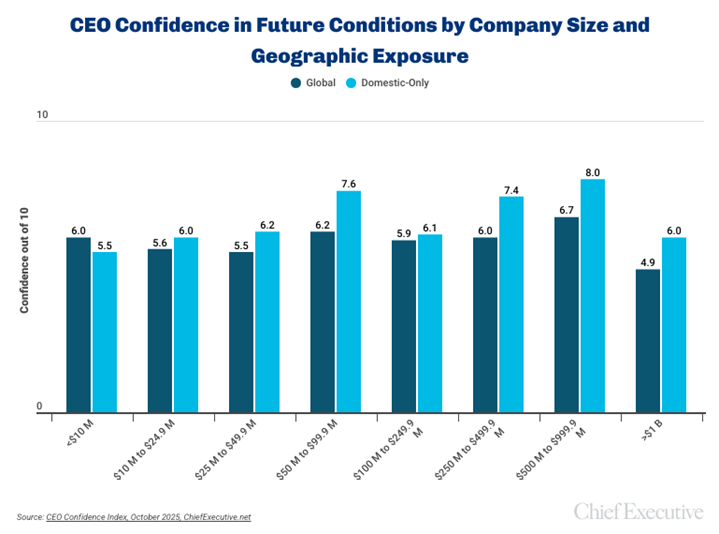

Digging deeper into the data, we find that most of October’s renewed optimism stems from CEOs who lead mid-sized organizations. A comparative analysis shows that the highest ratings of both current and future business conditions are from CEOs at companies with revenues between $50 million and $1 billion.

Among the least optimistic? CEOs at companies of more than $1 billion.

“Macroeconomic policy, increasing costs, margin pressures and uncertainty are putting a foot on the throat of our industry and a lot of business. Every time we think we are working out of it, a new tariff or policy comes out of nowhere that puts downward pressure on consumers and businesses,” said the CEO of a large retail organization who expects improvements in 2026 but only from a 1 out of 10 today to a 5 by this time next year.

Large companies also are more likely to have a greater international footprint—thus making them more prone to the whipsawing dynamics of Trump administration tariff policy and ever-changing geopolitical conflicts.

“There is not a robust consumer market in any of the global segments that we serve,” said a large consumer manufacturing CEO. “Chinese competition is aggressive, and operating to a different economic equation than Western financial markets (e.g., maintain export volume and keep people employed vs. pure profit motive).”

As you’d expect, the October data finds firms that operate solely in the U.S. generally report greater optimism than their peers with global operations. Among firms sized $250 million to $500 million, for example, domestic-exclusive CEOs provide a rating of current conditions at 6.8 out of 10––42 percent higher than those who operate globally.

The Year Ahead

Looking more specifically at how all this will impact their respective companies, CEOs report:

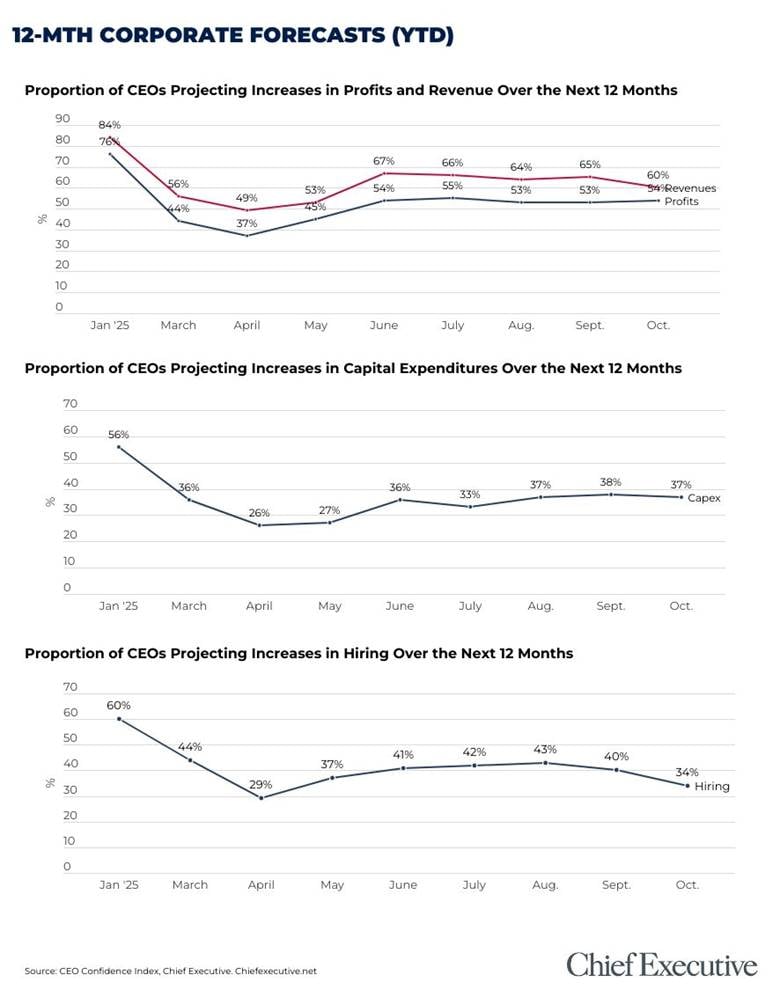

- 60 percent anticipate increasing revenues in the year ahead, vs. 65 percent who forecasted growth one month prior.

- 54 percent expect to increase profitability, vs. 53 percent in September.

- 37 percent plan to increase capital expenditures, vs. 38 percent in September.

- 34 percent plan to add to their headcount, down from 40 percent just one month ago.

“Persistent federal administration decisions are all over the place,” said one mid-market manufacturing CEO. “We’re having a tough time forecasting and pricing.”

“Uncertainty is still a problem with unemployment sneaking up, political quagmires, the fed unconsciousness and unpredictable tariffs,” said the CEO of a middle-market industrial manufacturing company with international operations.