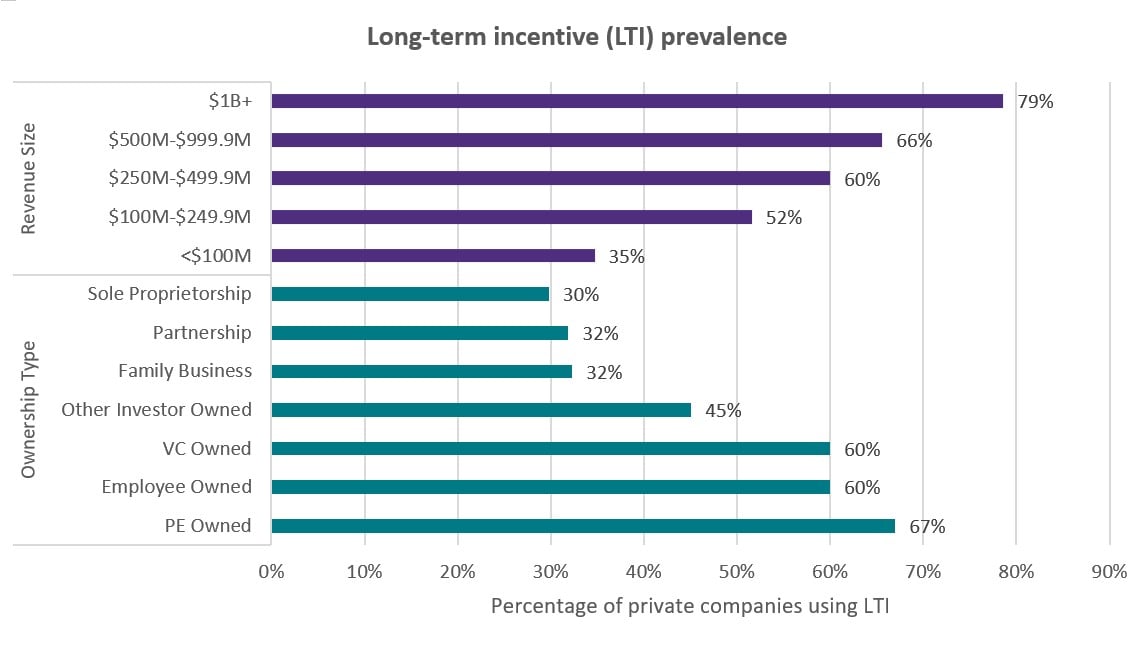

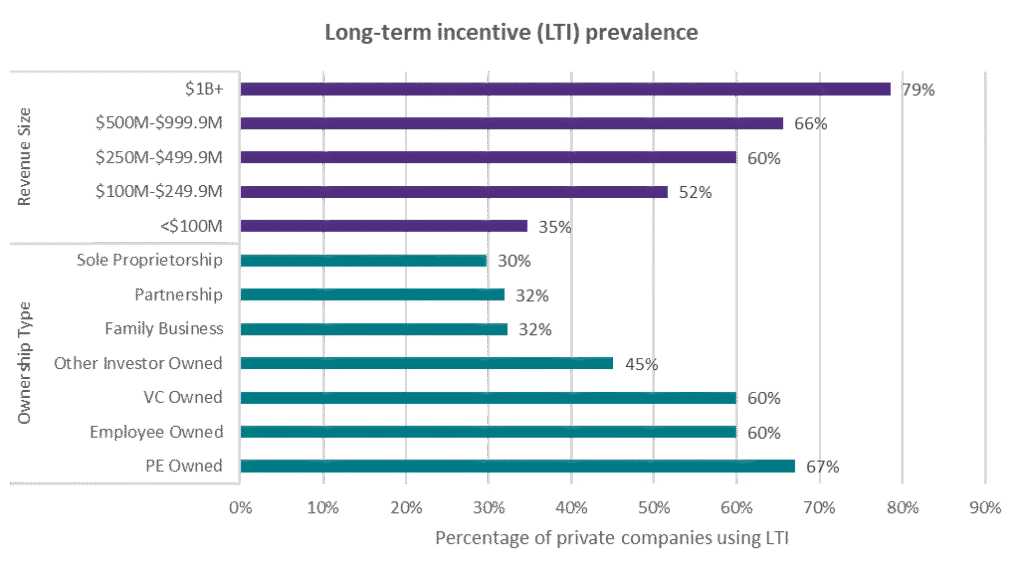

Recent data from Chief Executive Group’s CEO & Senior Executive Compensation Report for Private U.S. Companies finds that formal long-term incentive plans (LTIPs) have become majority practice (>50 percent) at companies with $100 million or more in revenue—only increasing in prevalence beyond that threshold to nearly 80 percent among the largest group of private companies ($1 billion + in revenue).

