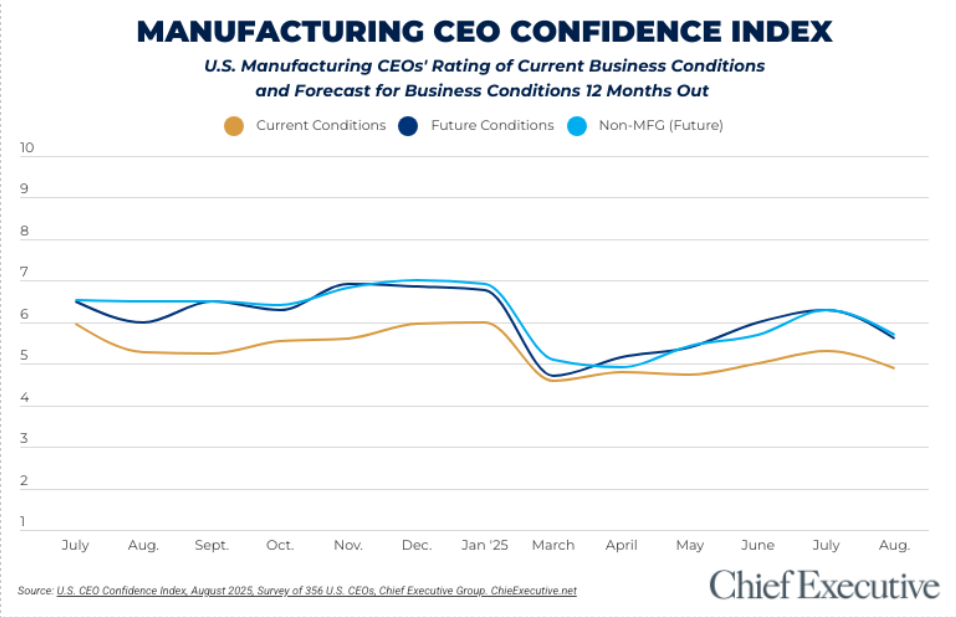

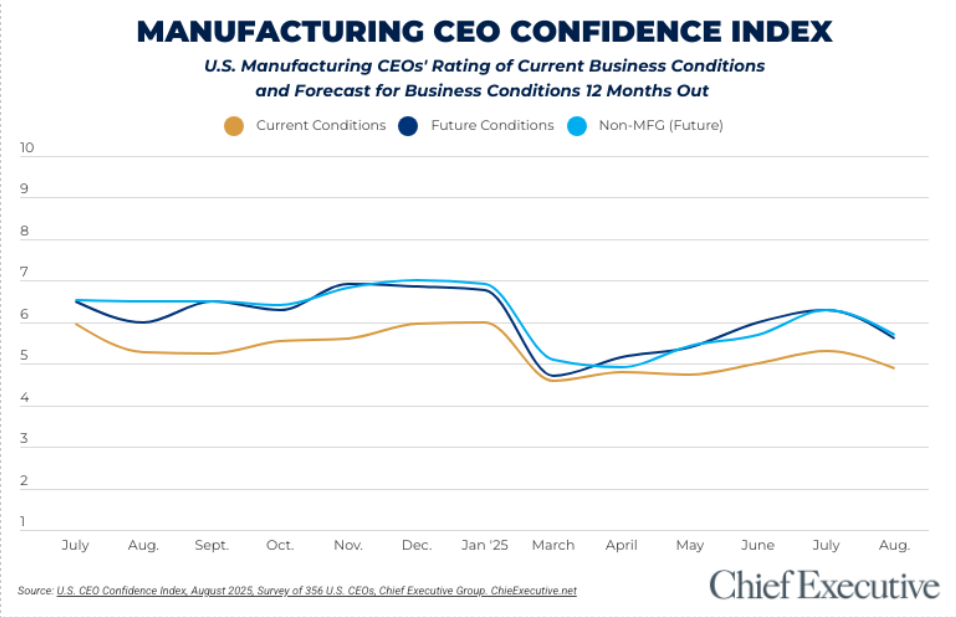

For months, manufacturing CEOs have held on to the hope that resolved trade deals and macroeconomic stability would improve business conditions heading into next year. While increasing optimism had been the dominant trend among them between March and July, recent tariff decisions and newfound legislative changes have altered sentiment this month.

