Approximately 50% of Americans receive healthcare benefits from employers, a benefit that 86% of employees surveyed for MetLife’s 20th Annual U.S. Employee Benefit Trends Study 2022 said was a “must have.” Corporate benefits managers are responsible for the increasingly difficult job of evaluating and selecting benefits plans that strike the right balance between comprehensive coverage and financial cost to their organization.

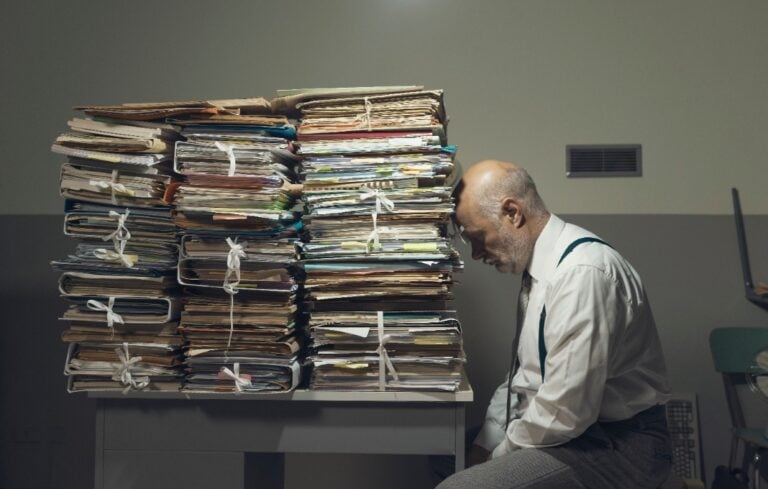

In recent years, the trend in benefit design has leaned toward plans with high deductibles and lower premiums, which shift more out-of-pocket costs to employees. The use of cost-saving strategies that control patients’ access to healthcare services, known as “utilization management” or “UM” has also increased dramatically. And formularies, the list of drugs covered by a health plan, have become more restrictive and include more pricing tiers, which can result in greater expense for employees who need certain medicines.

All this cost-shifting has helped employers keep their benefit costs under control, but what has it done to employees? According to the Kaiser Family Foundation, nearly half (46%) of insured adults report difficulty affording their healthcare out-of-pocket costs. In fact, a recent survey by Bankrate, a personal finance company, found that 56% of Americans would be unable to pay for a $1,000 emergency, such as an unexpected car repair or emergency room visit.

Money Saving Measures May Have Consequences

So, what’s a company to do? Benefits consultants often advise holding down prescription drug spend through UM and promote it as a benign measure that eliminates the unnecessary use of high-cost drugs and keeps coverage focused on drugs deemed both medically effective and cost effective. What they don’t tell you is that short-term savings may have costly long-term consequences for employers and employees alike.

Studies on restrictive formularies found that they’re associated with increased medical costs and higher healthcare spending. With a restrictive benefits plan, employees may be unable to access life-saving medications or those that can improve their quality of life and keep them working. When needed prescriptions aren’t covered or are only available with a high out-of-pocket cost share, the financial burden of paying for these medications can cause stress, debt, and dissatisfaction with the employer. Even patients with “good” health insurance can suffer from “financial toxicity”—the crippling financial side effects of illness, particularly with a serious disease such as cancer. Roughly 50% of cancer patients experience financial distress, and those who reported “significant financial worry” at the start of treatment had twice the risk of dying compared to similar patients.

Benefit design that increases cost-sharing for individuals, such as through higher copays, or coinsurance rates, restrictive drug benefits, or higher deductibles can make the financial impact of illness worse, and lead to financial toxicity. Employers may not be aware of the difficult financial choices that many employees face when they have a serious illness. When having to decide between paying monthly bills such as rent, food, and transportation or coming up with a copayment of $125, 45% of Americans will abandon their prescription. When the out-of-pocket cost rises to $500, 60% of people will walk away from their needed treatment.

Many insured employees who become sick must seek financial assistance to make ends meet, according to our own data. In 2021, CancerCare provided over $800,000 in charitable assistance to 2,985 clients who had private health insurance, to help them pay for expenses such as transportation to medical appointments, out-of-pocket prescription outlays, and other costs of living not covered by insurance, such as rent, food, childcare and utilities.

Millions of Americans—including some of your employees—become seriously ill each year. When you design your health benefits, we ask you to think about the impact that high out-of-pocket costs can have on your valued employee at a time when their priority should be getting well. Don’t look only at the cost of coverage to your organization; consider the impact that high deductibles and out-of-pocket costs, and restrictive access to needed treatments and prescription drugs might have on your employees. Ultimately, a quality health benefit plan not only helps employees, but employers, too. A well designed, and patient-centered plan can help maintain productivity, reduce long-term medical spending, attract and retain talented employees, and build satisfaction and loyalty by demonstrating that your company values its people.