Just two months ago, CEOs collectively breathed a sigh of relief, as tariffs for most countries went into effect and the Big Beautiful Bill ushered in promises of juicy corporate tax cuts and reduced regulation, giving business leaders hope that they could finally get back to business with some degree of planning ability.

That didn’t last long.

Our September CEO Confidence Index polling finds CEOs’ perception of current business conditions in the U.S. stuck in neutral, at one of the lowest levels of the year still: 5.1 (measured on a scale where 1 is Poor and 10 is Excellent). That’s flat from the 5.2/10 in August, 8 percent lower than July and 19 percent lower than where CEO perceptions were in January.

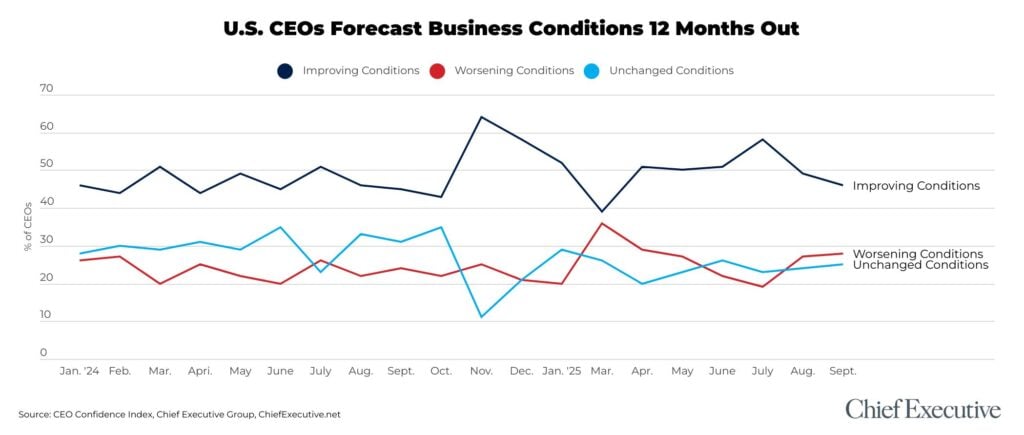

And while CEOs forecast the economy 12 months from now will reach 5.5/10—a healthy 8 percent higher from what it is today—their rating is the second consecutive monthly decline in their outlook, from 6.8/10 in July to 5.7/10 in August.

“Inconsistency and instability from DC makes planning extremely difficult right now, and inflationary costs that can be absorbed have been absorbed. Those are now being passed-through to consumers. It’s a tough climate for sustaining growth,” said David Reimer, CEO of The ExCo Group.

“Evolving tariff environment is reducing business confidence and increasing costs,” agreed Tim Zimmerman, CEO of Mitchell Metal Products.

The CEO of a wholesale manufacturer agreed: “[The outlook] is highly dependent on stabilization of global trade and tariffs. Too hard for people to create strategies when the ground moves every 30-60 days.”

Many of the CEOs polled said they saw increasing evidence that the Trump administration’s policies were starting to slow the overall economy. “[There is] demand uncertainty due to tariffs. We continue to see softness in multiple segments of our business that is driven by customers taking cautious approaches to their businesses, including very tight inventory management, as they wait to see how tariffs ultimately play out,” said the CEO of a publicly traded global manufacturer.

“The administration policies are not predictable and may create an environment conducive to stagflation,” said the CEO of a mid-market financial services firm.

Still, some are seeing improvements in pipelines and continue to hope that this period of uncertainty will lead to a better business climate.

“The tariff situation is currently freezing many consumers from making capital equipment purchases. If this strategy can stabilize, and interest rates can come down, things should improve,” said the CEO of a PE-backed global manufacturer.

“Even with all the tariff noise, inflation isn’t as bad … especially on products made in America. A year from now, as tariff concerns fade, the deportation turmoil settles and new favorable tax laws take effect, companies like ours, with little international exposure, will see real benefits,” said Andrew Ly, CEO of Ly Brothers Corporation.

