Headlines this year have declared a new season of megamergers. Mars bought Kellanova for $36 billion to wake the food sector from its M&A slumber. Capital One bought Discover, another iconic financial services brand, for $35 billion. Conoco Phillips further consolidated the energy business by acquiring Marathon Oil for $23 billion. HP created a ripple in tech when it picked off Juniper Networks for $14 billion.

However, other recent headlines have made CEOs take pause. The Federal Trade Commission sued to block the Kroger-Albertson’s supermarket megamerger. Union and political opposition has held up Nippon Steel’s proposed $15 billion takeover of U.S. Steel. There was also harsh criticism from both parties on the presidential campaign trail about companies getting too big.

Weighing these offsetting elements, CEOs, private-equity players and the investment banking industry are embracing a consensus about the M&A outlook for 2025: It’s rosy, though not exactly florid—a continuation and likely a strengthening of the rise in deal volume and size that has occurred already.

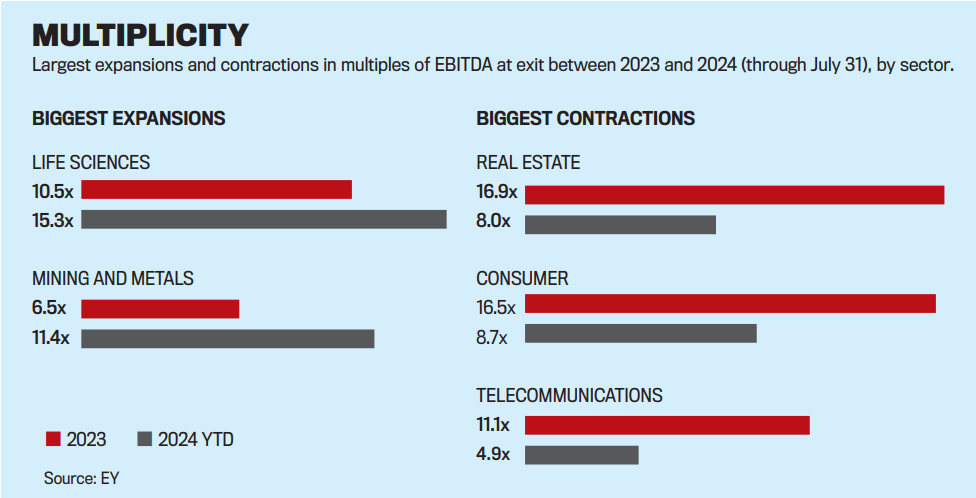

Reasons to believe include an economy that appears to be landing relatively softly, the beginning of a rate-cut regime by the Fed, technology enablement, abundant available capital and more. Complications could arise not only from regulatory interference but also from the election outcome. Sectors including life sciences, energy and physical infrastructure will be hot, but others, such as consumer products and climate tech, might only simmer at best.

“In 2023, a lot of corporations sat on the sidelines because of markets and interest rates,” says Mitch Berlin, vice president of Americas strategy and transactions for EY. “They can’t sit on the sidelines any longer. They’re reentering the market, and that will continue.”

In fact, a recent EY survey showed that more than 90 percent of CEOs “will do some kind of deal” in the months ahead, Berlin says. EY predicts overall corporate deal volume will rise by 20 percent for all of 2024 following a 17 percent year-over-year drop in 2023 (for transactions of more than $100 million), while private-equity deal volumes will rebound by 16 percent for all of this year over 2023, following a 15 percent contraction last year. For 2025, the consulting giant predicts another 20 percent increase in deal volume and a 9 to 10 percent further gain in private-equity deals.

The PE world seems especially poised for a surge in activity. “There’s $2 trillion in dry powder, interest rates are coming down, and limited partners really are demanding that their PE investors return their money,” says Dan Hawkins, founder of Summit Leadership Partners. “The only way private equity can do that is by selling companies.”

Yet, the M&A resurgence “won’t be a V-shaped bounce-back like during Covid,” warns J. Neely, Accenture’s senior managing director for M&A. “We’re working our way back, slowly climbing the hill.”

