This landscape of uncertainty has persisted for long enough. What seemed like a never-ending election cycle, rife with disruption, finally came to a close last month and now business leaders have high hopes for the year to come.

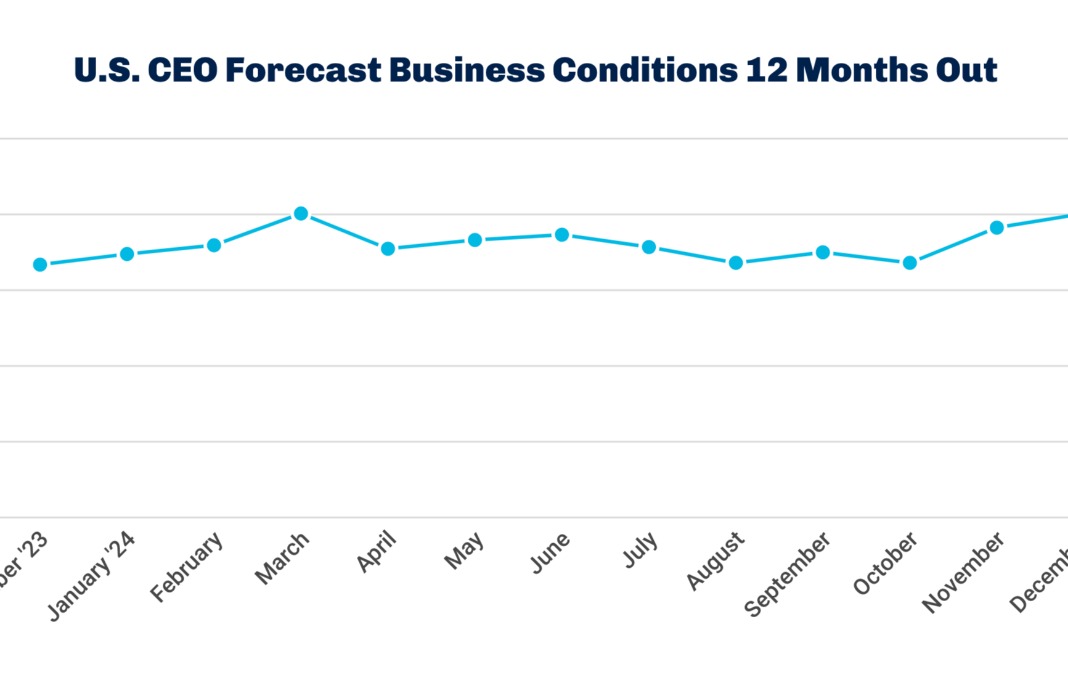

Chief Executive’s latest read of 135 CEOs, polled December 3-5, finds the majority expecting more business-friendly policies coming from the White House next year—and more rate cuts from the Fed. That’s driven their forecasts of business conditions 12 months from now above 7 (on a 10-point scale where 1 is Poor and 10 is Excellent) for just the second time in the last three years. CEOs’ outlook this month matches the 2024 high set back in March after the Fed chairman Jay Powell praised the economy.

CEO sentiment about the current state of business conditions also experienced a boost in December, going from 6 to 6.4, an increase of 6.2 percent, as more business leaders navigate with greater certainty.

“I have confidence and more certainty as a result of the election concluding,” says Tom Verratti, CEO at Contemporary Staffing Solutions, to explain the bump in his optimism.

Ron Joyce, chairman of Joyce Farms is also optimistic and says, “The new administration is much more pro-business. It has already caused an improved attitude among consumers and businesses that better times are ahead of us.”

This month, 58 percent of CEOs expect business conditions to improve by this time next year. And although this measure has dipped since last month, it is still the second highest proportion of CEOs to forecast improving business conditions since early 2021 when a Covid-19 vaccine was released.

Still, one in five CEOs expect conditions to worsen. Their concern? The talk of tariffs and how they could impact inflation and the greater economy.

THE YEAR AHEAD

This month revenue and profit forecasts are surging along with business sentiment, while thoughts surrounding capex and hiring are a bit more hesitant.

The proportion of CEOs who forecast an increase in profits 12 months down the line is now at 73 percent—up 6 percent this month on the back of a 14 percent increase last month. This is now at the highest level it’s been since 2021, when in-person commerce had a comeback.

Forecasts for revenue growth are also booming, with a whopping 82 percent of CEOs expecting boosted revenue a year from now, up 11 percent since last month and the highest proportion since January of 2022.

While the proportion of CEOs who project increases in capex slipped since last month (from 55 to 51 percent), still a majority of CEOs project increases in capital expenditures over the course of the next year. This is after the proportion of CEOs planning to increase capex jumped from 37 percent to 55 percent in November.

“Lower interest rates, more spending on capex and potential for onshoring of more manufacturing,” says the CEO of a $250 to $499 million manufacturing company that specializes in custom automation machine building to explain his forecast for the next 12 months.

Only 12 percent of CEOs reported planning decreases to capex, the lowest proportion since March of 2022.

Similarly, the proportion of CEOs planning increases to their headcount fell from 59 percent last month to 52 percent in December, also on the back of a major bump the month prior. Meanwhile, the proportion of CEOs planning decreases to headcount fell from 13 to 8 percent, the lowest proportion since February of 2022.

“The last three years have shown us that uncertainty is the new normal, and clinging to rigid plans can be more hindering than helpful,” cautions Vladislav Podolyako, CEO/Founder at Belkins, a lead generation agency.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/