Overall, just 46 percent of CEOs surveyed said they now expected the economic outlook for the coming year to improve, the lowest level since March and on par with CEO ratings throughout 2024. Those expecting conditions to deteriorate in the year ahead ticked up slightly in September, to 28 percent—higher than it was in 2024.

RECESSION ODDS

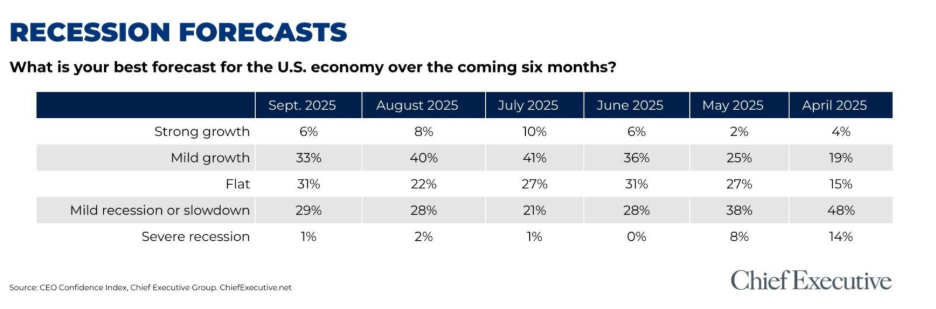

In our September polling, 29 percent of CEOs surveyed said they now expect a recession in the next six months, versus 28 percent last month and 21 percent in July (recession fears peaked at 48 percent amid the tariff rollout in April). The number of CEOs expecting growth in the next six months fell from 48 percent last month to 39 percent in this month’s poll.

THE FED’S ROLE

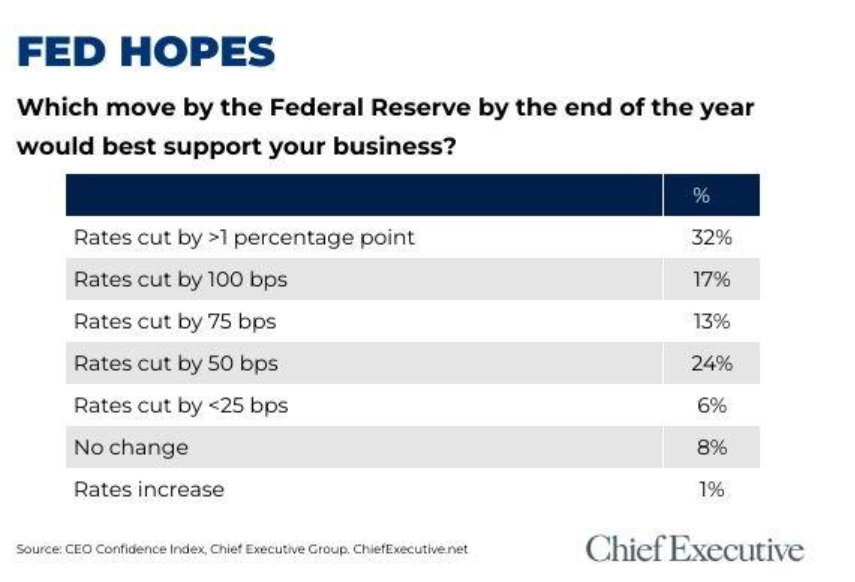

Asked what they would like to see from the Federal Reserve by the end of the year, 92 percent of CEOs responded they want to see deep rate cuts. Nearly two-thirds said they are hoping for the Fed to cut rates by at least 75 basis points, with a third asking for a percentage point or more. Only 6 percent said they’d be happy with a 25 bps cut.

Should the Fed not provide the expected cuts, CEOs expect the outcome to range from continuing “flatness” and margin pressure to broader economic strain, including delayed capital investments, layoffs and reduced demand.

“Without a stimulus to the economy I expect further deterioration of consumer sentiment and a weakening economy,” said the CEO of a large North American entertainment company.

“The organization will need to be shaped for potentially a smaller scale and protect the profits, while looking for very strategic initiatives in new products and labor reduction via automation,” said the CEO of a staffing agency.

