Volatility has clouded much of the year for U.S. CEOs, though manufacturing chiefs are continuously regaining confidence that steadier ground lies close ahead.

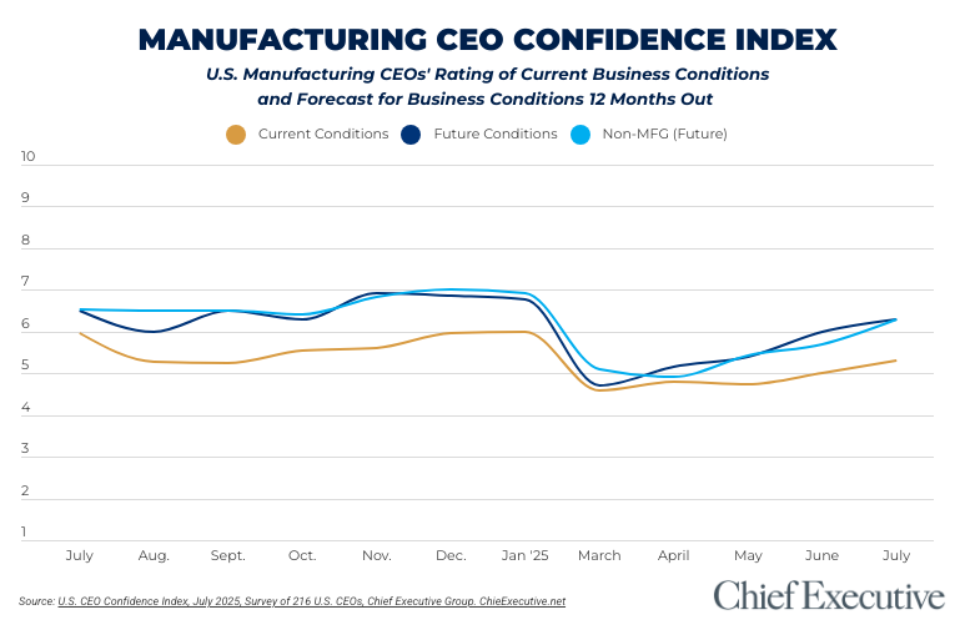

According to Chief Executive’s latest CEO Confidence Index survey, conducted July 1 and 2, manufacturing CEOs see improvements in current business conditions, rating them 5.3 out of 10 on a scale where 1 is Poor and 10 is Excellent. That is a 6 percent improvement from what they rated them just one month prior. Still, that rating remains well below that of non-manufacturing CEOs (5.6/10).

When looking out at what they forecast over the next 12 months, manufacturing CEOs continue to anticipate improvements, forecasting business conditions will reach 6.3 out of 10 by this time next year—on par with forecasts from non-manufacturing CEOs. This is a 5 percent increase since May. While the Index remains 7 percent lower than where it started the year, the gap since the abrupt 30 percent drop in confidence in March has been narrowing steadily for the past few months.

CEOs say they are hopeful that the trade volatility impacting many manufacturers will subside as agreements fall into place. “Small business depends on big business,” said Vance Patterson, president and CEO of Patterson Fan Company, and “a lot of big business coming to America.”

July data also shows recession fears are ebbing—and manufacturing CEOs are increasingly forecasting growth for the second half of the year: Only 25 percent of manufacturing CEOs expect a mild recession or slowdown over the next six months, compared to 60 percent in April. Instead, a near majority (47 percent) now expect economic growth.

Forecasting remains complex this month for international manufacturers compared to those operating only in the U.S., particularly when it comes to countries with a significant role in the global manufacturing industry; of special importance are the new tariff discussions addressing countries in East and Southeast Asia. This month, CEOs with a global footprint tended to express more optimism, while those focused solely on domestic operations reported a more negative outlook.

THE YEAR AHEAD

When asked how these improving conditions would impact their respective companies, however, manufacturing CEOs shared mostly declining forecasts in July.

The proportion of manufacturing CEOs expecting an increase in revenue and profits over the next 12 months fell 5 percent this month, from 69 percent and 59 percent in June to 66 percent and 56 percent in July, respectively.

Jim Nelson, president and CEO of Parr Instrument Company, says trade disruptions have affected demand, despite the tailwinds a weaker USD has provided. “June orders were very soft,” he said, echoing several other manufacturing chiefs.

While revenue forecasts are down, manufacturers operating in global markets appear more optimistic than their U.S.-only counterparts. Two-thirds (67 percent) of global manufacturers surveyed said they expect to see increases in revenues this year, in comparison to 63 percent of U.S.-only firms. The disparity between the two groups has slightly increased since last month, when 67 percent of U.S.-only and 70 percent of global manufacturers expected revenue increases.

Profit forecasts are also down among U.S.-only manufacturers: 50 percent of U.S.-only firms expect an increase in profits over the next year, down from 63 percent in June—a decrease of 21 percent.

Meanwhile, 59 percent of global firms expect an increase in profits, vs. 58 percent in June.

In terms of capital expenditures, 34 percent of manufacturing CEOs plan to increase their investments in the coming months, a decrease of 21 percent from 43 percent in June.

Data shows disparity between U.S. and global manufacturers: 33 percent of global manufacturers expect to increase capital investments over the next year, down from 46 percent in June, while 38 percent of U.S.-only firms expect an increase, up from 33 percent.

CEOs are also slowing hiring, according to the July data. 44 percent of CEOs plan to add to their headcount this year, down 3 percent since June. Global manufacturers appear to be bucking the trend, however, with 46 percent saying in July that they plan to increase their headcount within the next year (up from 42 percent in June).

About the CEO Confidence Index

Since 2002, Chief Executive Group has been polling hundreds of U.S. CEOs at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/