CEO Optimism Again Climbs In April Amid Soaring Vaccination Rate

After a punishing year of Covid, civil unrest and the most bitter and divisive election in nearly a century, America’s CEOs are looking forward to something new: An economic boom.

After plateauing in March, CEO confidence in business conditions 12 months from now gained 3 percent in April to reach its highest level since May 2018. CEOs say the vaccine becoming widely available across the nation is fueling their optimism for a full reopening of the economy in the near term. Similarly, their confidence in the current environment jumped 11 percent from March, snapping back to pre-Covid levels.

Those are the key findings from Chief Executive’s latest poll of 164 U.S. CEOs, fielded from April 6-8. America’s chiefs say they are pleased with the vaccine rollouts, as greater vaccination rates will lead to the removal of restrictions on businesses and spark demand. They rate their confidence in the current environment a 7 out of 10, on our 10-point scale, and business conditions by this time next year a 7.3.

This increase in confidence parallels that of CFOs, who shared their outlook with our sister publication, StrategicCFO360, last month.

“A lot of money that wasn’t spent during the pandemic will come back into play,” says Patrick George, founder of Heartwood Tree Services, a retail trade company based in North Carolina, explaining why he rates current conditions a perfect 10/10 and future conditions a 9/10. “Demand for housing will create jobs and material food demands. Biden’s infrastructure plan will create demand and opportunity and give confidence for contractors to invest in capital expansion.”

Karim Chichakly, co-president of isee systems, a technology company based out of New Hampshire, also expects future conditions to improve, albeit only slightly, from a 6/10 currently to a 7/10 by April of 2022, due to challenges that, he believes, will persist for some time still. “Business conditions in the U.S. will be better, but internationally, there will still be challenges,” he says, adding: “Inflation may also drag the business conditions in the U.S. down.”

Although many CEOs are predicting a near-term recovery fueled in part by the vaccine, infrastructure investments and money in consumers’ pockets, not all are confident that the Biden Administration’s policies will support growth. Many predict that increasing taxes and the minimum wage will hurt business.

“The Biden Administration’s planned tax hikes and economic policies are going to impede business growth and companies’ ability to hire. It will also drive up operating costs in unpredictable ways,” says the CEO of a small professional services firm headquartered in Connecticut, who predicts conditions will deteriorate from an 8 out of 10 to a 5 one year from now. This rating echoes that of 26 percent of respondents who also predict conditions to weaken, up 66 percent this month since March.

Many CEOs once again expressed their concerns this month about the uncertain state of the supply chain—with some seeing improvement and others still struggling to resolve their Covid-related issues. While some manufacturing CEOs are forecasting that the current breakdown in the supply chain will begin to get fixed, there are many others within the industry who remain concerned.

“New orders are up, and most customers are optimistic. The main drag on results right now includes supply chain disruptions and a shortage of skilled labor,” says the CEO of an industrial manufacturing company in Texas, who is anticipating labor, supply chain and material cost issues to continue. “Labor constraints are hindering production output, causing order backlogs to lengthen. Rising labor costs from overtime and rising material costs are also impacting profit projections.”

Despite the overall optimism among CEOs, the split in outlook has changed significantly this month: Those who forecast improving business conditions over the coming months has decreased by 22 percent, from 59 percent in March to 46 percent this month. This is, in part, due to the 11 percent jump in confidence in current conditions reported this month and to the number of CEOs who now believe that the growth they are experiencing will soon be capped.

April is the third consecutive month where we’ve observed a growing number of CEOs forecasting increases in profits, revenues, hiring and capital expenditures. The proportion of CEOs projecting an increase in profits and revenues by this time next year has risen by 6 and 3 percent, respectively, to 79 and 83 percent. This is the highest proportion of CEOs forecasting an increase in both profits and revenues since the beginning of 2018, when Trump announced his corporate tax cuts.

The percentage of CEOs projecting an increase in hiring has more than tripled since this time last year, illustrating a trend in line with decreasing unemployment levels and increasing confidence in the economy.

Up 3 percent since last month, 66 percent of CEOs are now forecasting an increase in hiring—also the highest proportion recorded since the beginning of 2018.

Similarly, a growing number of CEOs are now planning to increase capital expenditures over the next 12 months, at 65 percent—up 18 percent since March and once again the highest proportion on record since 2018. The CEO of a mid-size technology company in Minnesota explains the surge: “Companies that thrived during Covid are ready to invest in strategies to propel forward.”

