A year of Fed rate hikes have brought inflation down sharply following a painful period of soaring costs —and subsequent price hikes—for businesses trying desperately to preserve margins. But after last week’s sticky-stubborn CPI readings, the question remains: Have we licked inflation? Is the pricing war over?

The answer, at least so far for 2024, appears to be: “No. But…”

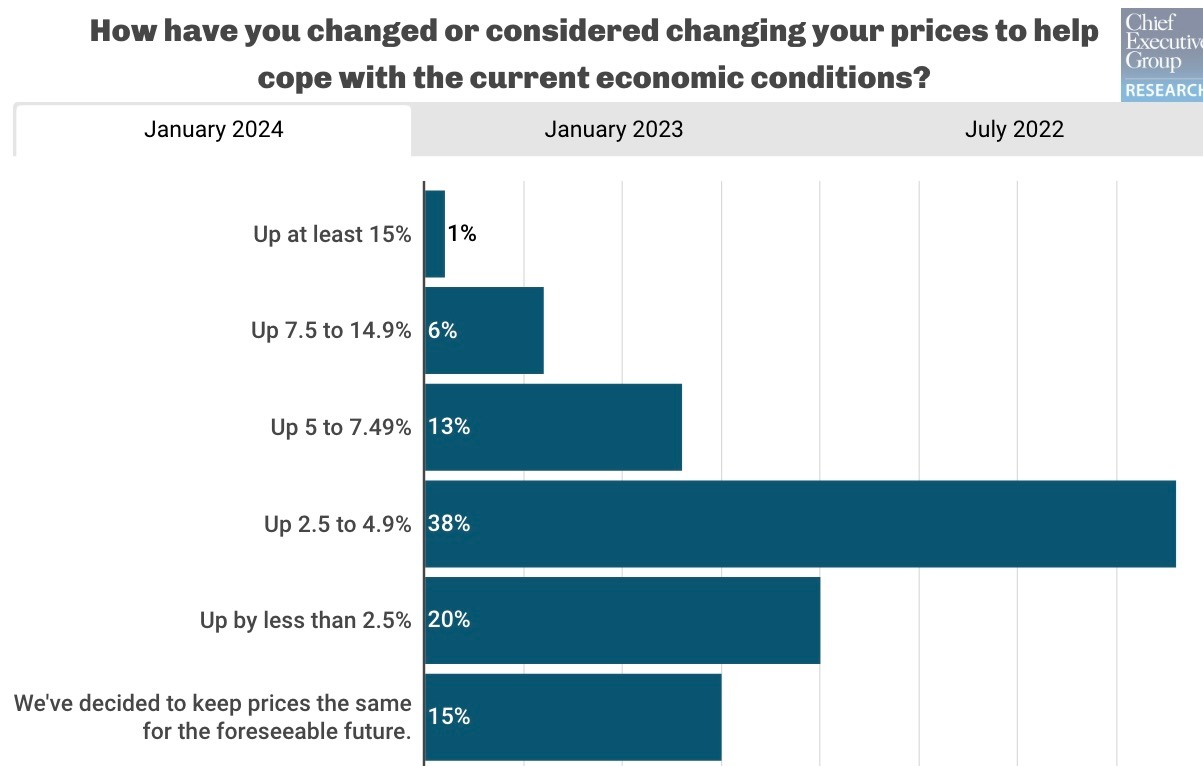

According to a Chief Executive survey of 239 CEOs in January, CEOs are planning to keep price hikes modest in the year ahead, and fewer are electing to raise prices at all since last year. The proportion of CEOs planning to increase prices in 2024 compared to 2023 is down 4 percent to 78 percent—although still one percentage point higher than the 77 percent of CEOs who increased prices in 2022.

This pricing data is part of an ongoing study by Chief Executive Research. We continually survey hundreds of CEOs about the most important KPIs in business. The resulting Financial Performance Benchmarks Report, available to the CEO community for a nominal fee, provides an in-depth look into pricing strategies, departmental staffing costs and turnover ratios, days receivables/payables, R&D budgets and other key performance indicators to help you benchmark your operations against peers and drive growth. (More info: chiefexecutive.net/benchmarksreport/)

In addition to a smaller proportion of companies raising prices at all, the size of price increases has also fallen dramatically since last year. In January of 2023, a whopping 42 percent of CEOs surveyed said they raised or considered raising prices by at least 5 percent, jump forward one year and only 20 percent of CEOs will raise prices 5 percent or more. (In 2022 that same proportion was 56 percent, so we’ve come a long way.)

Instead, this year the majority of CEOs we surveyed (58 percent) will keep price increases concentrated between 0.1 percent and 4.9 percent—that figure was only 39 percent last year—signaling that the rising price spirals of the post-Covid recovery period may finally come to an end.

Price Changes by Size, Industry

When examining the data across company size, by annual revenue, there isn’t a large difference between the proportion that increased prices to any extent since last year and company sizes—except for the largest and smallest companies.

For example, 6 percent of companies with $1 billion or more in revenue decided not to increase prices in 2024, compared to 0 percent last year. And the proportion of companies with less than $10 million in revenue who decided not to increase prices in 2024 is almost 30 percent larger, at 31 percent vs 24 percent in 2023.

This year there are also far fewer CEOs who increased prices by 5 percent or more. In fact, across most company size groups the proportion of CEOs who are raising prices by 5 percent or more in 2024 is less than half of what it was last year. For example, 63 percent fewer CEOs are raising prices by at least 5 percent in 2024 than in 2023 among companies with $25 to $99.9 million in annual revenue. For companies with less than $200 to $999.9 million in revenue that number is 47 percent fewer.

Pricing changes by industry are a bit more complicated. Although the proportion of CEOs who increased prices by 5 percent or more decreased between last year and this year for most industries, there are a few that are still increasing prices quickly. For example, in 2023, 20 percent of CEOs in healthcare said they would increase prices at least 5 percent. Fast forward one year and the proportion is now 21 percent (professional services is the other industry where the proportion climbed slightly).

The proportion of CEOs in construction saw the most dramatic drop in those who increased prices by at least 5 percent, going from 42 percent at the start of 2023, to only 5 percent in 2024, likely due to stabilization in the price of materials.

About Chief Executive’s Financial Performance Benchmarks Report for U.S. Companies

Utilizing data from U.S.-based companies, this annual subscription, delivered in monthly modules, provides an in-depth look into pricing strategies, departmental staffing costs and turnover ratios, days receivables/payables, R&D budgets and other key performance indicators to help you benchmark your operations against peers and drive growth. Learn More >