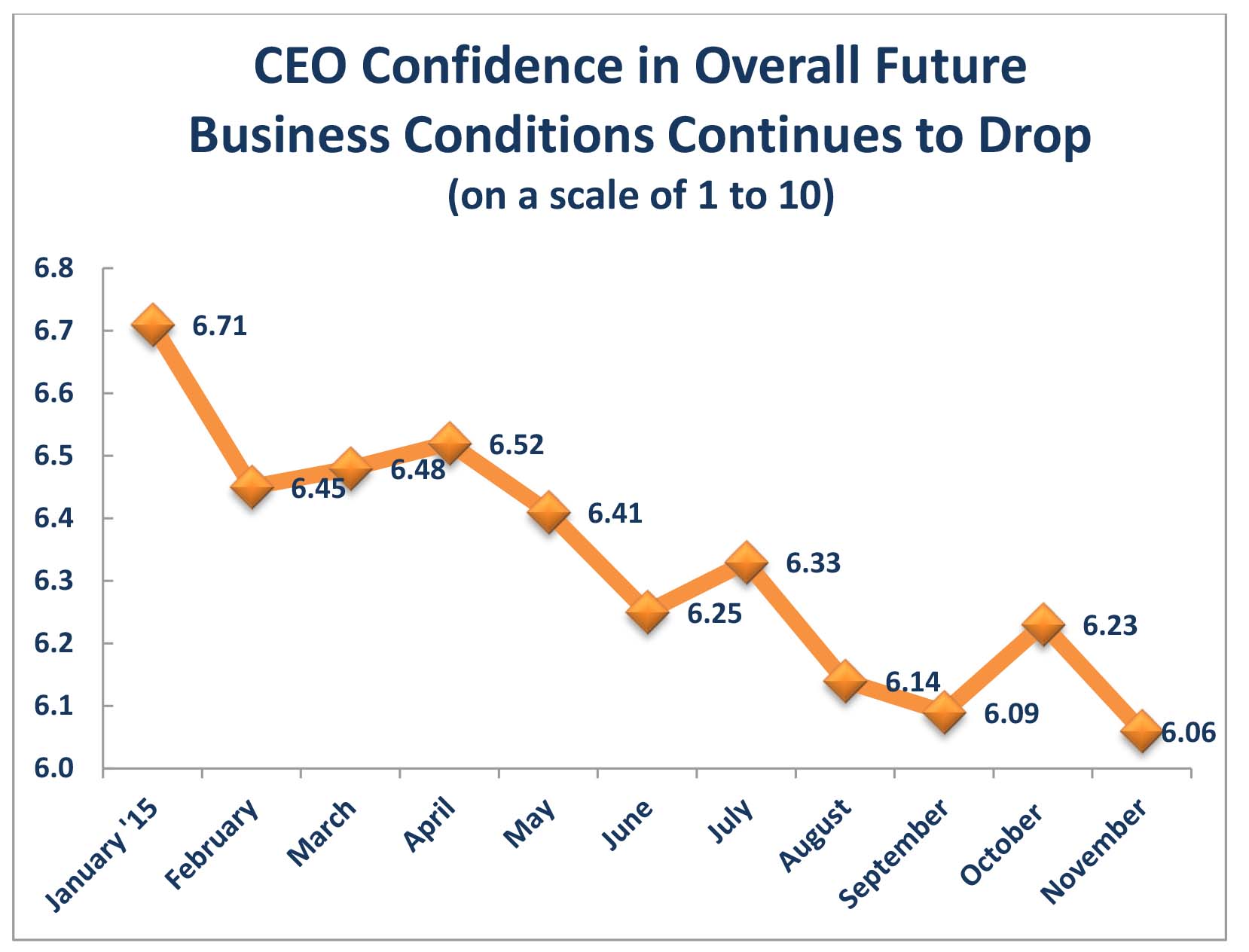

From flat interest rates to low oil prices, weak retail sales and the struggle over higher worker pay, many CEOs feel that nothing will improve until after the presidential election and are maintaining an air of cautiousness until then.

“This has to be the most pathetic economic recovery on record,” one CEO commented. “I was around during the 1980s recovery and saw a groundswell of business optimism as government lowered taxes and reduced regulation, and there was a message of optimism and confidence in Free Enterprise coming from the White House. As a result, business leaders then felt they had to get in front of an expanding economy. There is none of that kind of optimism now. Rather, business leaders seem to be in more of a defensive mode than anything else.”

“This has to be the most pathetic economic recovery on record,” one CEO commented. “I was around during the 1980s recovery and saw a groundswell of business optimism as government lowered taxes and reduced regulation, and there was a message of optimism and confidence in Free Enterprise coming from the White House. As a result, business leaders then felt they had to get in front of an expanding economy. There is none of that kind of optimism now. Rather, business leaders seem to be in more of a defensive mode than anything else.”