Sector & Size View

Sector & Size ViewOnly two industries show declining confidence in the future this month: industrial manufacturing (-3 percent) and professional services (-2 percent). CEOs in industrial manufacturing are primarily concerned by labor and material shortages, while those in professional services are most concerned with economic policy—and the resulting consequences.

Tim Zimmerman, president of manufacturing company Mitchell Metal Products in Wisconsin, believes conditions will decrease slightly, from an 8 to a 7, by this time next year due to the cost of raw materials. “We now find our organization in the midst of decisions to either walk away from contracts or take them at a loss because raw material costs have risen to a point where we can no longer honor contracts with customers,” he says.

Tim Zimmerman, president of manufacturing company Mitchell Metal Products in Wisconsin, believes conditions will decrease slightly, from an 8 to a 7, by this time next year due to the cost of raw materials. “We now find our organization in the midst of decisions to either walk away from contracts or take them at a loss because raw material costs have risen to a point where we can no longer honor contracts with customers,” he says.

Kelly Goodsel, CEO of Viking Plastics in Pennsylvania, says that “continued government unemployment support and a lack of labor” are what’s driving her 4 out of 10 rating for future conditions, down from 7 out of 10 for current conditions.

In many other industries, optimism has grown by double digits. The outlook of construction, engineering and mining CEOs has grown by 11 percent from March to April, and CEOs in the technology, transportation and wholesale/distribution industries show a 13 percent increase in confidence.

Steve Townes, CEO of ACL Airshop and Ranger Aerospace, speaks to why his peers in the transportation industry are becoming increasingly optimistic: “The brightest sector in the global air transport industry is air cargo. We are currently experiencing sustained steady business and growth. The outlook in the coming year by all expert market-forecasting groups suggests continued buoyancy across the sector. We are investing more to stay with these new trends,” he says.

Year over year, CEOs in all industries but two have improved their outlook—no surprise considering the state of the economy at this time last year.

Forecasts by company size (by annual revenue) tells a different story this month compared to March. In companies with less than $10 million in revenue, CEO confidence leaped 10 percent in April—the month prior, they were the only cohort to report declining confidence—while their larger peers show a 6 percent decrease in optimism for the year ahead.

Doug Clark, chairman, CEO and founder of Corcentric, an upper-middle market company located in New Jersey, says, “I am concerned that the proposed business and forthcoming personal tax increases will stymie the optimistic psyche of business and consumers.”

CEOs of companies in all size groups show an increase in confidence from April of last year, when the Covid-crisis reached a breaking point.

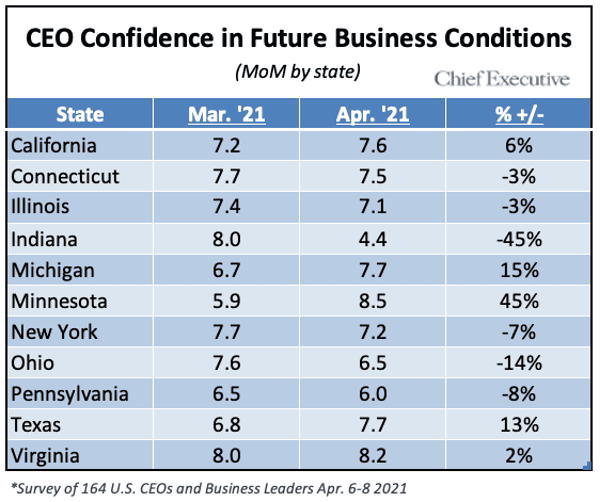

Looking at business confidence by region, Minnesota and Michigan CEOs experienced the largest increase in confidence month-over-month, up 45 and 15 percent, respectively. They attribute this boost in optimism to new business opportunities and customers, pent-up demand and an end to Covid.

Alternatively, CEOs in Indiana and Ohio reported the largest decrease in confidence in the future, down 45 percent and 14 percent, respectively. CEOs in those states say they’re concerned about government spending, inflationary pressures and an increase in taxes, among other economic policies.

Overall, the most optimistic business leaders are found in Minnesota, Virginia and Texas—where the re-opening of businesses and increases in both consumer demand and new opportunities are fueling their positive outlook—while Indiana, Pennsylvania and Ohio CEOs, at the bottom of the list, are less enthusiastic due to expectations that tax policy will harm their businesses.

About the CEO Confidence Index

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.