Are CEOs Underestimating The Importance Of IT In M&A?

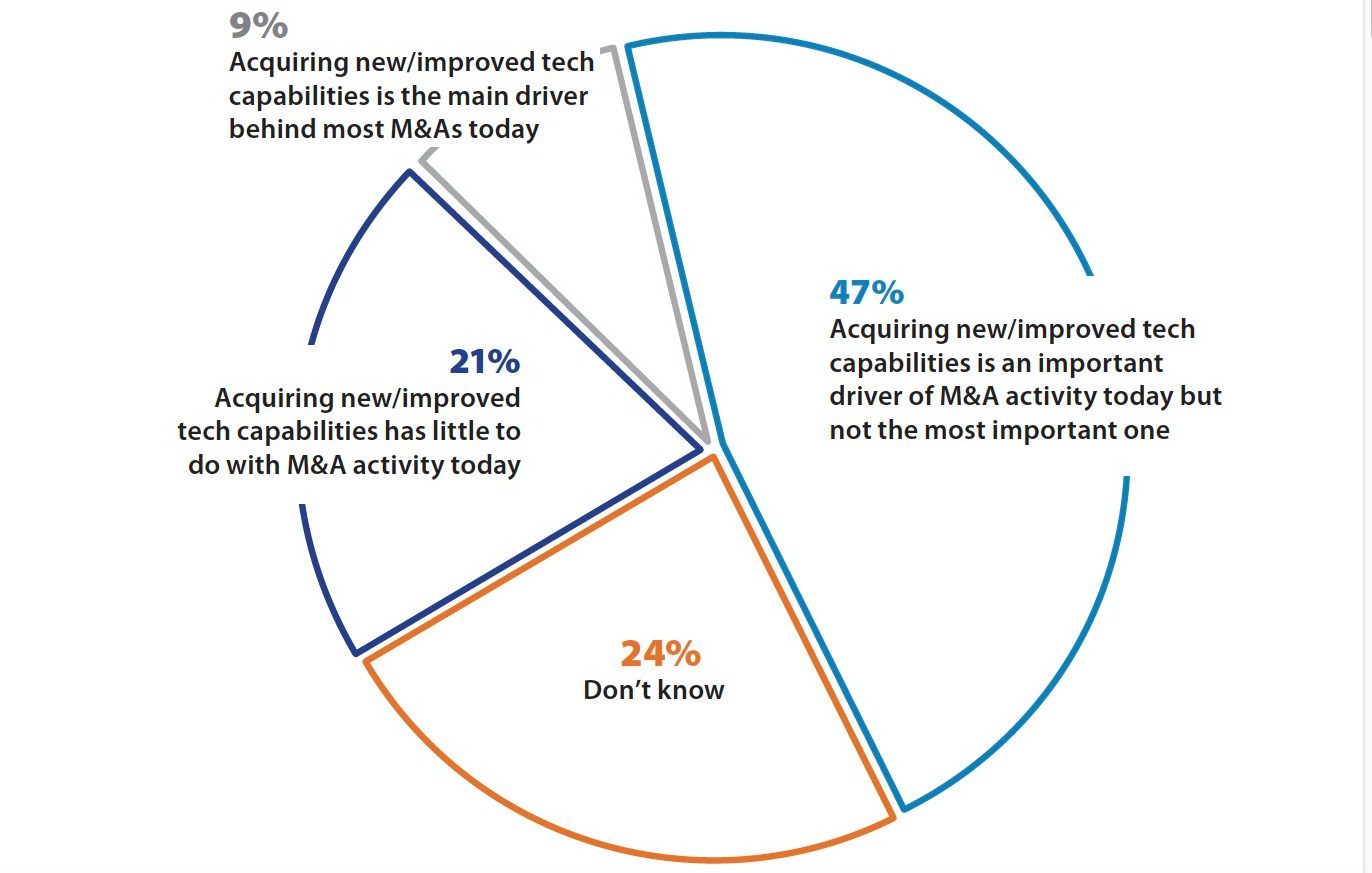

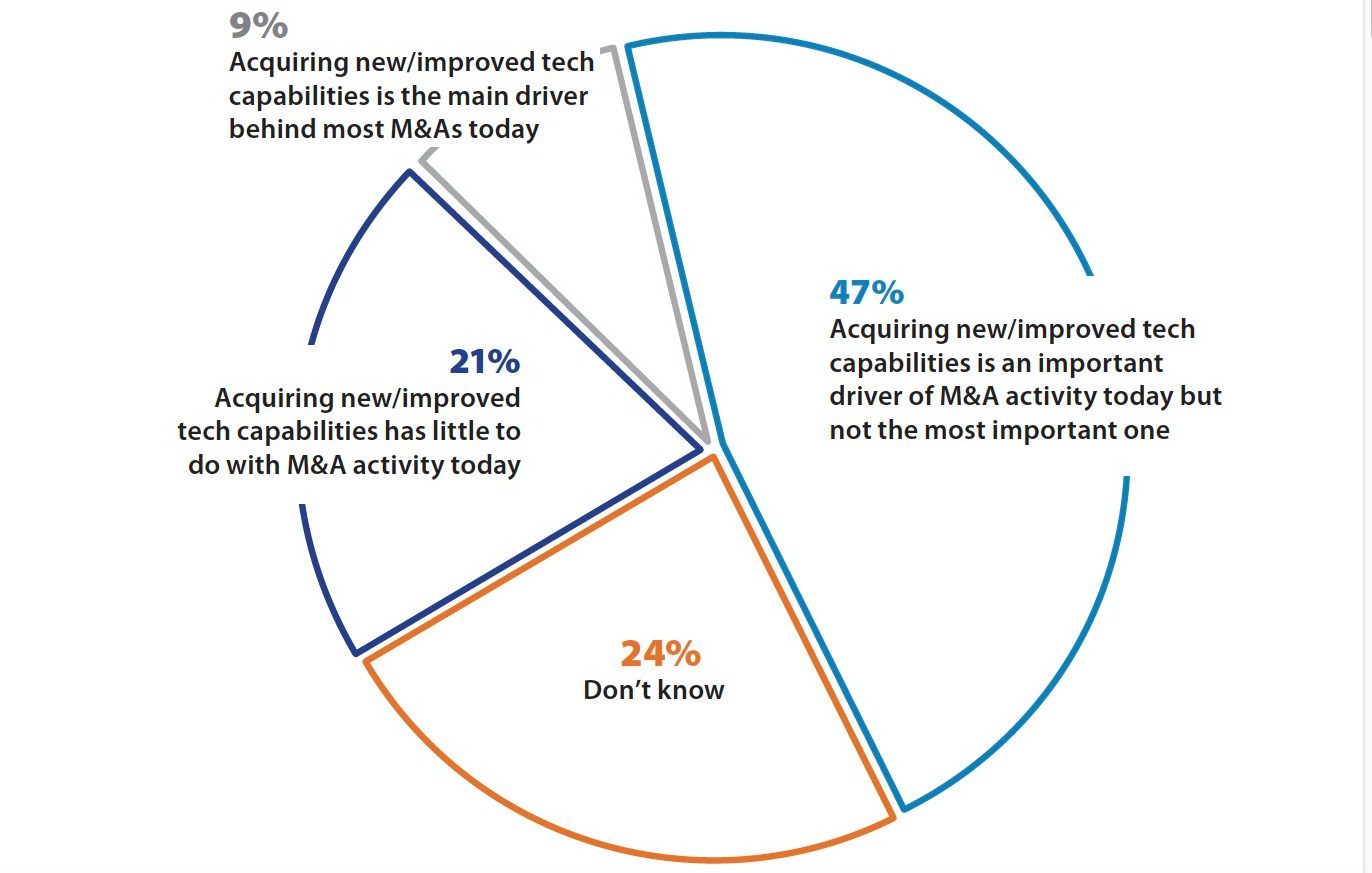

With technology playing such a critical role in organizations’ success or failure, one might think IT would be a chief concern in M&A due diligence—but it turns out the opposite is true. A January survey of CEOs, conducted by Chief Executive and Elliott Davis, found that only 9% of respondents believe an acquisition target’s tech capabilities is a critical driver of M&A, while 21% said technology had little to do with deal-making.

“That was very surprising,” says Jimmy Buddenberg, Digital Practice Leader for Elliott Davis, who explains why companies that fail to do IT due diligence miss out on key synergy opportunities and risk taking on ‘IT debt’ or other tech vulnerabilities unwittingly. At a minimum, IT is a potential indicator for how well or how poorly the business is run. “As you go through the deal process, you’re trying to understand more about the organization, and this is one more data point for a buyer to assess the maturity and health of the organization.”

By not understanding clearly what they’re purchasing from an IT perspective, the acquirer often loses out on efficiencies the deal might have driven. “Then post-merger, they tend to leave the two isolated and standalone instead of integrating,” says Buddenberg, who estimates the cost savings of proper integration would be 20%, at a minimum.

“There’s definitely an opportunity for an organization to develop an overarching IT strategy that includes integration. So, are you going to standardize on an ERP system across the board? Are you going to standardize on hardware? Are you going to move to the cloud? They should be thinking about how they’re going to integrate before they even close the deal—that’s going to drive the level of diligence that they need to do.”

