Click here for the full rankings:

2016 S&P 500 WEALTH CREATORS INDEX

2016 MID-MARKET WEALTH CREATORS INDEX

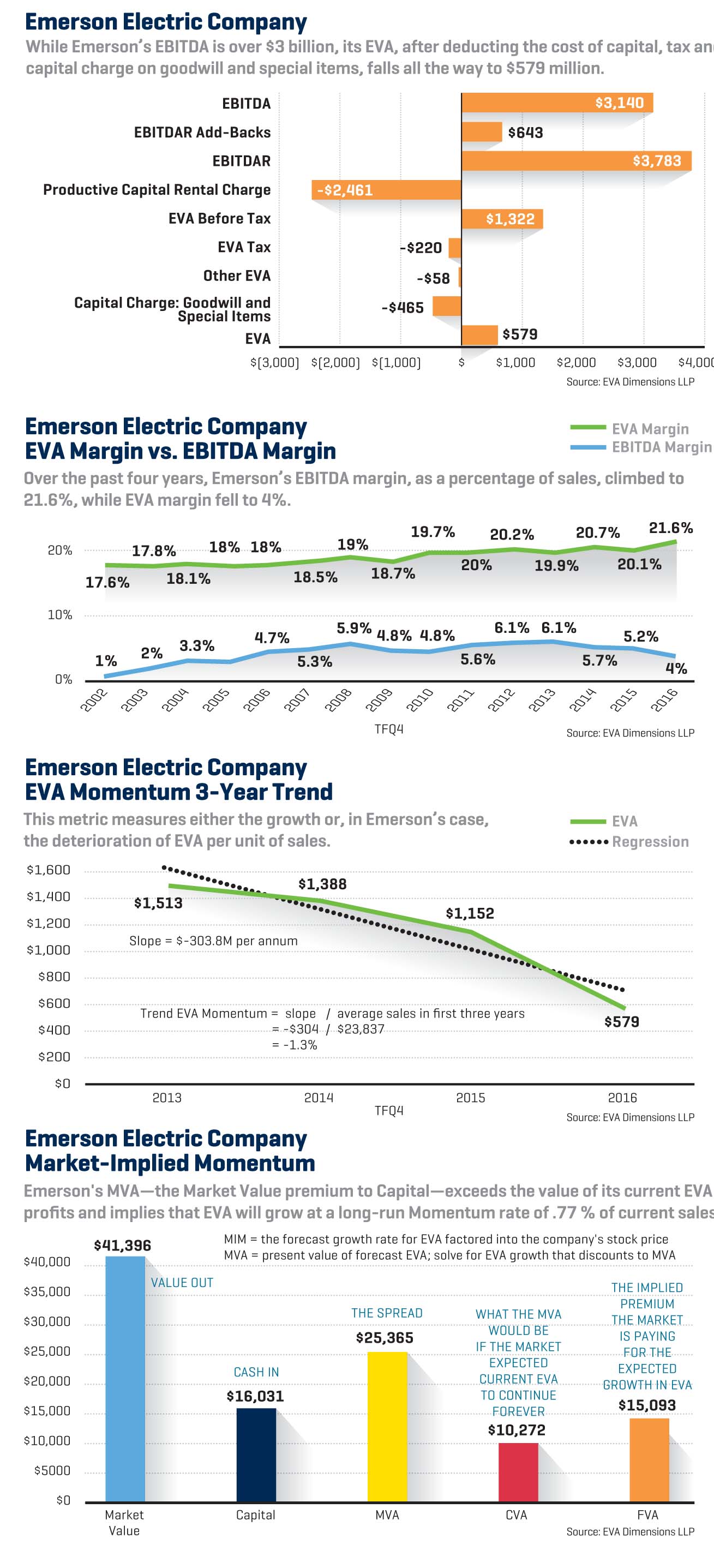

One way to gauge a company’s net value creation is by using EVA, or Economic Value Added. EVA, essentially, is profit remaining after subtracting the full cost of the capital the business uses, including a minimum shareholder return to compensate for risk.