That “hill” is the latest feature of an M&A market that has behaved like a rollercoaster for five years. Deals in the U.S. surged to record levels in 2021 and early 2022 before sharply declining, largely because of the Fed’s aggressive rate-tightening. The lull continued through 2023, then the market came back to life this year. Now, players aren’t expecting “a precipitous, hockey-stick-like move,” says Effram Kaplan, a managing director at Brown Gibbons Lang. “It will be a slow and steady improvement of M&A over what I would call a considerable amount of time. And it will be spotty and sector-specific.”

Lineage is one company betting on an increasingly friendly M&A outlook. The operator of cold-storage warehouses has made 116 acquisitions over 16 years, growing into the world’s largest REIT in its business. In July, Lineage went public to proceeds of $4.4 billion, the largest IPO of 2024 to that date. CEO Greg Lehmkuhl hails the months ahead as a “massive market opportunity” for more acquisition targets.

MRI Software executed 59 acquisitions in the past 15 years, but only three in 2023. “But we see things picking back up now,” says John Ensign, president. “There are a lot of very hot, high-quality companies in the market right now that are looking for an exit. We are busy evaluating them.”

Here are some of the drivers of optimism for the M&A outlook for 2025, as well as some offsetting factors:

Corporate strength. “Companies have built up a lot of cash on balance sheets over the year, so they will be strategically able to acquire businesses,” says Jonathan Moore, a managing director of advisory firm PKF O’Connor Davies. “And there is competition among companies chasing after deals.”

Strong equities are “always a driver for M&A,” says Don McCree, head of investment banking at the Citizens regional bank. Indeed, says Neely, “valuations have kind of evolved, closing the gap between what sellers and buyers thought they should be. That gap will close even more.”

Expectant private markets. Overall, private investment will continue to take share from the public in capital-markets activity, including M&A deal volume, Kaplan says, thanks to “new types of vehicles” that allow private interests “the ability to monetize returns, generate liquidity and hold investments for longer.”

PE firms, for example, “have been looking for other ways to get deals done in the current rate environment, whether through the use of private credit or consortium deals, or the use of hybrid capital,” says Amy Wollensack, an M&A partner with Akin. “A lot of technology has evolved over the last couple of years to enable such deals.”

PE players are eager to unleash their coffers of capital on the market. The U.S. has about 200,000 private companies with revenues from $10 million to $1 billion. “That universe is prime to transact,” Moore says. “Owners are getting older, and there is all this pressure on PE to deploy capital.”

As Dan Mahoney puts it, “Limited partners are saying, ‘We committed a bunch of money to you, and you’ve been holding on to it going on five, six, seven years—so go use it.’ And there’s pressure on general partners to sell, get some liquidity and return their money to the LPs,” says the co-chair of the VC and private-equity industry group at Snell & Wilmer.

Dogged economy. The Fed’s rate cuts will be a welcome tonic, though uncertainty remains about the U.S. economy’s strength. “M&A activity needs as an ingredient a stable economic outlook,” notes Axel Tismer, SVP of M&A for Schneider Electric. “That doesn’t mean necessarily a booming economy but predictability.” Mahoney believes that the rate reductions “will not only have a direct impact on borrowing costs but will also give confidence that you can do deals [with] all equity or minimal debt, and in a year or two, when rates are down to 4 percent or less, you can refinance and pull the equity out.”

Helping will be that “inflation has started to slow in most major economies,” says Jeff Weirens, leader of the global financial advisory business for Deloitte. “We’re seeing employment continuing strong and pressure on wages beginning to stabilize.”

Digital transformation. The need for companies to overhaul and advance a broad range of technologies—including AI, cloud computing, automation and cybersecurity—remains pressing. “The driver for that really is to remain competitive because the pace of transformation is so fast in every industry,” Berlin says. “So [companies] are turning to inorganic transformation versus organic and trying to build it themselves. They have a lot of catching up to do.”

Technology imperatives “cut through everything,” notes Neely. “There’s not a deal out there where you can’t consider technology. You can’t ignore it. And how you create value is different for every single business.”

