Canadian business leaders are worried—and for many, the reason is politics.

Chief Executive’s Q4 polling of nearly 300 CEOs across the country finds Canada’s business chiefs concerned over the political environment at home and abroad. Several voiced uncertainty as to how the U.S. presidential election will affect Canadian businesses and social trends, while others reiterated a change was much needed in Ottawa as well.

More than a quarter of Canadian CEOs now expect business conditions to deteriorate over the next 12 months, forecasting conditions to fall to 6 out of 10, on a scale where 10 is Excellent and 1 is Poor—down from 6.3 when asked in Q3.

“If Trump tariffs Canada, all bets are off,” said Paul McGrath, president at JEM Group of Companies in Ontario. “Unfortunately, we lack adults in Ottawa that can deal with Mr. Trump… the federal / provincial / local governments’ policies are at odds with running a MSB / SB in Canada.”

“Our customers are practically closed. They are not covering overheads. There is a disaster pending. Trudeau must quit even if only to give hope,” added Jeff Frank, president of Knotwidth Textiles in Montreal.

“It’s business despite the government, not the other way around,” said Daniel Sax, CEO of Canadian Space Mining Corporation in Toronto.

Alberta-based Pete Baran, founder of Blueneck Consulting, says there are actually some good indicators out there, but the recent U.S. election has thrown a wrench in many CEOs’ plans. “Although decreasing inflation and interest rates are a positive indicator,” he said, “the new increasingly isolationist U.S. government policy creates significant threats to international trade and investment.”

Most CEOs agree that the Bank of Canada’s series of rate cuts this year has helped—at least to some degree. Seventy percent say they have not so far observed an impact on consumer demand because, on one hand, it will take time to move the needle and on the other, there are too many other factors at play.

“The rate cut is not a substitute for disposable income,” said one of the CEOs, pointing to the high cost of living and cost of capital.

Beyond Politics

Politics aren’t the only reason for CEOs’ declining optimism. Many of those polled also cited the carbon tax—and its potential increase in 2025—alongside a rising cost of living (and doing business) and a difficult labour market that is marked by weak efficiency.

“Very poor level of productivity, very weak Canadian dollar. Ageing population, consumer discretionary income at very low level and much lower buying power at the consumer level,” said Pierre Somers, chair and CEO of Walter Group in Montreal.

Still, some are hopeful it will pan out, and maybe even get better.

Scott Tilley, president of Ontario-based distribution solution company Tandet, is betting on the good outweighing the bad: “Uncertainty in the U.S. (political, economic, population shift). Uncertainty on tariffs (inflationary). Uncertainty on near shoring (supply chain disruption). Uncertainty on ports labour strife (supply chain disruption). Uncertainty on immigration in Canada (labour force tightening, inflationary). Uncertainty on emissions direction. Decent business fundamentals (stock market lift, bonds in balance, crypto’s upward trend, gold valuations up, inflation lower, interest rates lower, demand reasonable). And hope that when all mixed together that things are a bit better,” he said.

Most, however, are simply hoping a sooner-than-later election redresses the course.

“Once we get the election over and done with, business will be able to plan and move forward. Right now, we all seem to be waiting for one to be called,” said Dale Wilcox, president and owner of training and development firm WATMEC.

“I think with changes in government in the U.S. and soon in Canada, we will see the economy and outlook improve,” said Allan Zander, CEO of data optimization solutions company DataKinetics.

Of the policies CEOs expect will most impact their companies in 2025, “corporate taxes” ranked at the top, followed by “monetary policy (including government spending)” and “international trade and foreign investment.”

Opinions Vary

Forecasts vary significantly based on where polled CEOs are located and the sector in which they operate.

For instance, CEOs in the Maritime provinces expect business conditions to rise to an 8.0 out of 10 by this time next year—34 percent higher than the cross-province average. Meanwhile, for those located in BC, the outlook is more akin to a 5.5 out of 10—8 percent lower than the overall average.