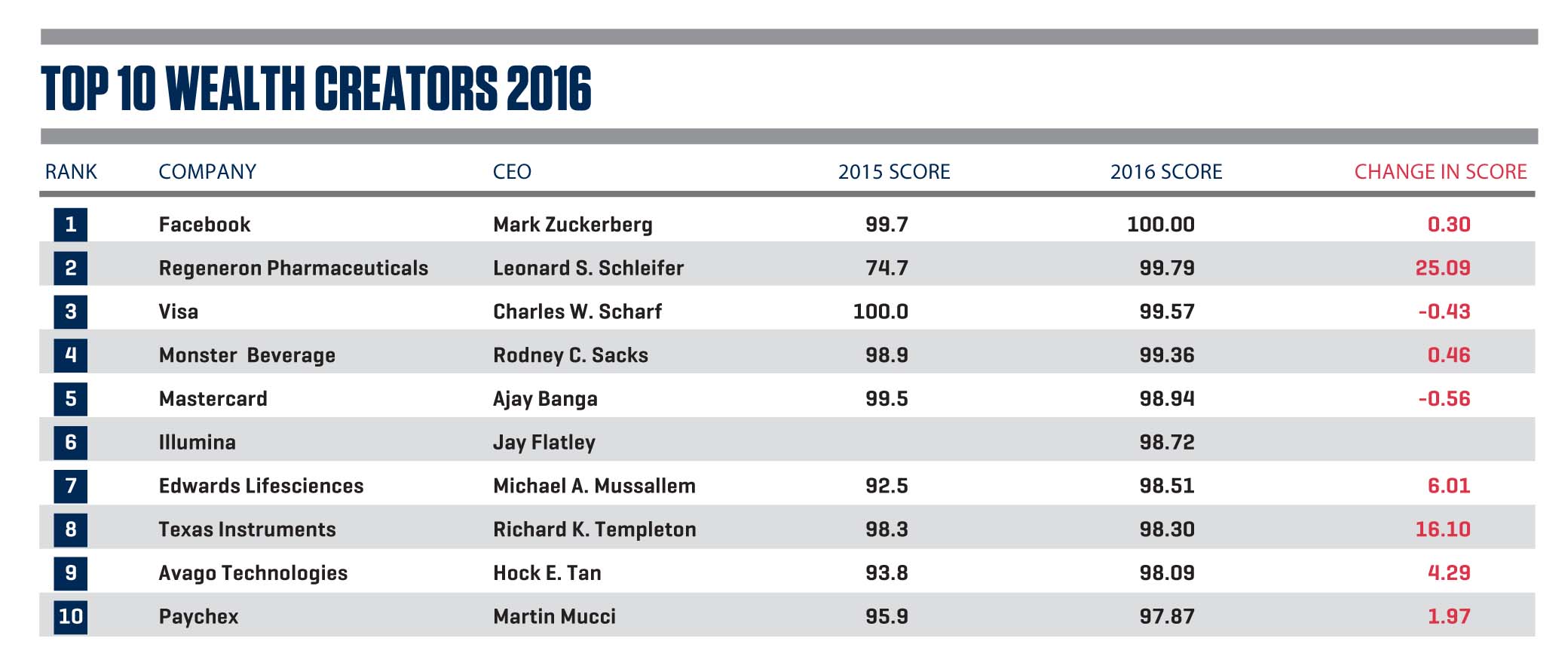

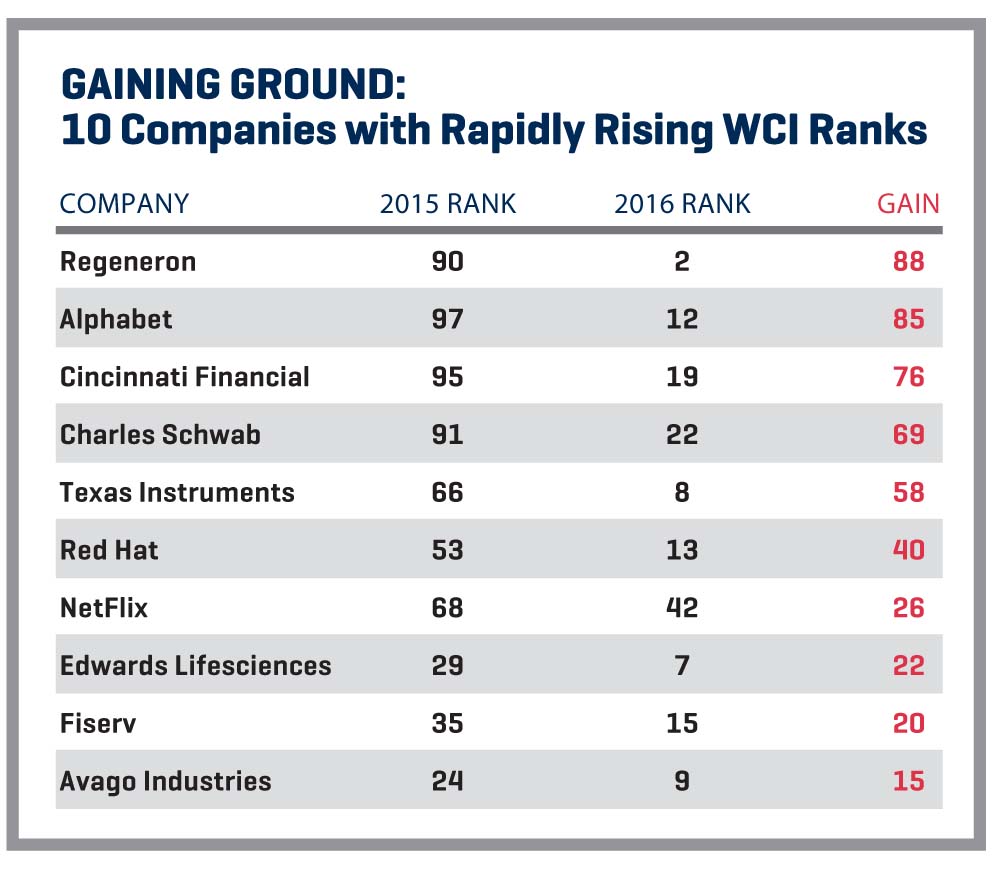

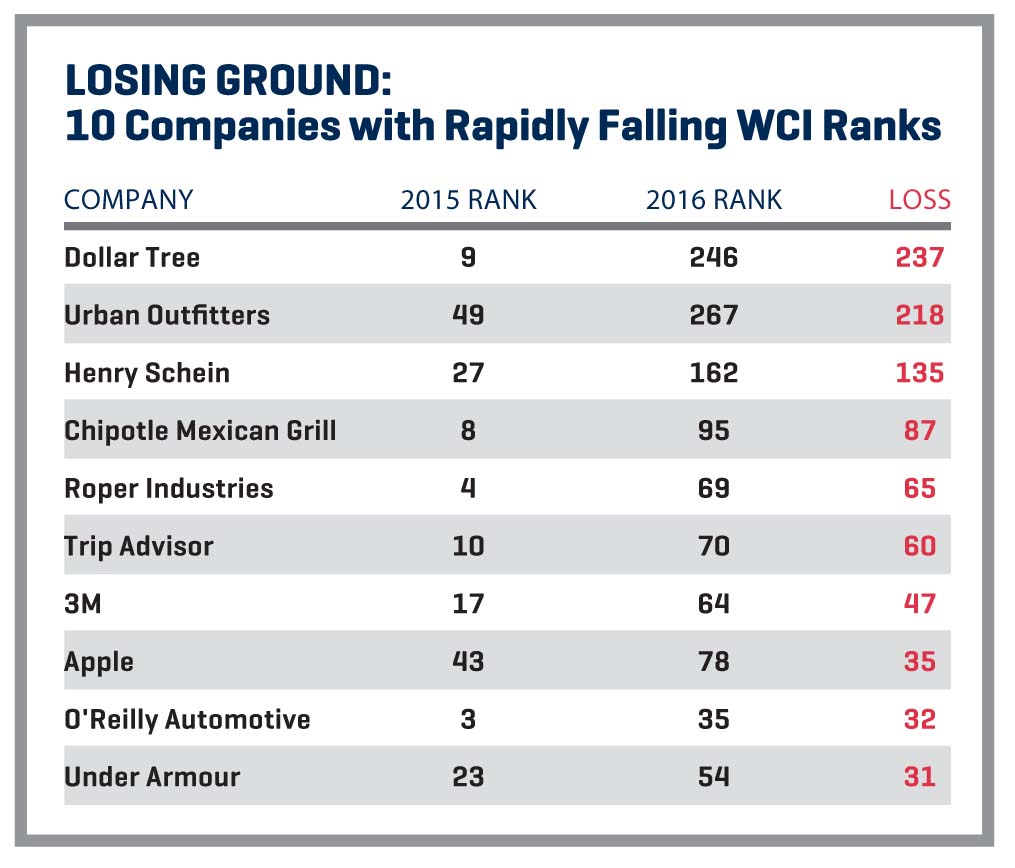

Chief Executive’s Wealth Creation Index (WCI) ranks the performance of companies in the S&P 500 index, and their CEOs, based on the EVA model. (Only companies for which the CEOs were in their roles for the three-year period ending on June 30, 2016, were ranked.)

Chief Executive’s Wealth Creation Index (WCI) ranks the performance of companies in the S&P 500 index, and their CEOs, based on the EVA model. (Only companies for which the CEOs were in their roles for the three-year period ending on June 30, 2016, were ranked.)

For this year’s rankings, the ninth annual, we chose to offer a deeper dive into the metrics used to calculate WCI scores and illustrations of why and how they work. The full list of top wealth creators can be found at ChiefExecutive.net.

As the graphs illustrate, and as Drew Morris of Great Numbers! and Bennett Stewart of EVA Dimensions explain, the rankings were calculated based on four criteria:

As the graphs illustrate, and as Drew Morris of Great Numbers! and Bennett Stewart of EVA Dimensions explain, the rankings were calculated based on four criteria:

1) EVA Momentum, which shows the trend in the growth of the firm’s EVA over the past three years;

2) EVA Margin, which calculates how profitable the firm is per dollar of sales, blending pricing power, operating efficiency and how well assets are managed into a single net-margin score;

3) Market-Implied EVA Momentum, which measures the expected future growth rate for economic profit as reflected in the company’s stock price; and

4) MVA Margin, which calculates Market Value Added, or MVA, as a percentage of sales. MVA is the difference between a firm’s stock-market value and the overall amount of capital it has invested, or the shareholder wealth created.

A look at one company’s success

How to Increase your WCI Score

Ranking CEO Wealth Creation: The Methodology