“Many of our clients feel the economy is stagnant,” another responded. “Decisions are on hold because of uncertainty of where interest rates are headed and concern over the lack of leadership in the current administration and the inability of Congress to accomplish anything.”

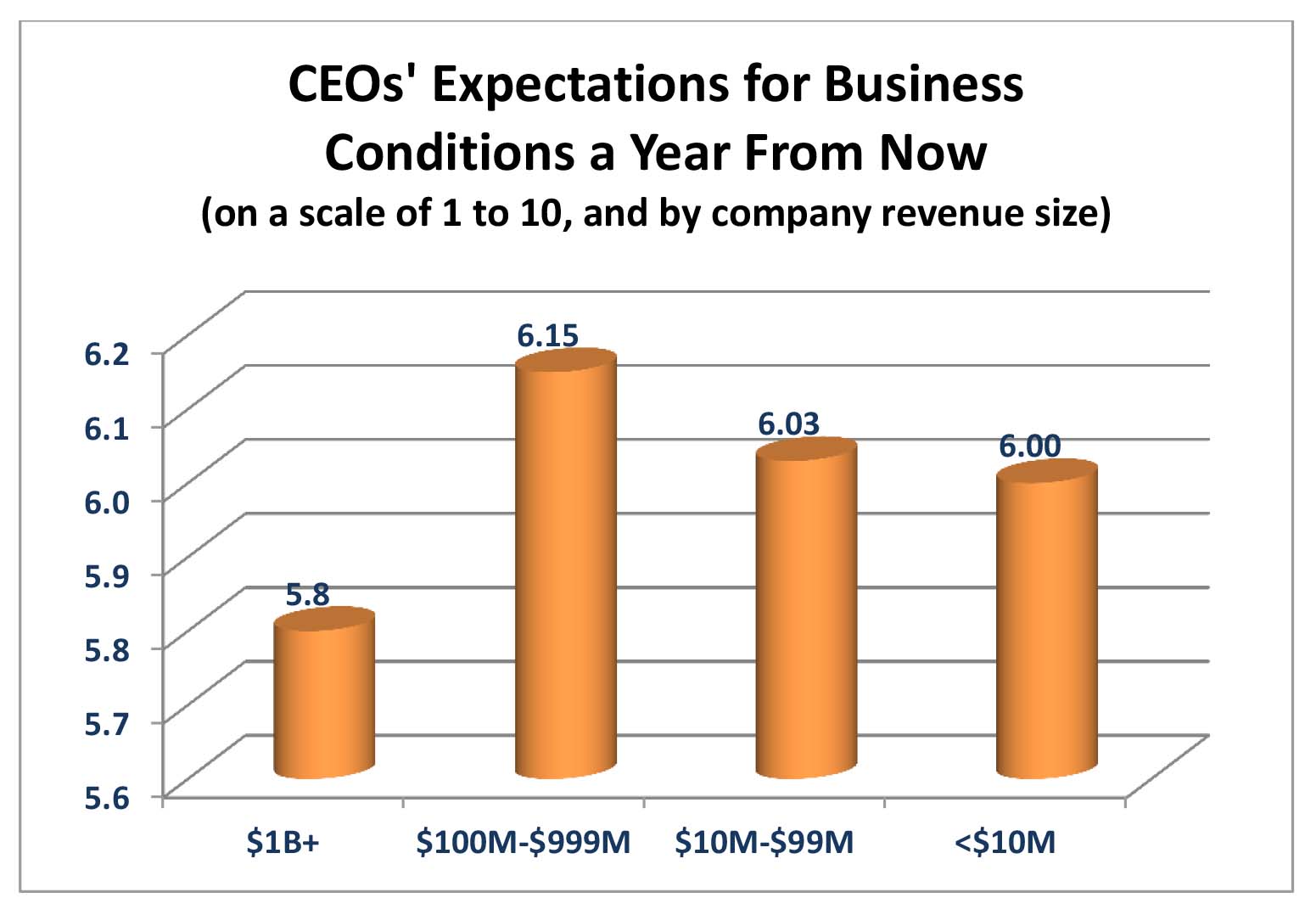

Large company CEOs—who are most exposed to international markets—have the least faith in future business conditions, registering a 5.8 on a scale of 1 to 10, compared with larger mid-market firms, which had the highest expectations, registering a 6.15 out of 10. Smaller mid-market firms were not far behind at 6.03, while small businesses rated their future expectations at 6.00.

Overall, 44% of CEOs anticipate their revenues will increase less than 10% next year, compared with 30% that expect revenues to rise more than 20%.

Overall, 44% of CEOs anticipate their revenues will increase less than 10% next year, compared with 30% that expect revenues to rise more than 20%.

“I don’t see an end in the near future of this weak cycle, as whenever one sector starts to pick up, another slows down,” one CEO said. It’s likely that until the presidential election next year, we can expect more of the same.