Poll: Despite Hype, CFOs Remain Deeply Skeptical Of Cryptocurrencies

Has cryptocurrency gone mainstream? There has been increasing chatter surrounding the use of the digital currency, and many CEOs have been giving it more thought. As bitcoin hit an all-time high at the beginning of 2021 and minted some “bitcoin billionaires,” companies and investors alike are looking to get their hands into the cookie jar. But CFOs are unsure whether the trends will stick, or are even worth the hype in the first place.

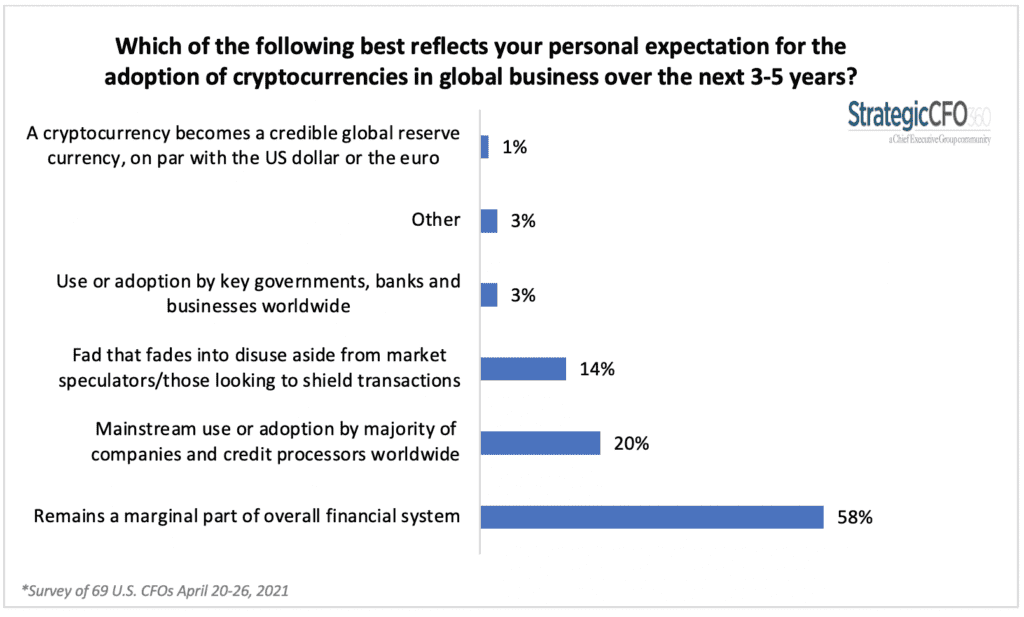

In an April poll conducted by StrategicCFO360’s monthly confidence index, 69 CFOs shared their sentiments about cryptocurrencies, and despite the buzz surrounding bitcoin, ethereum and dogecoin, among others, most CFOs believe that it’s only that: buzz.

A whopping 58 percent of the CFOs polled believe that crypto’s status will not grow in the future, responding that it “remains a marginal part of the overall financial system” when asked, “Which of the following best reflects your personal expectation for the adoption of cryptocurrencies in global business over the next 3-5 years?”

Fourteen percent of CFOs believe cryptocurrencies are a fad that will fade into disuse; the CFO of a small public tech company likened it to the “Dutch tulip craze” of the 17th century, when tulip bulbs reached extraordinarily high prices only to dramatically collapse shortly after. Twenty percent of CFOs who responded believe that various cryptocurrencies will be adopted into the mainstream by companies and credit processors, but not by governments. Nor, they argue, will cryptocurrencies become on par with any type of global reserve currency, such as the U.S. dollar or euro—at least not in the next 3 to 5 years.

“I think it could have a place in a global financial structure, but as it’s unregulated, there will always be mistrust,” says David Buley of the Department of Education, Skills and Employment of Australia, expressing a skepticism he shares with many other CFOs regarding cryptocurrency.

Only 3 percent of CFOs are using cryptocurrency in their company’s transactions. CFOs polled shared that none of their customers have asked them about the use of cryptocurrencies. Despite the lack of customer interest, 12 percent of CFOs are choosing to explore potential uses for cryptocurrencies in company transactions. Eighty-five percent of CFOs surveyed say their company is not exploring the use of cryptocurrency at this time. “The risk is that bitcoin and other cryptocurrencies are extremely volatile,” writes Matthew Scott, in an article on bitcoin strategy in our sister publication Chief Executive. He goes on to explain, “holding them can expose the company to spectacular losses,” a reason many CFOs are steering clear of crypto, at least as far as using it within their company. Of course, there are companies that have decided to give it a chance, such as Tesla, Visa, PayPal and others.

Many companies that have yet to look into the potential of various cryptocurrencies haven’t done so because there is not enough customer demand, according to 82 percent of CFOs surveyed. Aside from the lack of customer interest, 5 percent say their primary concern regarding the use of cryptocurrencies in transactions is that there could be effects to the reputation of the company; another 6 percent are concerned with cybersecurity.

CFOs remain deeply skeptical about the future of cryptocurrency in company transactions, but that doesn’t mean it isn’t on their radar. Some admit they don’t truly understand the currency yet. And as one CFO of a mid-size financial services company warns: “ignore them at your peril.”

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.