Do you have a reputation for innovation? Does your organization? Is it something you think about as an important strategic asset for your organization? If not, our research shows that you should. Here’s why.

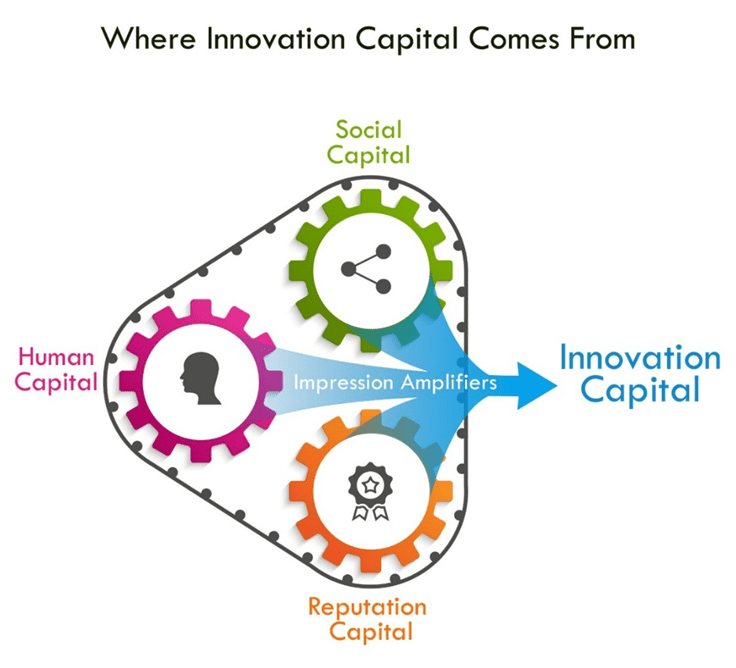

The most successful leaders and organizations have something unique that allows them to attract the support to change their organizations and bring new ideas to life. Most of all, they use this special ability to create new value through innovation. Our study of hundreds of S&P 500 CEOs shows some are better than others at building this quality that separates them from the pack, what we call innovation capital—an intangible capital, like political capital, that helps you win backing to turn novel ideas into reality. Innovation capital (see Figure 1) comes from three primary sources: your innovation-specific human capital (for example, your ability to see opportunities and lead the creative problem solving process), your innovation-specific social capital (connections with innovators, entrepreneurs, big investors, organizational leaders) and your innovation-specific reputation capital (your reputation and track record for innovation).

In our research, we quantified the value of a reputation for innovation, using metrics such as how leaders and their organizations are perceived in the media. Using these and other measures, we were able to rank leaders in our Forbes ranking of “Most Innovative Leaders.” (see Forbes Most Innovative Leaders). We then interviewed them to understand how they build their innovation capital and the impact it has upon their ability to win support to do new things.

Take Elon Musk as an example. Musk is ranked second behind Jeff Bezos on our list. Musk’s innovation capital explains why he was able to raise over a billion dollars to enter one of the most historically unattractive industries in the world (automobiles) and why he can simply mention “Hyperloop,” an idea that had been around since the early 1900s, and interest in the idea suddenly explodes, leading financial backers to step in to fund a company (see Figure 1.1).

Musk’s innovation capital also explains why talented people rush to work at the companies he has founded and why SpaceX president Gwynne Shotwell has said, “We rarely lose a candidate.” And finally, Musk’s reputation for innovation explains why twenty-two million people follow his every tweet. Due to his reputation for innovation, Musk can assemble the resources necessary to convert novel ideas into transformative realities. His ability to draw human and financial resources to Tesla and SpaceX is what makes him such a valuable leader.

But we learned that organizations also benefit from having innovation capital. Consider how Amazon’s innovation reputation gives it an advantage over Walmart. Although Amazon and Wal-Mart are both large, successful discount retailers battling for dominance, when the two companies announce new initiatives (especially innovative ones), they receive dramatically different responses from shareholders. Historically, Amazon has launched dozens of new products and services, often outside of its retail business, even as it delivered low or negative profits. It launched Amazon Web Services and introduced the Kindle. It experimented with drone delivery. It acquired companies that didn’t seem near the core retail business at all, like Twitch, a video game company and LoveFilm, a live streaming company. Furthermore, not all Amazon’s innovation efforts were a success. Amazon’s Fire Phone was a memorable flame out. Indeed CEO founder Jeff Bezos once admitted, “I’ve made billions of dollars of failures at Amazon.com. Literally.” And all the while the company has had no trouble getting the capital needed to try wild new experiments.

But not so for Walmart. If Walmart’s profits dipped even a little, the capital markets would penalize the stock. When Walmart engaged in acquisitions that were in retail but seemed a stretch from the core—like MooseJaw, outdoor retailer of brands like Patagonia and Northface, and Modcloth.com, a women’s vintage-inspired retailer—the market response was tepid at best. When Wal-Mart announced in 2015 that they would cut profits to reinvest in store improvements and innovation, the stock price collapsed nearly 30% while the CEO was speaking. Why?

We had a hunch that it had something to do with the distinct reputations of the two companies. Amazon was known for innovation. Walmart for efficiency. To verify that hunch we measured the media reputation for innovation for both companies over the past 15 years and found that Amazon had almost 10x the innovation reputation as Walmart. We then looked at the stock market response to Amazon’s acquisitions versus Walmart’s from 2000-2017 and discovered that Amazon received an average bump to its market value of .70 percent with each acquisition—which translated into an average increase of roughly $975 million. In contrast, Walmart got only .02 percent increase in market value from its acquisitions. Investors simply didn’t support Walmart acquiring to expand into new arenas like Amazon. Moreover, we found that this effect was not just isolated to Amazon and Walmart. Our analysis of the S&P 500 companies showed that a reputation for innovation is a valuable company asset. In fact, companies with a strong reputation for innovation (in the top 10%) achieved market value multiples (market value to book value multiples; these are indicators of value creation) that were 2x higher than firms at the 50% decile, and almost 3x higher than firms at or below the 40th decile. In the case of Amazon versus Walmart, Amazon’s market multiple is over 5x the book value of its assets whereas Walmart’s market multiple is only 1.5x the book value of its assets.