“Additional increases will be passed to customers to combat the rising cost of insurance and need to increase wages,” said the CEO of a family-owned business.

“We will be looking to restructure our business and potentially shutter capacity,” said the CEO of a publicly traded consumer manufacturing company.

The Year Ahead

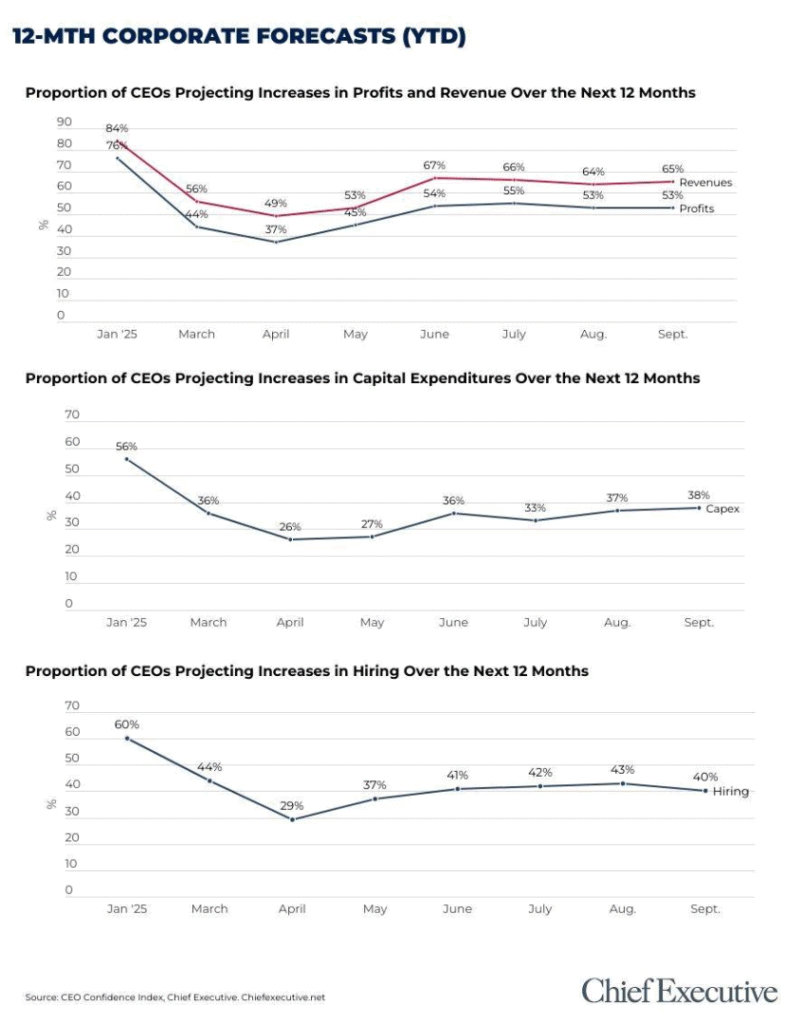

Corporate forecasts for the year ahead have been holding fairly steady over the past few months, but CEOs say their companies are nevertheless falling short of their 2025 targets.

- 65 percent anticipate revenue to grow in the year ahead, but 57 percent say they expect to end the year below their 2025 target.

- 53 percent expect profits to increase in the next 12 months, but 54 percent expect to end the year below target.

“Growth is mostly stealing market share from underperforming competitors that are laying off people and cutting services,” said one CEO. “We are able to remain high touch with clients and being private with a lower overhead than our competitors is allowing us to take market share.”

