Big Pharma is facing rapid structural changes in several areas of its traditional business. Drug discovery is increasingly expensive and generics are grabbing more and more share while pressure on margins continues unabated. Many blockbuster drugs are coming off patent in record numbers. Pfizer’s best selling Lipitor, for example, comes off patent in November of this year. Next year, Merck faces patent expiration for its top-selling asthma medication Singulair. Most firms are struggling to maintain spending on R&D investment amid cost cutting and slowing economic growth. Meanwhile, governments everywhere are seeking ways to control healthcare costs and are looking to cap the drug prices their public health systems are willing to pay.

The Swiss giant Novartis aims to transform itself from a pharmaceutical company to become a broader-based health care company over the next five to ten years. To do this it has been strengthening its core competence of science-based innovation while focusing on five high-growth segments of healthcare: Pharmaceuticals, eye care, generics, consumer health and vaccines and diagnostics.

When he was named chief executive in February 2010, Joseph Jimenez has had to fill some big shoes, replacing Daniel Vasella who ran the company for 14 years. Jimenez is neither a physician nor a scientist; he isn’t even Swiss. Born in Walnut Creek, Calif., he earned a bachelors degree at Stanford and an MBA from Berkeley in 1984 before joining Clorox in nearby Oakland. This launched a career in consumer package goods that ultimately led to H.J. Heinz where he became president and CEO of its North American business. While Jimenez was serving as president and CEO of Heinz Europe from 2002 to 2006, Astra-Zeneca chairman Percy Barnevik asked him to join the Anglo-Swedish pharma company’s board where he served until 2007. Vasella then tapped him to join Novartis in April 2007 as divisional head of its consumer health unit.

“When I first joined, some skeptics said, ‘This guy’s not a physician or a scientist. Are we sure we want him leading us?’” he recalls. “When I became CEO, those who didn’t know me from the pharmaceutical division had the same reaction. It was a legitimate question, and it wasn’t until I proved myself with that division that I got the kind of support that I have today.”

Jimenez is fortunate that his predecessor left a robust pipeline at a time when others are running close to empty. In addition, the company’s pharmaceuticals are running ahead of the industry in key areas of R&D productivity. Its median success rate for approvals in pre-clinical trials is 72 percent vs. the industry’s 64 percent. In Phase III trials the comparable figures are 82 percent vs. 67 percent respectively. But even Novartis faces a big hole when the patent for its $6 billion blood pressure drug Diovan expires. It has no replacement for the U.S. market, which may experience flat growth for the next five years until the pipeline kicks in. In the meantime, Jimenez is betting that the BRIC countries will generate the growth that Europe and America is not offering.

The affable Californian sees his mission as growing faster than market rates in all of five segments—no small achievement if he can pull it off. “Five years from now I want to be able to look back and say, ‘We’ve taken this pharmaceutical company and turned it into a broad-based health care company.’” Recently CE caught up with Jimenez at the Palace Hotel in New York during a brief visit.

We approach R&D differently than most health care or pharmaceutical companies. Ten years ago, to develop a blockbuster drug one needed to target a broad therapy area like hypertension with large patient groups. After a while a new compound was developed that might be incrementally better than the rest. Then the company would build a massive sales force to market it. Our approach is different. We take what we call a pathways approach, where we seek to understand the pathway of a particular disease. We usually start with rare diseases.

Well, it does. But if you look at the pathway for a rare disease, it usually has a genetic basis in one or two mutations, so it’s a very homogeneous type of a disease. This allows us to develop a compound that will interrupt that pathway. But the molecular pathway of that disease is also active in many other diseases, so we will develop the compound in a very rare indication, but then expand it mechanistically to other disease areas once it’s proven that it can interrupt the pathway.

A perfect example is a drug that we launched last year called Ilaris, which we developed for gouty arthritis. It’s a rare autoimmune disease that affects less than 10,000 people globally. The marketing people said, “Why would we do this if there are only 10,000 patients?” The key to this disease is a pathway called interleukin-1, which happens to play a role in severe gout, which affects 3.5 million people. So we have a compound that works in this rare autoimmune disease that is linked to a pathway that is consistent with a bigger disease like acute gout. We’re about to get approval for this compound for use for acute gout. This is a different approach from developing a blockbuster drug 10 years ago.

