Despite a sharp escalation in global trade tensions, rising interest rates and the tightest labor market in a generation, our July reading of CEO confidence in current business conditions remains very good, at 7.55 out of 10, in line with June’s rating of 7.54—and where we started the year (7.57).

But confidence in future conditions is another story. In July, our monthly poll of nearly 300 U.S. CEOs found their outlook for future business conditions at a low for the year, down 2.4% this month to 7.02 out of 10 from 7.19 in June. This is the biggest drop since March, when confidence fell 5.2% as the Trump administration fired its shots in what now threatens to become a global trade war. Erosion in CEO confidence has remained steady all year, falling an average 1.3% each month since hitting its high in January on news of the GOP tax cuts. It is now at its at lowest point since last October.

“[It’s] hard to see business remaining this strong in the industrial sectors,” said the CEO and president of a mid-sized industrial manufacturing company.

Tariffs and lack of qualified labor continue to weigh down CEOs’ outlook. “I am assuming that the current trade war issues will be resolved within 60 days. If not, then I think we will be a [rating of] 6 [out of 10] one year from now,” said the CEO of a mid-sized consumer manufacturing company who believes the tariffs could cause serious supply chain issues and increase his company’s costs substantially. “We believe this will drive the economy into a recession within two years,” he says.

Lack of entry-level labor and otherwise qualified worker remains a challenge as well. “Retirements are getting harder to replace,” said Jim Nelson, president and owner of Parr Instrument Company. Nelson says people are his company’s most valuable asset and talent availability will, therefore, have the greatest influence on his business planning for the next 12 months.

Several CEOs also mentioned the political landscape as a factor for their dwindling confidence. The CEO and president of a mid-sized media organization says extreme partisanship is hindering progress on key issues in Washington. Overall, however, most seem to view the current economy as a positive backdrop for growth. Those wary of the upcoming midterm elections fear a shift in power could affect their business outlook, although some say a “blue wave” is become more and more unlikely.

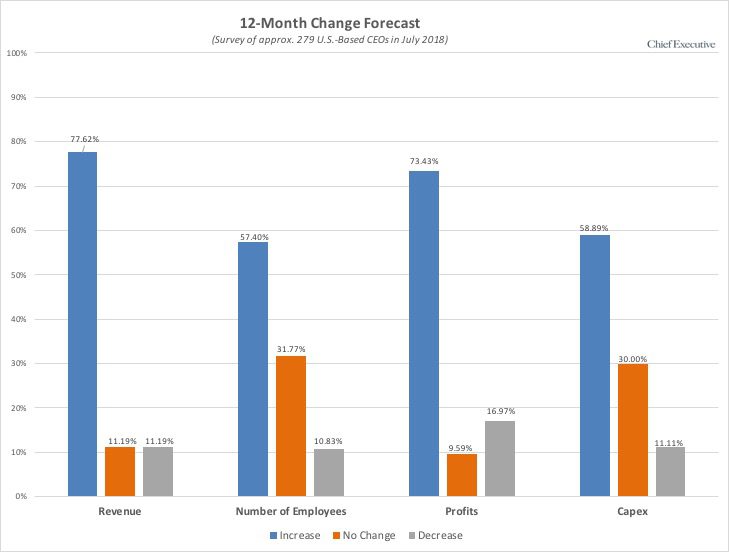

When looking at 12-month forecasts, all signs point to wavering confidence in the future, despite staying relatively robust when compared with years past. July data indeed reveals that 78% of CEOs now anticipate revenues to increase over the next 12 months, a very positive number on an absolute basis, but a big drop from the first half of the year, during which, on average, 85% expected revenues to increase. Furthermore, 11% now expect revenues to decline, compared to 7% for the first half of 2018.

Similarly, 59% of CEOs believe capital expenditures will be up 12 months from now, a decrease of six percentage points from the 65% average of the first six months of 2018, and 57% anticipate an increase in the number of employees, compared to the 1H2018 average of 62%, a decline that is surprising since the majority of CEOs told us they are anticipating placing a strong focus on talent recruitment over the coming year.

Finally, profit expectations are also down, albeit to a lesser degree, as 73% anticipate profits to increase vs 76% during the first half of the year.

