| The CEO & Senior Executive Compensation Report for Private Companies includes information on base salaries, bonuses, equity gains, benefits and perks, as well as how CEO and other senior executive compensation varies by company size, industry, type of ownership and geographic region. The full report can be found at ChiefExecutive.net/CompReport. |

Chief Executive Group recently conducted a groundbreaking study of the compensation practices of private companies with revenues of $5 million to $5 billion. In our last issue, we provided some of the highlights about CEO compensation practices. This charticle focuses on some of the key findings related to other senior executives.

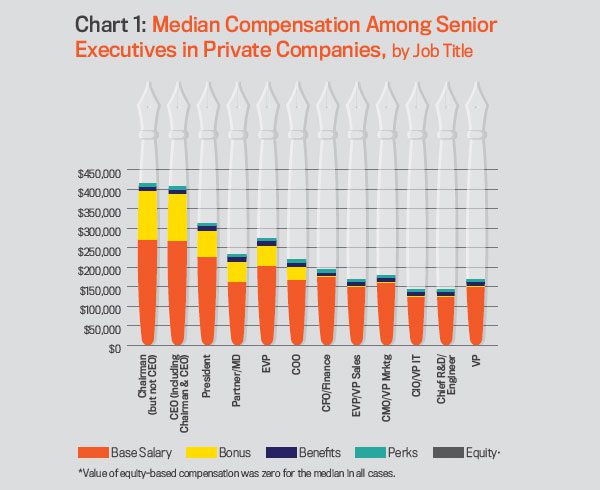

We were surprised to see that chairmen who are not also CEOs had higher average and median compensation levels than their peers who are chairmen and CEOs or just CEOs. While we expected chairmen who are not also CEOs to be well compensated due to equity gains (because they are often founders or significant equity stakeholders), we found that they also often enjoy substantial base salaries and bonuses—usually higher than those of the CEO. Chart 1 provides a look at the median salaries by job title across all company sizes, industries and ownership types. Most chairmen, including the 50th percentile, do quite well in terms of cash compensation.

We were interested to see that the gap between CEOs and presidents was not that large on a relative basis (less than 25 percent for the median) and that the pay gap between CEOs and other senior executives, such as CFOs, COOs and EVPs, was also less than 50 percent (see chart 1). This is in sharp contrast with the pay gap at public companies, where CEOs often earn five to 10 times that of their direct reports.

As you would expect, there were big differences by company size, industry, type of ownership, level of growth, profitability and other factors that are further detailed in the full report. (See ChiefExecutive.net/CompReport for more information.)

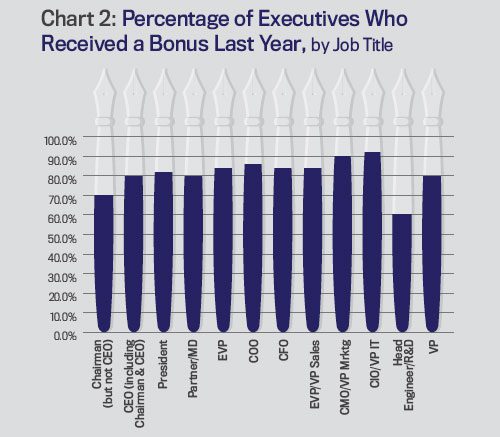

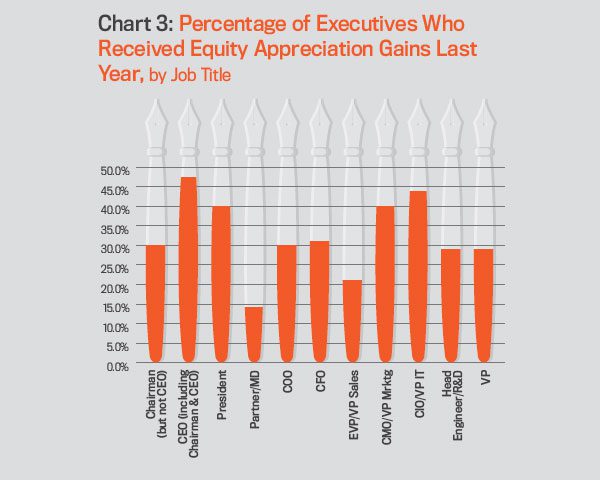

Larger private companies tend to have more formal compensation programs, but the majority of private companies do not follow best practices for compensating their key executives. While most private companies do have basic incentives, such as cash bonuses for key executives (See chart 2), only a minority of senior executives at private companies can cite any equity gains last year (See chart 3). This doesn’t mean that the majority of private companies do not have equity incentive plans for their senior executives (In fact, they do). Instead, it suggests that less than half of private companies regularly quantify and communicate the value of equity gains to senior executives. Private companies that manage these equity incentive programs well and leverage their power as a motivator are the exception, rather than the rule.

| The CEO & Executive Compensation in Privately Held Companies Report 2011 includes information on base salaries, bonuses, equity gains, benefits and perks, as well as how CEO and other senior executive compensation varies by company size, industry, type of ownership and geographic region. The full report can be found at ChiefExecutive.net/CompReport. |

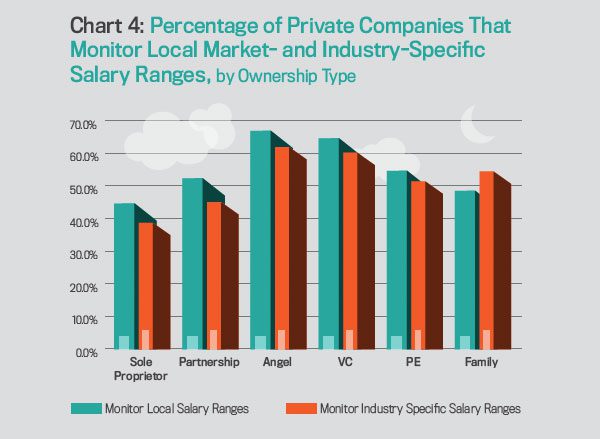

With only a modest investment, private companies could reap enormous benefits from a more professional approach to compensating key executives. Most companies spend a great deal of money on compensation but don’t spend it wisely based on data-driven benchmarks and best practices. For example, many companies do not even benchmark their senior executive compensation packages against other local firms or companies in their industries (See chart 4).

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.