As the year creeps into fall, U.S. manufacturing CEOs downgrade their forecast for future business conditions and their rating of current conditions for the second month in a row in September, citing volatility, tariffs and reduced demand as the main drivers.

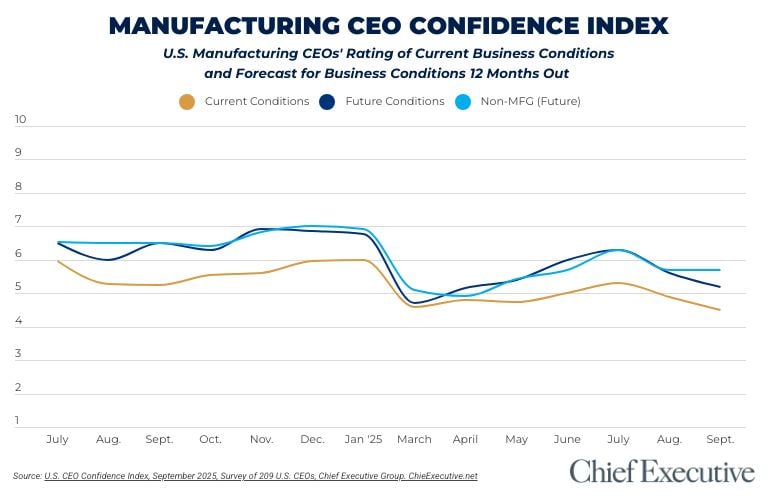

According to Chief Executive’s latest CEO Confidence Index survey, conducted September 9 and 10, U.S. manufacturing CEOs now forecast business conditions 12 months down the line at 5.2/10, on a scale where 1 is Poor and 10 is Excellent. That’s down another 7 percent since last month, after an 11 percent decrease in August. Now for a third consecutive month, this score is well below that reported by non-manufacturing CEOs (5.7/10).

When it comes to their rating of the present business environment, the consensus is grim. U.S. manufacturing CEOs rate current business conditions at 4.5/10—their lowest rating of current conditions since the pandemic. Their rating also signals a growing gap between the reality of business for U.S. manufacturing CEOs versus those in other industries, who rate current conditions a relatively sunny 5.6/10.

Tariffs and trade policy are the most frequently cited topics to explain manufacturing CEOs’ forecasts with many explicitly mentioning that tariffs are a large source of uncertainty. Weak demand, rising costs and global instability are also to blame for the low ratings this month, according to manufacturing CEOs.

“Slow orders and customers are confirming business has slowed.,” says Leonard Bedell, president & CEO at Mobil Steel International.

Still, manufacturing CEOs are hopeful that conditions will improve, given stabilization and reduced interest rates.

“The tariff situation is currently freezing many consumers from making capital equipment purchases,” says the CEO of a global printing equipment manufacturer. “If this strategy can stabilize, and interest rates can come down, things should improve.”

Recession forecasts remain unchanged, with a steady 30 percent of manufacturing CEOs forecasting a mild or severe recession over the next 6 months compared to 31 percent of non-manufacturing CEOs who project the same.

However, over one-third of manufacturing CEOs (35 percent) expect no growth from the U.S. economy over the next 6 months, compared to only 28 percent of non-manufacturing CEOs. On the bright side, an equal proportion of manufacturing CEOs is also forecasting mild growth.