Recession Fears

Recession Fears

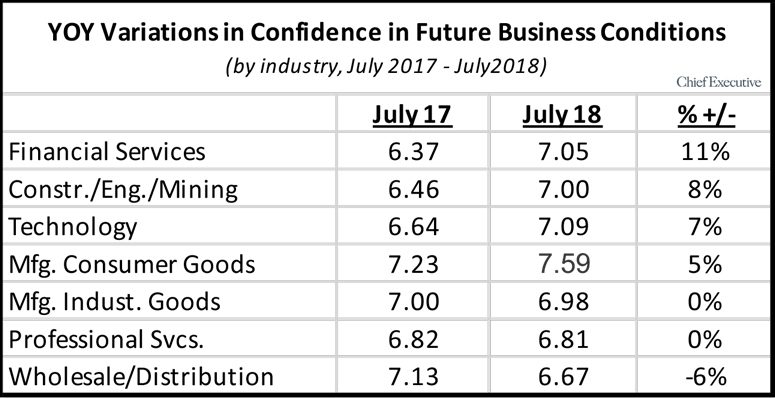

Looking at trends by industry, despite a gain of 11% year-over-year, the confidence of financial services CEO in the future outlook of business conditions plunged 6% in July, from 7.50 out of 10 in June to 7.05. These CEOs tell us that while they are pleased with the current mix of reduced taxes, low interest rates and regulatory relief, they fear a potential recession looming. Additionally, some have observed an increase in competition that makes hiring all the more difficult amid the current state of the labor market.

CEO confidence level of construction and industrial manufacturing—two other key barometers of the overall economy—fell by more than 7% in July.

The construction/engineering/mining industry has been losing confidence for two consecutive months now, and, at 7.00, it has returned to its lowest level this year, matched only by March when the steel and aluminum tariffs went into effect. CEOs once again say tariff policies are playing a big role in their outlook and they, too, foresee a potential recession settling in by 2020.

For industrial manufacturing CEOs, confidence is flat since the same time last year, but the sector has nonetheless registered a sharp drop this month, also losing 7% on the heels of three months of gains. Unsurprisingly, these business leaders attribute their prediction to the tariffs and, in some areas, a lack of qualified workers, particularly engineers.

In a complete reversal of roles, CEOs in the wholesale/distribution industry increased their confidence level in the future business outlook by 7% this month after a drop of nearly 10% last month. They say that despite the trade wars, which could affect inflation, they have observed increased demand and increased liquidity in the market. They nevertheless closed the 12-month period down 6%.

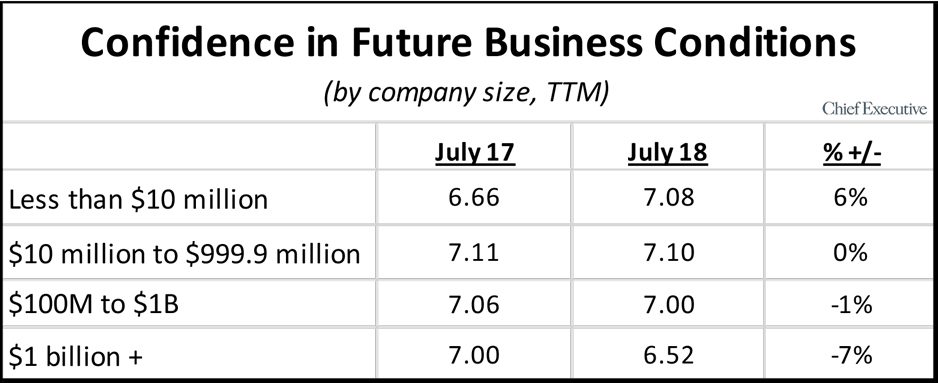

When looking at confidence in future conditions by company size (based on annual revenues), all groups lost ground in July. Small company confidence has dropped 1% since June, somewhat in line with the pace of decline recorded during the first half of the year, during which they ebbed and flowed to the tune of -1.5% per month. Nevertheless, this now amounts to a total loss of 8.8% since January.

Mid-sized companies slid almost 2% this month, their second biggest setback of the year, albeit to a much lesser degree. They had indeed lost 6% in March alone. Their year-to-date decline is 6.10%.

A look at upper middle companies tells a similar story, having lost 3% since June and 6.5% since the start of the year, while large companies have cumulated a loss of 20.8% year to date, 7% of which was in July alone. Their biggest drop, much like their counterparts, occurred in March (-18%).

CEOs across size brackets say the fear of a recession is mainly to blame, alongside trade and foreign affairs, all of which are undercutting the benefits of the new corporate tax rate and the overall state of the economy.

About the CEO Confidence Index

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across corporate America, at organizations of all types and sizes, to compile our CEO Confidence Index data.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.