AI’s sway. Not surprisingly, AI capabilities are sought after. “AI is a major trend when it comes to having a favorable outlook on growth for the industry,” Kaplan says.

Generative AI offers a potentially powerful new tool for streamlining the M&A business. In a recent Accenture survey, GenAI alone is expected by 64 percent of global C-Suite executives to revolutionize deal processes more than other recent technological advancements, due to its ease of use, the expanding relevance of the technology and its application fully across deal cycles.

Regulatory fears. The FTC Commission and it’s chair, Lina Khan, have been generally thwarting some of Corporate America’s largest M&A ambitions, and many players worry that won’t change under Trump, as Republican vice presidential elect JD Vance has been sympathetic to Khan’s approach.

M&A principals have also bemoaned how long deal approval has been taking. “Two or three years ago, it was common to expect to close within nine months, even for a large deal,” Neely says. “Now it’s become common for an expected-to-close time of 12-plus months, even 18.”

Rising expectations. “Valuations are expectations of the future, and they’re up,” says Mark Sirower, a U.S. leader in Deloitte’s M&A and restructuring practice. “When companies pay a 30 to 40 percent premium for a target, they’re raising the bar even higher in terms of what investors expect, by a lot.”

A Deal-making Roadmap

Deal gurus suggest these six strategies when playing in 2025’s bigger, faster M&A derby:

Keep it together. The relatively long drought in dealmaking can test leadership skills at a PE-owned outfit. “Exits have slowed down, and CEOs are really struggling, trying to keep it together, when their thought was that there would be an exit or they would be selling sooner,” says Hawkins, who says staying aligned can be challenging. “When you’re going through the exit process, there are a lot of stops and starts. Buyers are asking and expecting companies to drop their valuations a bit, and you may not be willing to do that. And meanwhile you’re putting your management team through the grind of the selling process and due diligence.”

Have a plan. If your company is on the prowl, consider: “Do you know what you want and why, and how you’re going to create value with it?” says Sirower. “With market valuations this high, it’s more important for CEOs to know what companies they want to buy… if the market turns down, you’re in better position to take advantage of more favorable valuations.”

together, when their thought was that there would be an exit.”

—Dan Hawkins, Consultant

CEOs must “read the market and have confidence to step out and engage in conversations,” says investment banker Don McCree. “We’ve seen some hesitancy because of volatility, rates and regulatory challenges. People haven’t wanted to put the company in play, waste two years and see it fall apart. So, a lot will depend on CEO psychology and turning impediments into catalysts.”

Don’t miss out. “As all the rivers start to go the other way, you hit a tipping point where this happens pretty quickly,” says Neely. “You don’t want to be blindsided and miss out on a deal.”

Preparing for the moment is crucial, he says. “Organizations may have lost muscle memory and not be dialed up to deal with M&A volume. It’s always good to have done your homework for what deals you might want to do and why. If someone beats you, you’re out in the cold. The readiness factor is important.”

Prepare for transition. A recent Deloitte survey showed that of any phase of the process, M&A-minded CEOs were least ready for post-close planning and execution. “But that’s where you actually get to bake the cake and eat it,” says consultant Jeff Weirens. “You want to make sure you’re putting effort into and around that.”

Adds Sirower: “Gone are the days when you sit around for a couple of months and start thinking about launching an integration-management office. You have to be prepared to launch right after you announce the deal.”

Stick to your knitting—or not. While most recent acquiring companies are sticking to their core, says Sirower, there are clearly big returns for successful adjacency plays. “They’re just harder to pull off. The best practice is to have a robust plan to demonstrate to the market how you’re going to take advantage of adjacency: topline growth and growth synergies, as well as the synergies they’ve usually figured out such as procurement and SG&A reductions. Show how you’ll apply the same rigor of the cost side to growth synergy, product introductions and salesforce training.”

Outlast long approvals. “You need to have the wherewithal to stick all the way through,” Neely says. “Nine months is a decent amount of time for integrating; you can keep your focus on driving the business. But it’s a whole different game for 18 months: How do you plan, how much do you plan, how do you avoid getting out over your skis? There’s a natural destabilization as people worry what’s going to happen to them.”