Volatility Keeping CEO Bonus Pay At Multi-Year Lows, New Report Finds

Despite widespread optimism for economic growth at the beginning of 2025, new data reveals just how much the extreme volatility that has been plaguing business in recent years has impacted CEO compensation.

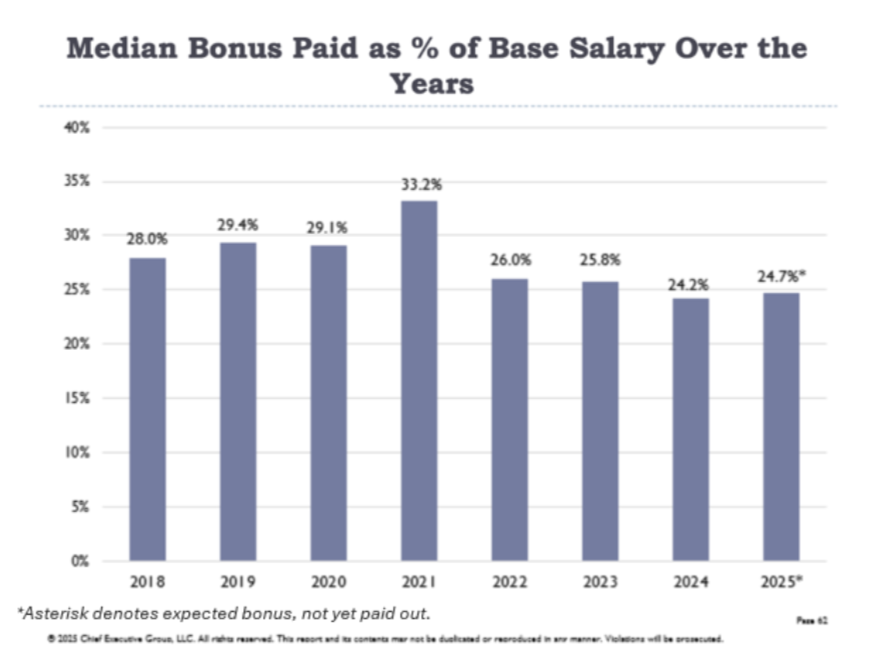

According to the just-released 2025–26 CEO & Senior Executive Compensation Report for Private U.S. Companies, the median CEO bonus payout for 2025 is expected to be just 25 percent of base salary, significantly down from the 33 percent achieved in 2021 and even below the pre-pandemic norm of 28–30 percent.

The level of volatility—economic, geopolitical and otherwise—that the business environment has experienced since the pandemic, and its impact on corporate goal setting, has played a critical part in this inability for bonus pay to recover.

Compounding the effect is the fact that while base salaries at private companies have increased over the years, which could have helped support a lower bonus-as-a-percentage-of base bonus, they have done so at a much slower pace than inflation.

“The median CEO bonus expectation saw no change between the years of 2021 and 2024, hovering at $100,000,” said Isabella Mourgelas, Chief Executive Group’s lead research analyst who has been producing the report for the past five years. “In turn, bonus pay has become a smaller piece of the total compensation package, and data from 2025 shows that trend continuing, with the median CEO bonus expectation falling to $80,000.”

