Costs factor prominently. According to Zillow, for workers between the ages of 22 and 34, rent claims upward of 45 percent of income in Los Angeles, San Francisco, New York and Miami, compared to closer to 30 percent of income in metros like Dallas-Fort Worth and Houston. In Los Angeles and San Francisco, a monthly mortgage takes, on average, close to 40 percent of income, compared to 15 percent nationally.

Prohibitive home prices in core cities are driving would-be home buyers out. According to a TD Bank survey, over 80 percent of 18- to 34-year-old renters want to own a home. A Fannie Mae survey of people under 40 found that the vast majority thought owning made more financial sense, offering potential for asset appreciation and a hedge against rent increases.

Homeownership prospects vary greatly by metro. Millennial homeownership rates are 37 percent in Nashville, 29 percent in San Antonio and 27 percent in Orlando, compared to under 20 percent on the California coast or New York City and environs.

The Burb Boom

So where are millennials and other generations moving? First, we have to realize that more than 80 percent of 25- to 34-year-olds in major metropolitan areas already live in suburbs and exurbs, according to the ACS data. Among older generations, this number jumps to more than 85 percent.

As economist Jed Kolko notes, people tend to move out of core cities to suburban locations as they age. Over 393,000 people age 30 to 44 in 2007 to 2011, largely covering members of Generation X, left the urban cores by 2012 to 2016, while 678,000 moved into the suburbs.

Although younger millennials migrated toward urban cores more than previous generations, the website FiveThirtyEight notes that they are more likely than prior generations to move to the suburbs as they age. We have already passed, in the words of University of Southern California demographer Dowell Myers, “peak millennial” and are seeing the birth of a new suburban wave.

This trend is likely to accelerate as early as 2020, when millennials enter their 30s, the age when people tend to raise children. As generational researchers Morley Winograd and Mike Hais have long pointed out, millennial attitudes about family remain surprisingly conventional, other than a greater emphasis on gender equality. The vast majority want to get married, start a family and be “good parents.”

Millennials may take longer to take the vow or have the child, but they are doing so in increasing numbers. Today, 16 million millennials have children, up from barely six million a decade ago—and that number is likely to soar in coming years.

Young, growing families tend to opt for the suburbs for reasons of affordability, safety and education quality. Among those under 35 who do buy homes, four-fifths choose the single-family detached houses most often found in suburban locales. Surveys such as those from The Conference Board and Nielsen consistently find that most millennials see suburbs as the ideal place to live in the long run. According to a recent National Association of Homebuilders report, more than 66 percent, including those living in cities, actually prefer a house in the suburbs.

Generational preferences on where to live remain remarkably similar. Generation X, perhaps the best guide to future millennial behavior, saw the urban core share drop 7.8 percent, from 15.6 percent in 2007 to 2011 to 14.3 in the 2012 to 2016 period. Employers need to pay attention to this generation, which, while smaller than millennials, now makes up the majority of managers at U.S. companies. They are also far more entrepreneurial than their millennial successors, with a startup rate roughly twice that of millennials—and growing—while the younger generation’s rate has been on the decline.

Boomers—many of whom also went to core cities in their 20s—also are largely clustered in suburbs or exurbs. The much-hyped “return to the city” is a minor phenomenon. As with other groups, the share of boomers living in urban cores since 2010 has dropped from 13.9 percent to 13.1 percent.

Some might dismiss the boomers as a potential talent pool, but many are well-educated, particularly in skilled trades, and now remain on the job longer than at any time since the 1950s. They are also, along with immigrants, increasing their entrepreneurial presence.

Shifting Regions

Shifting Regions

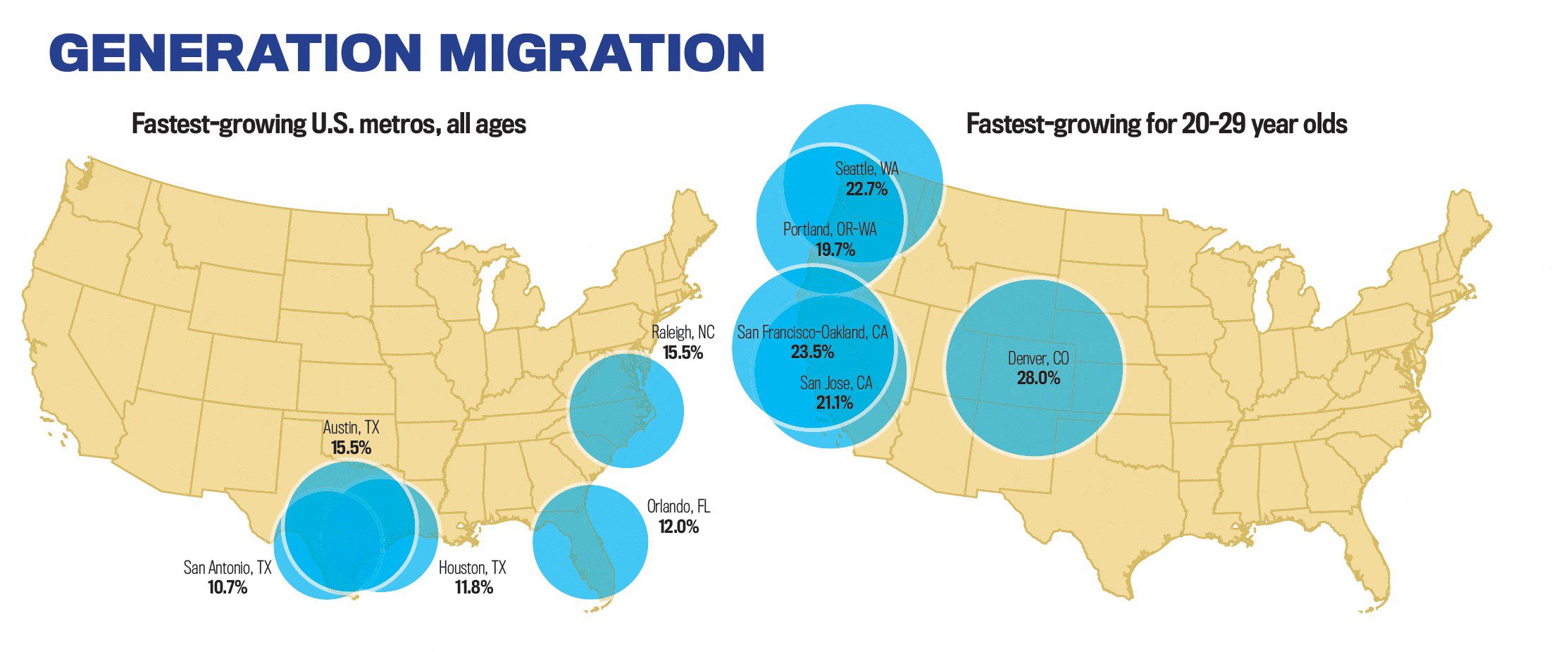

Perhaps even more significant for talent acquisition may be regional shifts, measured by the latest U.S. Census Bureau population estimates (2016). Virtually all the major metropolitan areas with the strongest population growth since 2011 are cities with smaller or, in some cases, even negligible urban cores—places like Austin, Orlando, Raleigh, Houston, San Antonio, Dallas-Ft. Worth, Nashville, Phoenix, Denver and Charlotte. For example, less than five percent of the population of these metropolitan areas is in the urban core. In comparison, more than 50 percent of the population of New York lives in the urban core, while in Boston, San Francisco, Philadelphia and Chicago, the number exceeds 25 percent.