According to Chief Executive’s latest CEO Confidence Index survey, conducted August 5 and 6, manufacturing CEOs rate current business conditions a 4.9/10, on a scale where 1 is Poor and 10 is Excellent. Down 8 percent since last month, this is the first decrease in current ratings since May. For a second time in August, this score is well below that reported by non-manufacturing CEOs (5.3/10).

When looking at what they forecast over the next twelve months, manufacturing CEOs predict improving conditions, forecasting a rise to 5.6 out of 10 by this time next year—just shy of the 5.7 rating forecasted by non-manufacturers. An 11 percent decrease since last month, the Index is down 18 percent from where it started the year (6.8/10).

When asked to explain what’s driving their forecast, manufacturing CEOs largely mentioned two things: tariffs and the geopolitical atmosphere. “Currently tariffs are causing a lack of enthusiasm in the manufacturing segment. Factories are cutting back or delaying purchases because of the added cost,” says one mid-size manufacturer.

Recession forecasts are also up this month, with a growing proportion of manufacturers predicting economic decline into next year. 29 percent predict to see a mild recession within the next six months, compared to 25 percent in July—nonetheless, the largest proportion (39 percent) continues to predict mild growth.

Healthy backlogs and continued consumer demand convince this proportion of manufacturers that growth will be seen in the coming months: “There is still a larger than usual backlog in the construction industry that things should stay busy for the next six months,” reports Jeff Stone, CEO of wood components manufacturer Navy Island. Even so, he notes “next year’s activity should be down.”

Lurking in the data, however, is the reality that much of this negative forecasting can be attributed to global manufacturers—those who are bearing the brunt of recent tariff implementation and who are operating in a dynamic geopolitical space. A comparative analysis shows that only 12 percent of domestic manufacturers predict a mild recession, whereas 35 percent of those with global operations predict the same. Surprisingly, the largest proportion of U.S.-only firms (47 percent) forecasts economic growth into next year.

“Tariffs are a major concern for increasing material costs. International sales are slumping with anti-U.S. sentiment, which is unfortunate and unnecessary,” says Gerry Lamberti, CEO of global suspension enhancement firm SuperSprings International.

Dennis Cook, CEO of medical device manufacturer Superior Felt & Filtration, echoes Lamberti’s sentiment: “We see customers pulling back and international customers looking to source to other countries. We’ve had international accounts ask us to take Made in USA labels off of our packaging in fear packages would be vandalized.”

While forecasts of the economy are down, manufacturers have followed the majority to remain optimistic about their respective companies within the year ahead. They attribute this largely to healthy backlogs, business development and an aspiration that tariff stressors will eventually bring positive change.

“As tariffs are finalized some stability will enable decisions to move forward,” says the CEO of a large-size manufacturing firm.

64 percent of manufacturers expect to increase their revenues, compared to 66 percent last month. Similarly, 55 percent predict an increase in profits, compared to 56 percent in July. Domestic manufacturers are more optimistic than those with global operations for both categories.

Manufacturers are planning to deploy more capital within the next year: 37 percent predict an increase this month in comparison to 34 percent in July.

At the same time, however, only 38 percent expect to increase their headcount, compared to 44 percent last month. The disparity in hiring between domestic and global manufacturers is significant: 52 percent versus 32 percent, respectively, plan to increase their headcount within the next year.

A more positive prediction lay in operational expenditures: Just 69 percent expect to increase their opex this month, whereas 80 percent forecasted the same in July.

Since 2002, Chief Executive Group has been polling hundreds of U.S. CEOs at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.