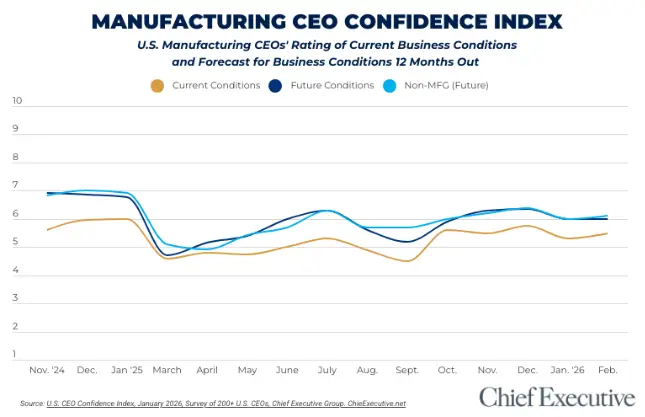

Amid a backdrop of market volatility and shifting takes from the Trump Administration on trade, U.S. CEOs’ outlook for business conditions 12 months from now continued to fall in April, the third straight month of decline.

Chief Executive’s most recent survey of American business leadership found that while overall sentiment remained “very good” in April, clocking in at 7.16 on a scale of one to ten, the numbers are nearing their lowest point since last September, representing a round-trip to where they were prior to the GOP tax cuts.

Many of the 316 CEOs who participated in our monthly survey say their tempered outlook is at least partly due to the political volatility fueled by the Trump administration, and what that might portend going forward.

“It’s hard to imagine things getting better,” one industrial manufacturing CEO said of the current state of the economy, “but the mid-term elections are a concern.”

Confidence in current business conditions also slid to 7.41, after dwindling from 7.78 in February to 7.47 in March. This is now the third consecutive month during which CEOs have shown less confidence in the future than in the present, a clear indicator of uneasiness with the goings-on both in Washington and across corporate America.

“[The] bull market will end, consumer spending will retreat,” wrote the owner and president of a small consumer goods manufacturing company who says it’s just another typical business cycle.

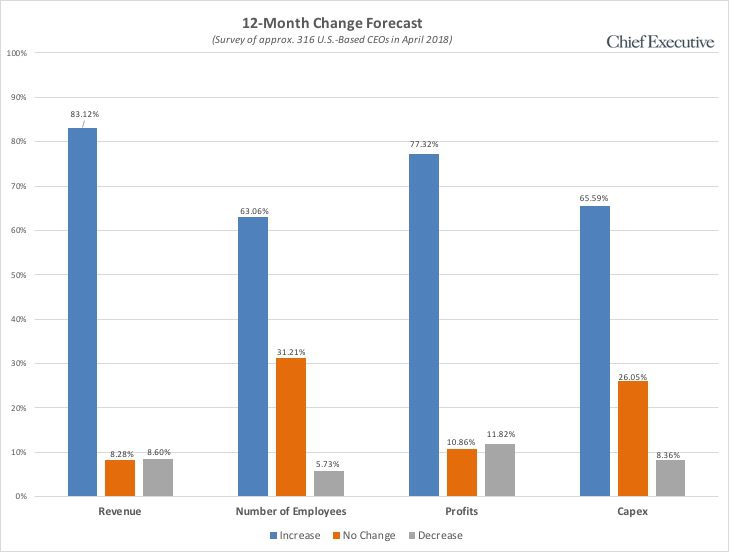

Still, 66% say they’ll increase capex over the coming year and 63% say they will add to their workforce–both representing an uptick of 3 percentage points month over month. Talent remains the top priority for the majority of CEOs (58%), with most reiterating how difficult it is to find qualified workers in a tight labor market.

Elsewhere, an impressive 83% expect jumps in revenues, compared to 77% anticipating rising profits–both up from February forecasts.

A gradual downward slope

While confidence levels remain at healthy levels, the slow decline that has taken place over the past twelve months is now apparent across most industries, and particularly in technology, where confidence in future conditions has dropped 13% since the same time last year and four percentage points month over month.

Financial services (7.17 out of ten in April) and consumer manufacturing (7.32) CEOs also reported significant setbacks, retreating 7% and 5% respectively since last month—those three sectors representing the biggest upsets of the month.

Construction (7.67) is the only sector to have recorded a major improvement since last month, adding 10% to its level of confidence in future conditions, mainly on the back of new housing starts and despite being down 4% year over year.

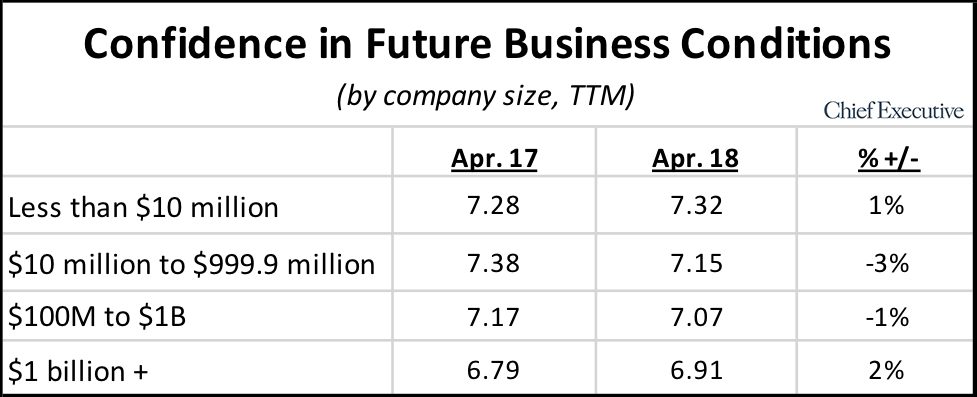

By size, in terms of annual revenues, small and large companies, at both ends of the spectrum, seem to be the most positive when looking ahead, finishing the month up 2% and 1% respectively from the same time last year. Mid-sized companies registered the biggest loss, losing 3% in their confidence outlook.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across corporate America, at organizations of all types and sizes, to compile our CEO Confidence Index data.