Is a recession no longer in the cards for 2023? If you ask CEOs of private companies in the U.S., you’d probably get a resounding yes—as we did when we polled 138 of America’s chiefs July 10-13 to ask them about their forecast for business in the year ahead.

The discussion does seem to have shifted away from the risk of a recession, at least for the time being, with very few CEOs citing it as a concern for the next 12 months—but that doesn’t mean we’re in the clear. According to the CEOs polled, there is a new concern on the table: the impact of the Fed’s persistence on increasing rates amid otherwise strong economic conditions.

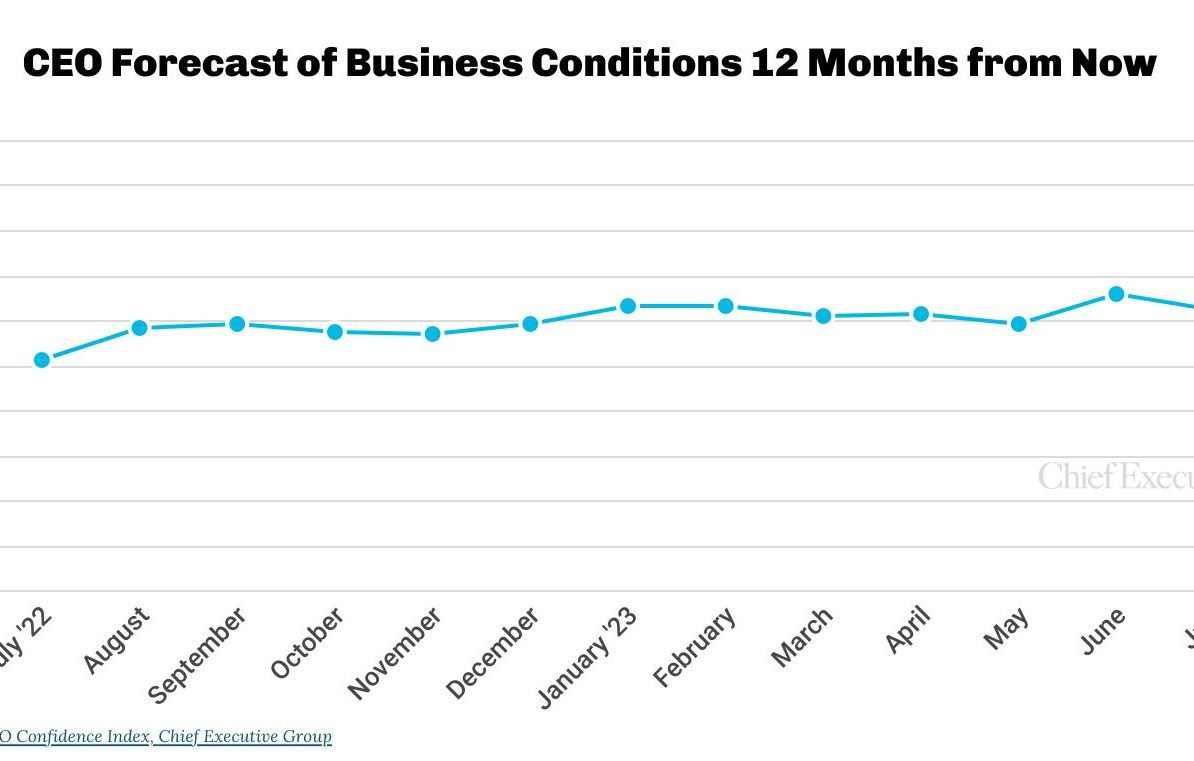

And so, after a 12 percent gain in June that had propelled it to a 12-month peak, Chief Executive’s CEO Confidence Index retracted more than 5 percent in July, falling to 6.2 on a 10-point scale where 10 is Excellent and 1 is Poor.

CEOs’ assessment of the current business environment also declined in July, to 5.9 from at 12-month high of 6.7 in June.

Still, not all of this is gloomy. At that level, the Index, which measures CEOs’ forecasts for business conditions 12 months out as well as their assessment of the current environment, remains well within “Good” territory. That’s because despite concerns over the impact of further rate hikes, CEOs say demand and pipelines are healthy, and costs and supply chains are normalizing.

“The reason I show better [conditions] in 12 months is each month, we continue to see the supply chain and material volatility improving,” said the CEO of a large construction company, echoing general sentiment.

And while labor remains a challenge—with limited supply of skilled employees and high wages—that, too, appears to be easing, CEOs say.

“While there are some clouds on the horizon, the underlying strength of the U.S. economy continues, driven in large part by a combination of continued growth and a tight labor market,” said Terry Keating, the CEO of Access Capital.

Chris Mangum, founder and CEO of Servato Corp., expects that as inflation continues to ease, “which will hopefully allow the Fed to slow rate increases, the market will adjust to the new reality of historically moderate borrowing costs, and business investment will increase reasonably.”

Overall, nearly half of the CEOs polled in July expect conditions to show improvement by Q3 of 2024. That is a significant jump from the month prior, when less than a third had projected things to improve over the same time period.

THE YEAR AHEAD

Despite expectations of slowing demand in the near term, 76 percent of the CEOs we polled this month said they expect revenues to still be up by this time next year (vs. 78 percent in June). After the high reached last month, this proportion is the highest on record since March 2022, when it topped 80 percent.

When it comes to profitability, however, our survey found only 65 percent who expect profits to follow the same uptrend as revenues (down 7 points from 71 percent in June). A renewed uptick in prices is the main factor affecting this forecast. Once again, putting that number in perspective is important, and the last time we found that high of a proportion forecasting an increase in profits (other than June) was also in March 2022.

Where we do observe a fraying is in the proportion of CEOs planning to increase hiring and capital expenditures over the next 12 months. Only 47 percent said they intend to add to their headcount (down from 56 percent last month), and 45 percent said the same of capex (vs. 50 percent last month). The good news in all this, perhaps, is that most do not expect to cut jobs or decrease expenditures either; rather, the forecast is for the status quo for the time being.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/