With renewed concern about a Fed-induced recession, a string of regional banks teetering on the brink of failure, softening consumer demand and a still-dear labor market that won’t seem to cool on costs, it’s no surprise that when you ask CEOs about their view of business conditions in the U.S.—and what they are doing to mitigate the risks—they’ve curbed some of their recent enthusiasm.

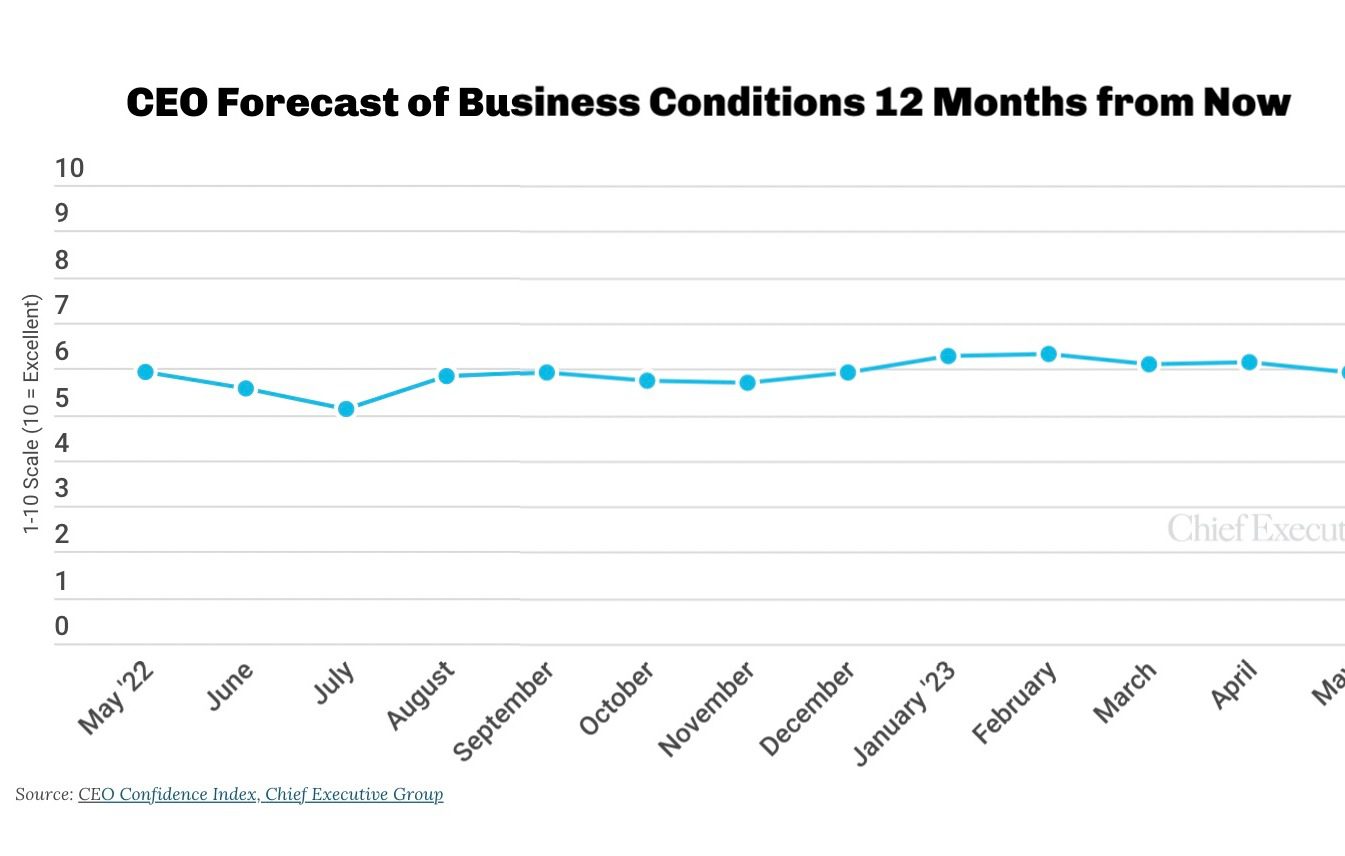

That’s exactly what happened in May. The confidence index we create based on our monthly survey of CEO sentiment for the business landscape 12 months out fell to 5.9 in May (as measured on a 10-point scale where 10 is Excellent and 1 is Poor), a 4 percent drop since we last polled CEOs during the first week of April—and 6 percent off where it started the year.

CEOs’ rating of current business conditions also declined this month, by 3.5 percent, to 5.9 from 6.2 in April—the third such consecutive decline. That rating hasn’t been this low in nearly a year, since July 2022, when a majority of CEOs said they expected the Fed’s decisions to send the economy into a recession.

Persistent concerns over the Fed’s ability to reverse inflation continue to linger, even as concerns rise about a smoldering crisis in the banking sector. CEOs say these events will most likely impact future credit availability, creating even greater uncertainty for the economy.

“Financial recovery will take time. Interest rates will need to come down for the economy to rebound,” said Angela Phillips, CEO of welded steel tubing manufacturer Phillips Tube Group, adding that the election year ahead will add even more volatility to the mix.

The downturn in GDP and persistent inflation are the main reasons Byron Van Epps, CEO at veteran-owned business consultancy ISCI, doesn’t expect any improvement in business conditions for the next 12 months. “As the economy continues to slow, businesses will suffer and continue to eliminate positions well into 2024,” he said.

Not everyone agrees. For several months now, we’ve observed a sharp divide in CEOs’ opinions over what comes next. In May, 34 percent of the 182 CEOs we polled said they expect improvement by this time next year, while another 34 percent said they expect things to get worse—and 32 percent are betting on the status quo.

THE YEAR AHEAD

The proportion of CEOs forecasting increased profitability over the next 12 months declined 8 percent in May, to 52 percent (vs. 57 percent in April), while the proportion expecting revenues to increase during that same period fell 11 percent, to 61 percent (from 69 percent in April).

For the first time since January, fewer CEOs now expect demand to continue to increase in the months ahead (52 percent in May vs. 55 percent in April). While most say demand has so far remained strong despite inflation and increasing rates, they say there are now indicators of buyer hesitancy and spending is beginning to show signs of slowing.

“Companies have trimmed down their capital investments, and high interest rates are postponing making investment decisions,” said the CEO of an industrial manufacturer, who added that wage increases aren’t helping either.

Fifty-three percent of the CEOs we polled said they expect consumer spending/demand to be their biggest challenge over the next 12 months (though interestingly, only 8 percent of financial services CEOs said they were concerned about demand slowing, the one outlier in the survey).

As a result of that—and rising costs—only 35 percent now expect to increase capex over the next 12 months, down from 39 percent in April. That is the lowest proportion since the summer of 2020, at the height of the Covid pandemic.

In response to these forecasts, two-thirds of those polled said they are prioritizing cost containment as their main strategy for the remainder of the year—and hiring is no exception. Despite continued struggles to find—and retain—skilled labor, the percentage of CEOs we polled who plan to add additional staff in the coming months declined sharply. Only 35 percent of CEOs polled in May said they plan to add to their headcount in the coming year. That’s an enormous drop from April, when 53 percent of the CEOs we polled planned to add to their payrolls. The last time that proportion was this low was also during the summer of 2020.

“Labor force issues with turnover and higher wages means hiring less people,” said Bill Block, president and CEO of Blood Centers of America.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/