When looking at confidence by sector, we find CEOs in the mining sector have the lowest forecast for 2025 (4.9, or 19 percent lower than the cross-sector average), while those in technology were the most optimistic, with a 7/10 forecast—17 percent higher than the cross-sector average.

Trickling Down

The impact of the current environment is translating to companies’ top and bottom lines: 69 percent say they expect revenue to be higher by this time next year (down from 71 percent who felt the same in Q3), and 58 percent say they expect profits to be up by the end of 2025 (vs. 63 percent who expected this outcome when we asked in Q3).

Unsurprisingly, fewer CEOs expect to increase spending during those months, with 44 percent saying they would raise capital expenditures (vs. 49 percent in Q3) and 41 percent who say they will add to their workforce (vs. 46 percent in Q3).

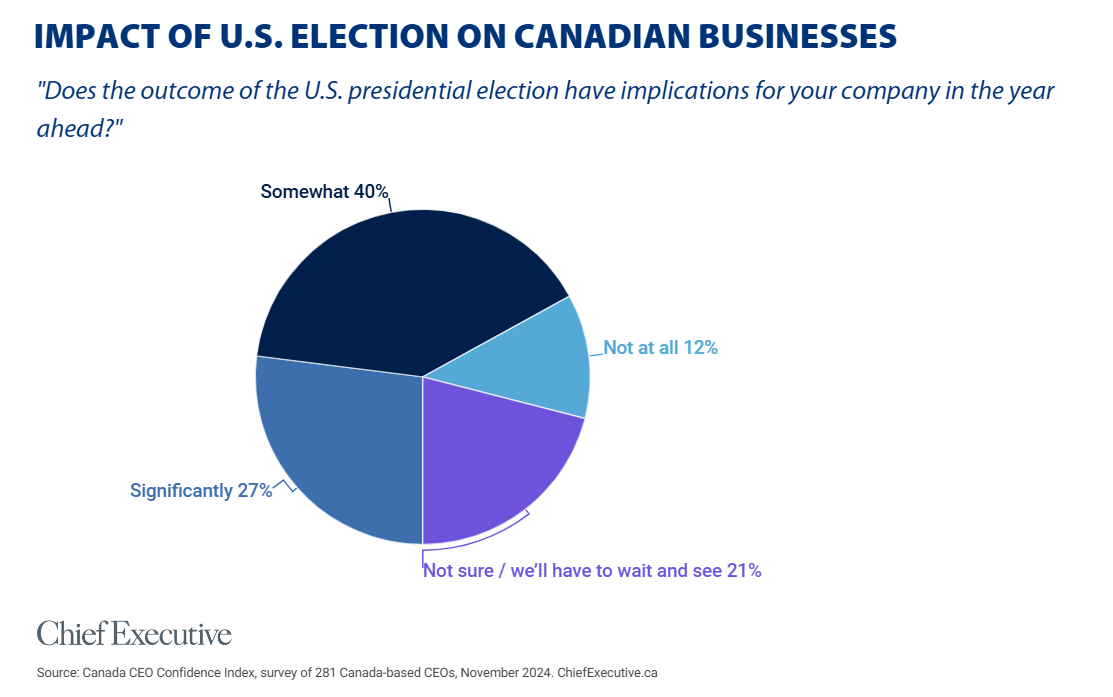

Overall, two-thirds said the outcome of the presidential election south of the border will have implications for their company, though the feedback is mixed as to what those will be—from tariffs and increasing costs, to immigration, deregulation and currency impacts, to name a few cited.

About Chief Executive Group’s Canada CEO Confidence Index

Chief Executive Group polls hundreds of U.S. CEOs, CFOs, CHROs and board members throughout the year to build our CxO Confidence Index series. The Index provides insightful data into business trends and what will likely shape strategies for the year ahead. In August 2024, we expanded the series to Canada. Our November edition of the Canada CEO survey was the second one in the series. It received 281 responses.