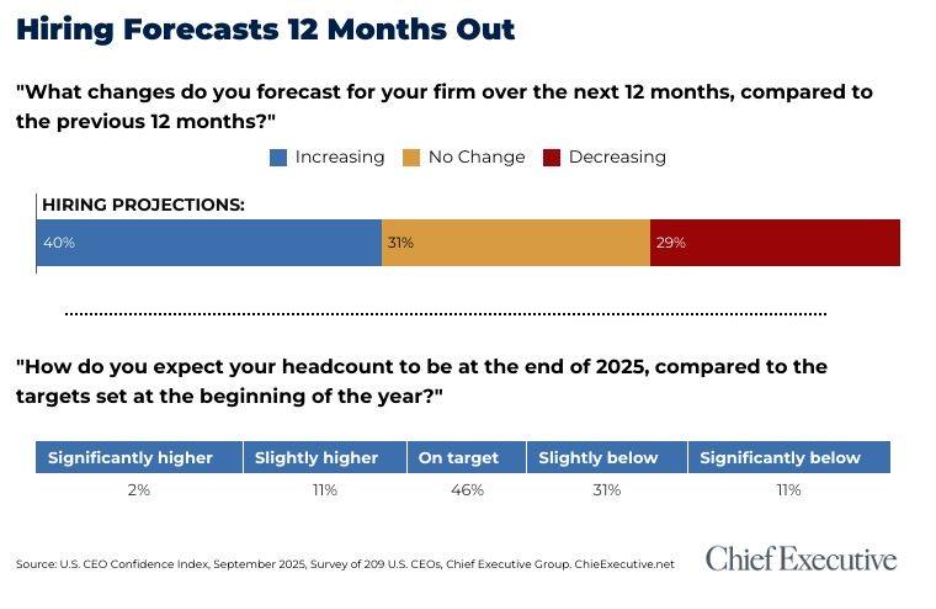

When it comes to hiring, CEOs are split: While only 40 percent plan to add to their headcount over the next 12 months (down from the 49 percent average of 2024), 46 percent say they’re actually on target for the year—and 41 percent say they’re falling short of goals.

Of those falling short of targets this year, most blame the overall cost of labor and the difficulty finding skilled, dependent workers as the primary headwinds, though several mentioned capitalizing on AI to shore up that gap.

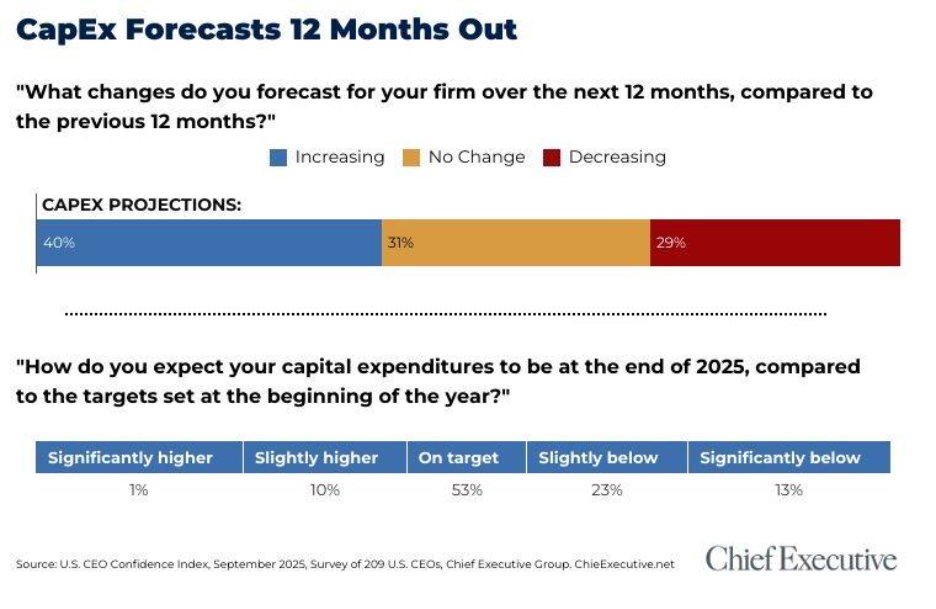

One area bucking the trend: capital expenditures. While only 38 percent plan to increase those investments in the next 12 months (down from the average of 46 percent in 2024), 53 percent say they’re on track to end 2025 on target.

Perhaps a bit of good news is that the impact of inflation on the cost of doing business appears to be easing: 66 percent of CEOs now expect operational expenditures to continue to increase in the year ahead, vs. 81 percent back in April.

About the CEO Confidence Index

Since 2002, Chief Executive Group has been polling hundreds of U.S. CEOs at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/