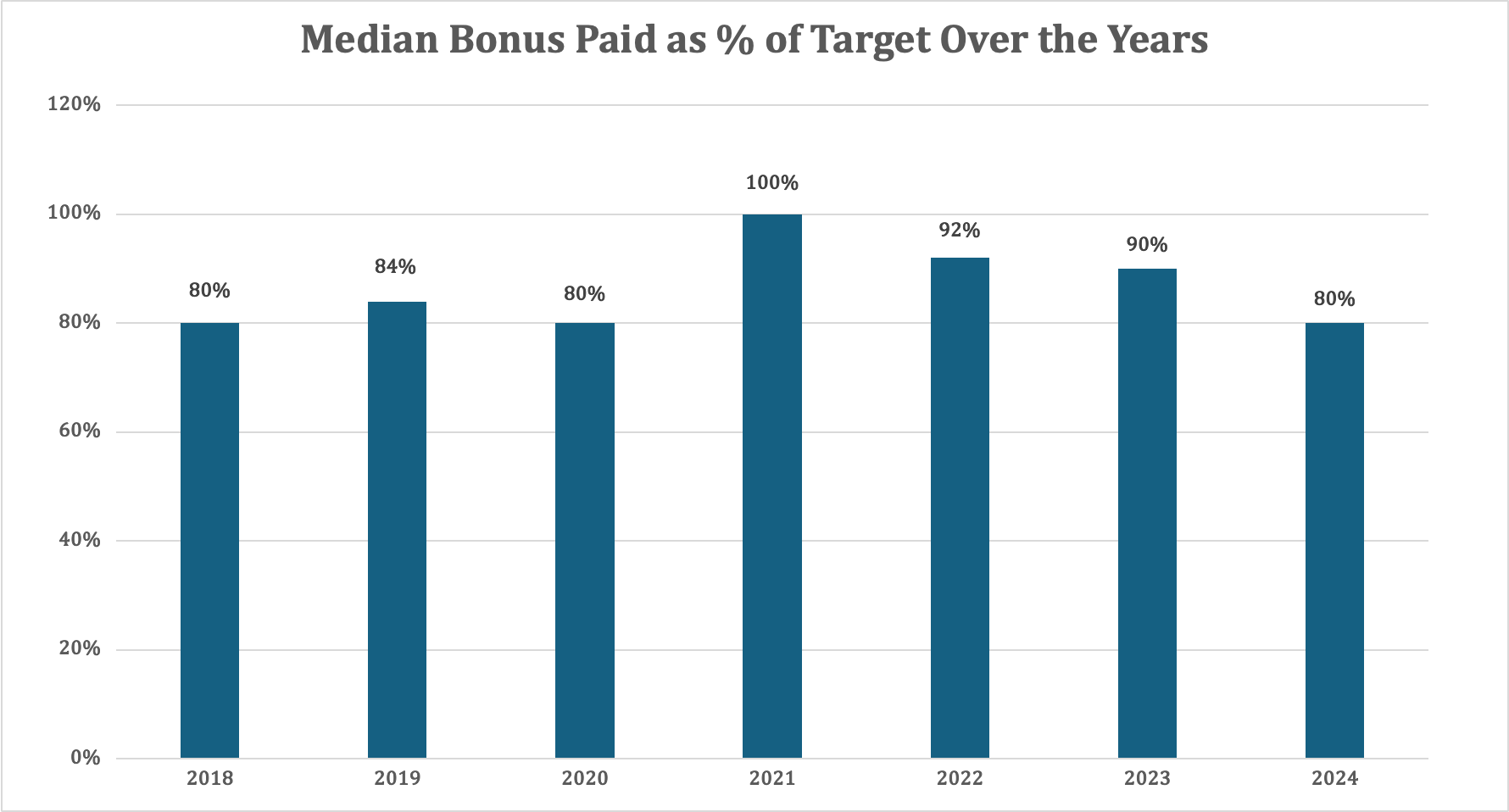

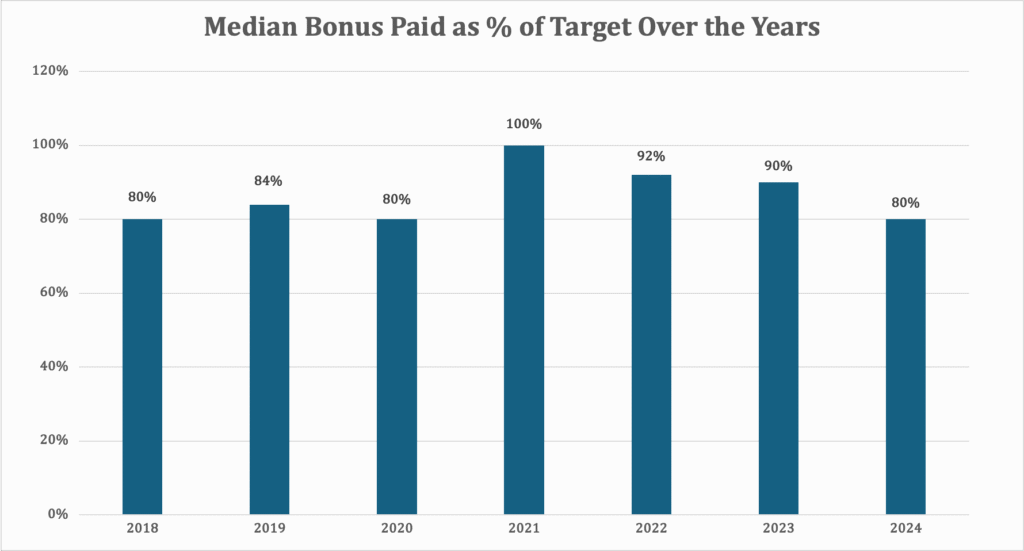

What’s more, companies rarely pay out the full target bonus—at least to those in the CEO seat. Indeed, data from the report shows that from 2018 to 2020, the median CEO bonus actually paid out to the CEO represented 80 to 85 percent of the original target. The pandemic year of 2021 marked a notable exception, with the median CEO bonus payout reaching 100 percent of the target, likely reflecting efforts to make executives whole again after 2020 cuts. But that number was an outlier, and it has been declining back to pre-pandemic levels since then.

The combination of the lower target as a percentage of base salary, near-stagnant base salaries and the fact that the actual bonus payout is only a fraction of that target explains why CEO bonus pay has been on a decline. It isn’t clear whether that’s because a higher percentage of CEOs haven’t met their performance-based goals or because more companies have been setting their revenue and profit targets too high in recent years with the mistaken hope of a strong bounce back to growth. But Eric Gonzaga, a Grant Thornton principal and practice leader specializing in executive compensation strategies, says volatility plays a big role in all of this and he doesn’t see much of that changing in 2026—or at any time in the future.

The challenge, he says, is that the type of volatility we’ve been experiencing isn’t transient and the use of bonuses tied to company financial performance in executive compensation isn’t likely to alleviate. “It’s difficult for organizations right now to pick apart [all that’s happening.] … Annual incentive opportunities are staying the same, but boards are being very diligent about setting the right metrics, and that’s not easy right now because volatility makes it difficult to predict what a good goal should be,” he says.

Mourgelas agrees: “Data from our CEO Confidence Index shows uncertainty is a main driver of CEO sentiment about the current and future business environment month after month. With that uncertainty comes moving targets that are often reevaluated mid-year, making any long-term forecasting a challenge—and that’s reflected in the data for CEO bonus pay.”

Still, according to the report, there is hope.