The research finds that long-term incentive use is more prevalent among certain ownership types. Private equity and venture-backed companies, where LTI’s are considered table stakes for senior management, tend to use them to influence decision-making and behaviors that drive company value ahead of a near-term exit or financing event. In contrast, family-owned or closely held private companies are less likely to use LTIs, as these businesses often focus on a more distant time horizon such as pure valuation growth or generational wealth creation.

But regardless of these unique circumstances, CEOs play a key role in shaping their company’s compensation programs and how the executive team should be rewarded for delivering the desired results and behaviors. In fact, for many private companies, it is senior management who drives the initial adoption of a long-term incentive program. That’s because CEOs and top senior executives tend to be the first to recognize concerns related to attracting and retaining key talent.

But as private companies explore the value of LTIs, we have found that a common set of strategic debates often emerges, putting the plan at risk if left unaddressed. Here are four conversations senior management teams need to have with their board before implementing an LTI component to their executive program:

- Does the LTIP support our ownership model and long-term strategy? The effectiveness of any new or updated LTI hinges on its alignment with the company’s overarching strategic objectives. Ownership structure plays a pivotal role in shaping this alignment. For instance, private equity-backed firms often prioritize value creation and exit readiness, necessitating LTIPs that emphasize equity appreciation or milestone-based payouts. In contrast, closely held or family-owned businesses may focus more on long-term sustainability and cultural continuity, favoring retention-oriented incentives. Ultimately, the role of executives also influences LTIP design and those incentives that reinforce accountability and growth. This may be the most challenging aspect of this debate for private company boards, as these leaders are typically tasked with both facilitating strategy sessions and executing the vision.

- What behaviors and outcomes should the LTI drive? A well-crafted LTIP should drive behaviors that align with both performance expectations and values. This may include fostering a sense of ownership, encouraging long-term thinking, and reinforcing collaboration. Boards will also debate eligibility criteria and will need to carefully consider participation to ensure the plan motivates key contributors without diluting its impact. When it comes to debating outcomes, performance metrics should be transparent, measurable and tied to strategic outcomes such as EBITDA growth, revenue milestones or operational efficiency. Finally, payout mechanisms and timing should enter the debate, whether time-based or performance-based, as there is typically a need to balance near-term rewards with the level of required performance, while remaining competitive with market benchmarks.

- How do we govern the LTIP to ensure fairness, flexibility and risk control? Robust governance is essential to safeguard the integrity of an LTIP. This includes implementing risk mitigation strategies such as scenario modeling to manage downside exposure, as well as payout caps and clawback strategies. Governance structures should clearly define the balance between formulaic and discretionary elements, ensuring consistency while allowing flexibility in exceptional circumstances. Careful selection of strategic outcomes can reduce the potential for overlap with short-term incentives. This aspect of the debate must be carefully managed to avoid conflicting signals and ensure that longer-term goals remain the focus.

- How should we tailor LTIP structures to fit our ownership model and capital strategy? Different ownership models necessitate different incentive structures. In private equity environments, phantom equity or stock appreciation rights may be preferred to align with exit valuations and liquidity events. Conversely, in closely held entities, cash-based LTIs or deferred compensation plans may be more appropriate, offering predictability and alignment with conservative capital strategies. The choice of incentive vehicle should reflect the company’s capital structure, growth trajectory and cultural priorities, ensuring that the LTIP is not only motivational but also sustainable and strategically coherent.

If these conversations open the path to LTI implementation, we recommend boards and leadership teams follow the following three steps, generally up to six months prior to the effective date of a future LTI award:

- Initiate a structured diagnostic review of the current incentive landscape, including alignment with ownership structure, strategic goals and cultural values. This review should involve both management and board-level stakeholders to ensure a shared understanding of priorities and constraints.

- Commission a benchmarking study to compare LTI design elements, such as eligibility, performance metrics and payout structures, against peer organizations and market norms. This will help calibrate the plan to remain competitive while reinforcing desired behaviors.

- Establish a governance roadmap that defines approval authority, risk controls and oversight responsibilities, ensuring the LTI is not only well-designed but also resilient and adaptable.

These steps will help lay the groundwork for a robust, strategically aligned LTI ready for rollout in the upcoming fiscal year.