Over the next 20 years, companies will be compensated not on the drugs that we sell but on delivering a positive patient outcome. It’s increasingly no longer about the transaction of selling a pill. Payers, physicians and regulators don’t want seven out of 10 people who get a drug not to respond to the drug. So if we offer, let’s say, a companion diagnostic and the right therapy, there will be much greater receptivity to the prices charged and that will enable us to recover our cost of R&D.

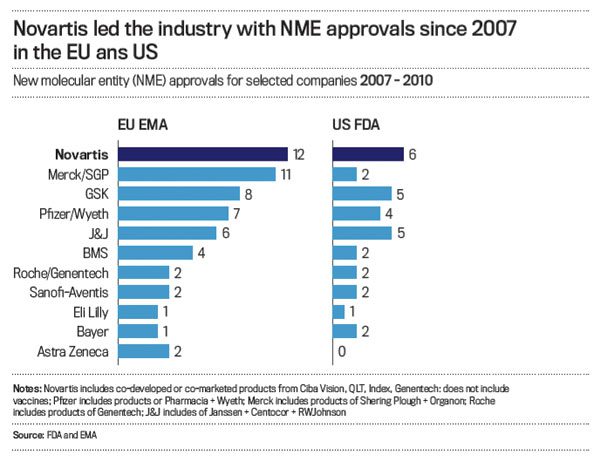

It’s working already. Novartis has the greatest number of new drugs approved by the FDA and also in Europe—more even if you combine Pfizer and Wyeth and combine Merck and Schering-Plough.

We have one of the best pipelines in the industry. We’re about to lose patent protection on Diovan, a blood pressure drug that is our largest [source of revenue]. It’s a $6 billion drug on a $55 billion company, so it’s a substantial piece. But because we have a robust pipeline thanks to the Novartis Institute of Biomedical Research using this pathways approach, we are able to offset patent expirations in a way that some of our peers can’t. For example, we just launched a breakthrough multiple sclerosis drug that is the first oral therapy for multiple sclerosis, which is taking off. We have a drug called Lucentis that we market it outside the U.S.). It’s for macular degeneration, and it continues to grow significantly.

E-health or telehealth is the interface of technology and healthcare. For example, look at social networks that are emerging. PatientsLikeMe.com is a web site for patients with rare diseases to come together and talk about the disease. When we were having trouble recruiting patients for a clinical trial of our multiple sclerosis drug, Gilenya, physicians promoted the drug on the site and helped enroll more people in clinical trials. That enabled us to get the drug to market faster.

We’re also investing in a chip-in-apill technology connected to remote patient monitoring. It’s a microchip in a pill. When a patient takes the pill and it digests, it sends a message to a server that confirms that that patient took their medication. If the patient doesn’t take the medication they get a message saying, “We noticed you didn’t take your Diovan today. Why not?” Or, “Is there some problem?” This is with no human intervention. The technology already exists.

If, for example, 50 percent of patients stop taking the drug, those are lost sales for us. So we have a vested interest in ensuring that that patient continues to take that medicine. The physician has a vested interest in ensuring that patient stays on medication to ensure a positive outcome.

Novartis CEO Joseph Jimenez

That’s the question. They would if they believed that the lack of compliance from the patient resulted in more cost such as greater hospitalization. The onus is on us to demonstrate to the payer that this is a good deal.

Novartis has been a loose collection of divisions, meaning each of the five divisions has historically been very autonomous. There’s a huge amount of duplication of work that is transactional in nature, like financial reporting that doesn’t add value—duplicating this five times in 70 countries.

You can imagine the cost reduction that could potentially be gained if we were able to consolidate this. One of my biggest challenges is figuring out how to maintain the autonomy of the divisions while capturing some of the synergies associated with becoming a broader-based health care company. This is something that the company really didn’t face in the past because pharma was so dominant, but pharma has moved from about 80 percent of our total to 50 percent of our total sales because of the growth of the other divisions.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.