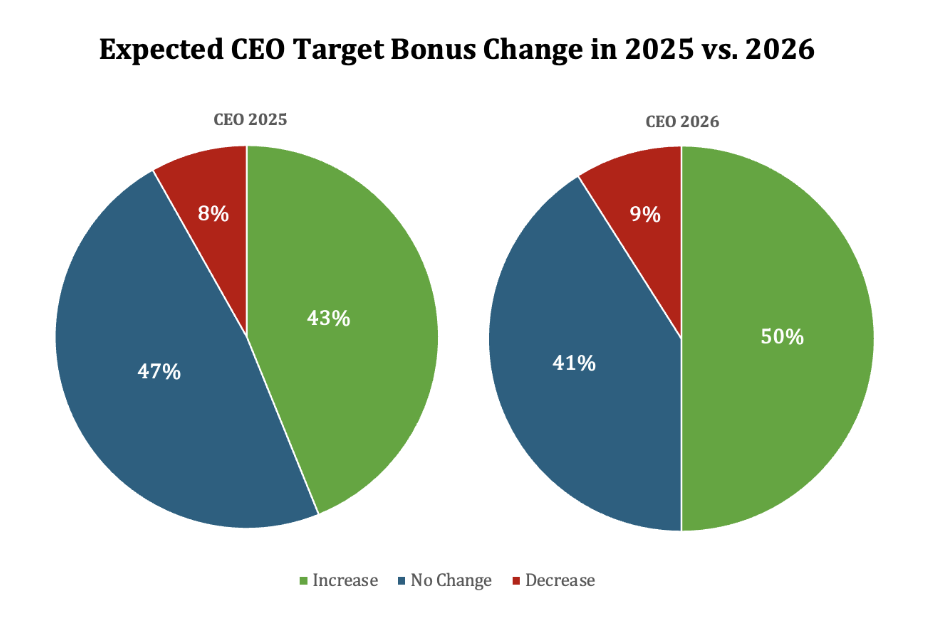

Exactly half (50 percent) of the companies surveyed said they are planning to increase their CEO’s bonus pay target for 2026, while 41 percent expect to maintain current levels for at least another year—a modest improvement compared to 2025, when just 43 percent of companies started the year expecting higher CEO bonus payouts.

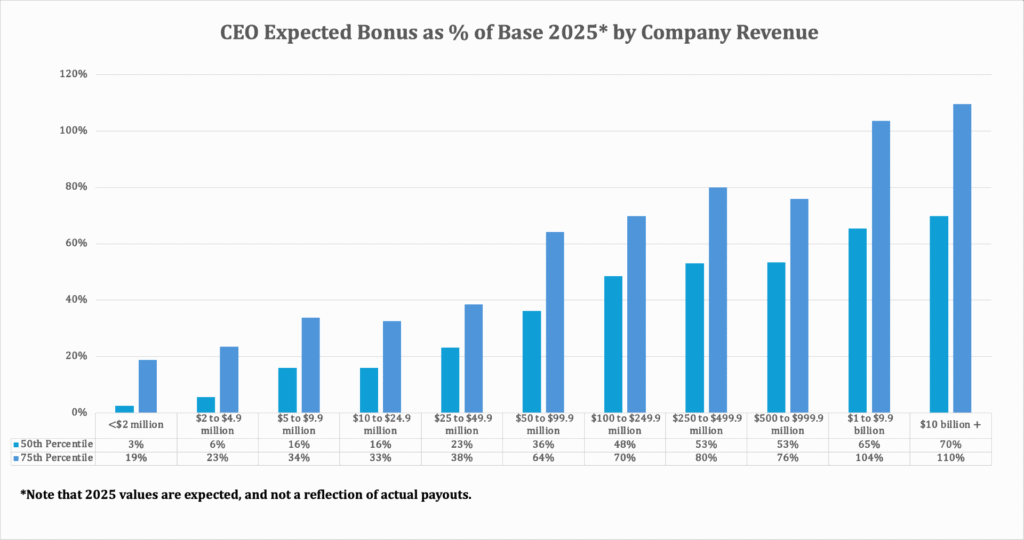

The report analyzes the pay packages of CEOs and senior executives across multiple dimensions, one of them being company size (by annual revenue), and according to that data, there is a clear correlation between organizational scale and bonus compensation strategy: The larger the company, the greater the bonus as a percentage of the base salary.

At companies with revenues under $100 million, the median CEO bonus fails to top 40 percent of base salary. Meanwhile, CEOs at companies with revenues of $1 billion or more typically receive bonuses exceeding 60 percent of their base salary.

The sustained stagnation in CEO bonus compensation raises important questions about talent retention and motivation in an increasingly competitive executive marketplace. As companies grapple with economic uncertainty, the traditional balance between fixed and variable compensation appears to be shifting, potentially affecting how organizations attract and retain top leadership talent.

Executive pay is shifting: bonuses are down for many while base salaries inch up, and ownership structure, industry and size continue to drive big differences. The 2025–26 CEO & Senior Executive Compensation Report for Private U.S. Companies unpacks these trends across roles and industries, with detailed breakdowns and forward-looking insights to guide your 2026 planning.

Order your copy and make informed, future-ready compensation decisions at chiefexecutive.net/compensationreport/order/.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.