It will also drive decisions about which organization’s technology will absorb the other’s. “Don’t necessarily assume that you want to conform the new organization to your existing [platform] because the new organization might actually have something better,” says Buddenberg. “When you acquire a modernized environment, that’s something you should be leveraging.”

To that end, talent should also be a part of the diligence discussion because you may be bringing on tech employees with unique skills that would benefit a transformation you’re undertaking; you might also have the opportunity to expand the role of certain IT managers at either company, which could help with retention. On the flip side, you will also find out if the combined technology staff is too lean to support an integration project. “That’s when you would want to bring in a fractional CIO or other outside resources,” he says.

Buddenberg recalls working with a healthcare company that did an acquisition and shortly after closing suffered a breach because of security gaps in the technology of the acquired company. “It was something that should have been caught during a diligence process, but wasn’t,” he says. “You [as the acquirer] are responsible on Day 1 for the cybersecurity posture of the new organization. Insurance will help with the cost but it’s not going to help you with the reputational damage and the potential loss of clients.”

Seeing under the tech hood of the target company will also allow the acquirer to get a sense of any ‘technology debt’ they might be inheriting, which will give them some leverage to adjust the purchase price. “For example, if we know we’re going to have to invest $500,000 in this company, then let’s talk about that from a price perspective,” he says.

But Buddenberg notes that an acquiring company should not plan to bring in a firm like Elliott Davis too early in the process. “First you want to look at EBITDA, make sure the financials are in reasonable order—so really, right after quality of earnings. We’re not the first call,” he says, “but we’re probably the second call.”

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.