The Year Ahead

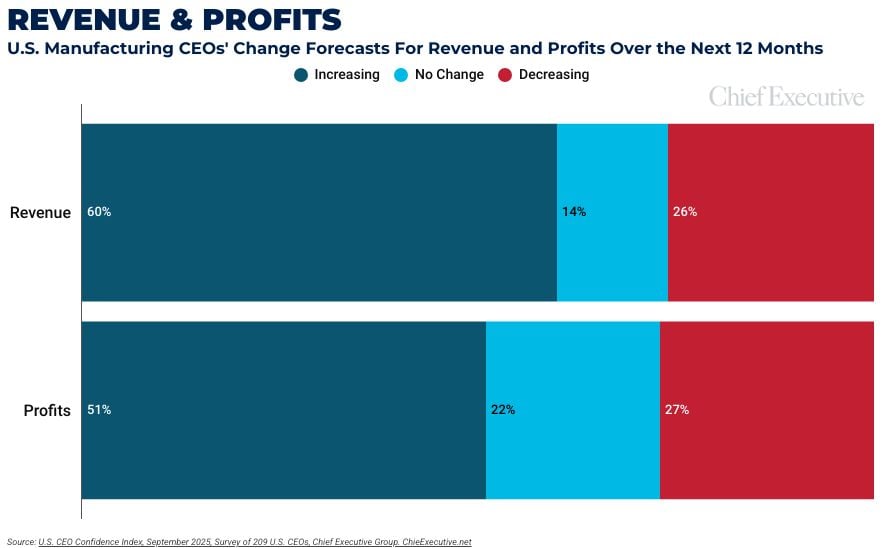

Projections for revenues and profit are down for manufacturing CEOs in September, for the third consecutive month. Now, only a very slight majority project increasing profits over the coming year, at 51 percent, down 7 percent from the month prior—compared to 55 percent of non-manufacturing CEOs who project the same.

Similarly, the proportion of manufacturing CEOs forecasting boosted revenue is down 5 percent, to 60 percent of manufacturing CEOs vs 68 percent of non-manufacturing CEOs. This figure is also down for the third consecutive month.

However, it is worth noting that the majority of manufacturing CEOs still do expect revenue and profit increases by 2026, although the proportion is falling.

“Much of manufacturing has been in a recession over the past year. It should turn by 2026,” says the CEO of a mid-size U.S.-based steel manufacturer and supplier.

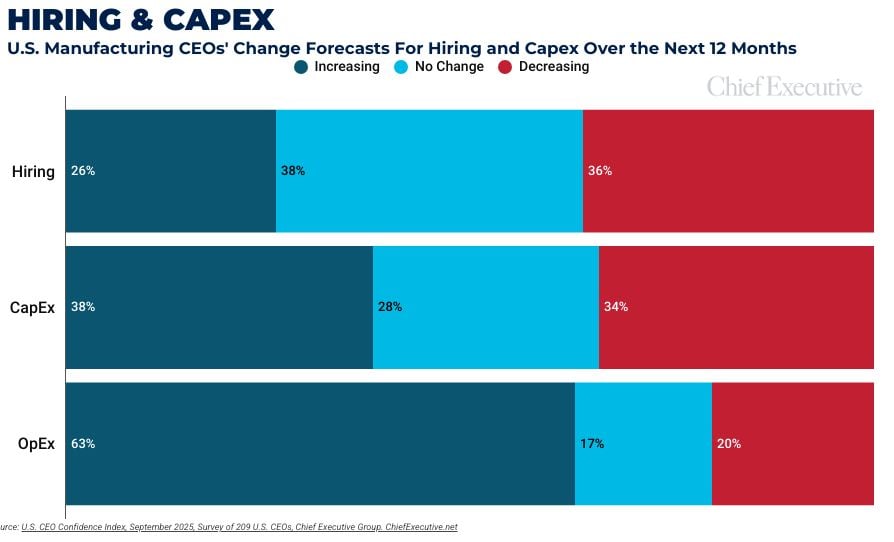

In September, 63 percent of manufacturing CEOs expect increases in operating expenses, down from 69 percent the month prior. This is not too far off from the 68 percent of non-manufacturing CEOs who said the same this month.

When looking at the proportion of manufacturers who are planning to deploy more capital within the next year, it displays a different pattern. Up for the second consecutive month, now 38 percent plan an increase in capex over the next 12 months in September vs 37 percent in August and only 34 percent in July.

Conversely, only 26 percent expect to increase their headcount, compared to 38 percent last month and 44 percent in July. The disparity in hiring plans between manufacturing CEOs and CEOs in other industries is now especially striking: 26 percent versus 48 percent, respectively, who plan to increase their headcount within the next year. This signals that manufacturers are pulling back hiring in favor of capital investments, such as automation to address ongoing labor scarcity in manufacturing.

“[There is] continued investment into aerospace manufacturing and factory automation to address labor scarcity,” says Terry P. Meier, CEO at Allways Precision, global manufacturer of industrial machinery.

About the CEO Confidence Index

Since 2002, Chief Executive Group has been polling hundreds of U.S. CEOs at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/