President Trump’s escalation of the trade fight with China may have spooked global markets, but U.S. CEOs are taking it in stride so far. Chief Executive’s monthly reading of CEO confidence for May—with polling fielded during the first few days of the President’s announcement of additional tariffs—came in at 7.4 out of 10, the highest level so far this year and up 2% since January.

President Trump’s escalation of the trade fight with China may have spooked global markets, but U.S. CEOs are taking it in stride so far. Chief Executive’s monthly reading of CEO confidence for May—with polling fielded during the first few days of the President’s announcement of additional tariffs—came in at 7.4 out of 10, the highest level so far this year and up 2% since January.

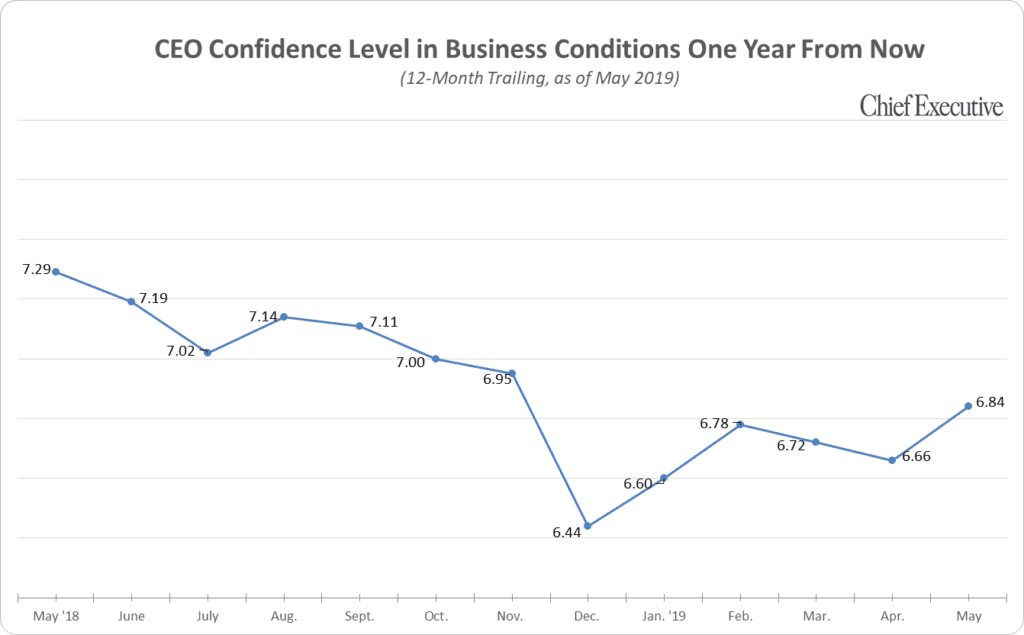

CEO confidence in future business conditions was also up, at 6.8/10, the highest level since last November. The index gained 3% month over month and 4% since January. While both indexes made up some of the ground lost during the past few months, both remain down from where they were last year.

Note: Chief Executive’s CEO Confidence Index is measured on a scale of 1-10. May poll had 260 responses.

Note: Chief Executive’s CEO Confidence Index is measured on a scale of 1-10. May poll had 260 responses.

Surveyed CEOs say positive consumer sentiment, high job creation, continued deregulation, low interest rates, the revised tax law and low unemployment are all reasons why the future business climate is looking bright.

“Reduced regulations and a tax plan that allows for one year expensing of capital goods are sparking terrific business conditions,” says Scott Heim, divisional president of industrial manufacturer Evo, Inc., a division of Middleby Corp. Heim rates both current and future business conditions a perfect 10 out of 10, as he believes productivity gains are the hidden driver behind the economic growth. “Only meddling by politicians (individuals that never had to meet a payroll) could screw up the favorable economic conditions for 2019 and 2020,” he says. While he doesn’t anticipate adding to his workforce over the next 12 months, he expects revenues and profits to be up by more than 20%.

Several of the 260 surveyed CEOs—across all industries—tell us they welcome the strategy employed by President Trump’s administration, justifying the short-term pains with what they expect to be significant long-term gains.

“We are an American manufacturer that has been hurt by subsidized Chinese imports,” says Gregory Owens, co-founder and CEO of Sherrill Manufacturing/Liberty Tabletop. “Things are really looking up for our flatware company, and sales are growing monthly.” He rates current and future conditions 10/10 and 9/10, respectively, expecting revenues and profits to increase by more than 20% over the coming year.

Scott Glaze, chairman and CEO of Fort Wayne Metals, a manufacturer of precision wire-based materials with a presence in North America, Asia, Central America and Europe, says he doesn’t anticipate the current trade events to have a significant impact on future business conditions for his company. He rates his outlook 8 out of 10, saying that while there are significant price pressures, there is a very high demand for the company’s products.

John Danieli, CEO of The Computer Merchant, an IT staffing and solutions company with headquarters in Massachusetts, says that while his company isn’t affected by the recent U.S.-China trade events, there is a risk that clients could be impacted if the equipment buying process slows down, which would have repercussions on the business. He’s not too concerned, though. “I will tell you that I have been hearing positive feedback from many people who I deal with but who are not into politics that they are rather happy President Trump took this position with China as it seems the long-term effect for the U.S. will be positive,” he says.

Jack Zenger, CEO of leadership consultancy Zenger Folkman, says the recent China-U.S. trade dispute doesn’t change his outlook “mainly because Trump does not appear to ever have a long-range strategy in mind. It is short-term, quick, punch, do the unexpected and then move on,” he says, predicting that we will see an end to this conflict as the U.S. presidential election draws closer.

Marc S. Rowland, president of TMPartners, an architectural firm in Brentwood, TN, says he also hasn’t seen any negative implications from the trade events thus far. “Since our firm’s practice is centered in healthcare and other institutional project types, we tend to experience less volatility than some of our peers whose practices are more rooted in residential, commercial or industrial project types,” he says. While he is pleased with the current climate (rating it a perfect 10 out of 10), he says he does worry “about the impacts of the tariffs and the lack of an overall federal strategy,” thus rating his confidence in future business conditions an 8 out of 10.

He’s not alone sharing that sentiment. Other CEOs also told us they are hoping the situation gets resolved promptly so they can move forward with more confidence.

“The recently announced move to 25% tariffs on Chinese products is going to cause business to retreat from new initiatives,” said Tim Zimmerman, president of Wisconsin-based Mitchell Metal Products. “The cost impact is going to be dramatic on first line manufacturers in the U.S., which have to rely on Chinese products for parts they cannot source in the U.S.” While he rates the current environment 8/10, he downgrades his future outlook to a 5 out of 10 for that reason.

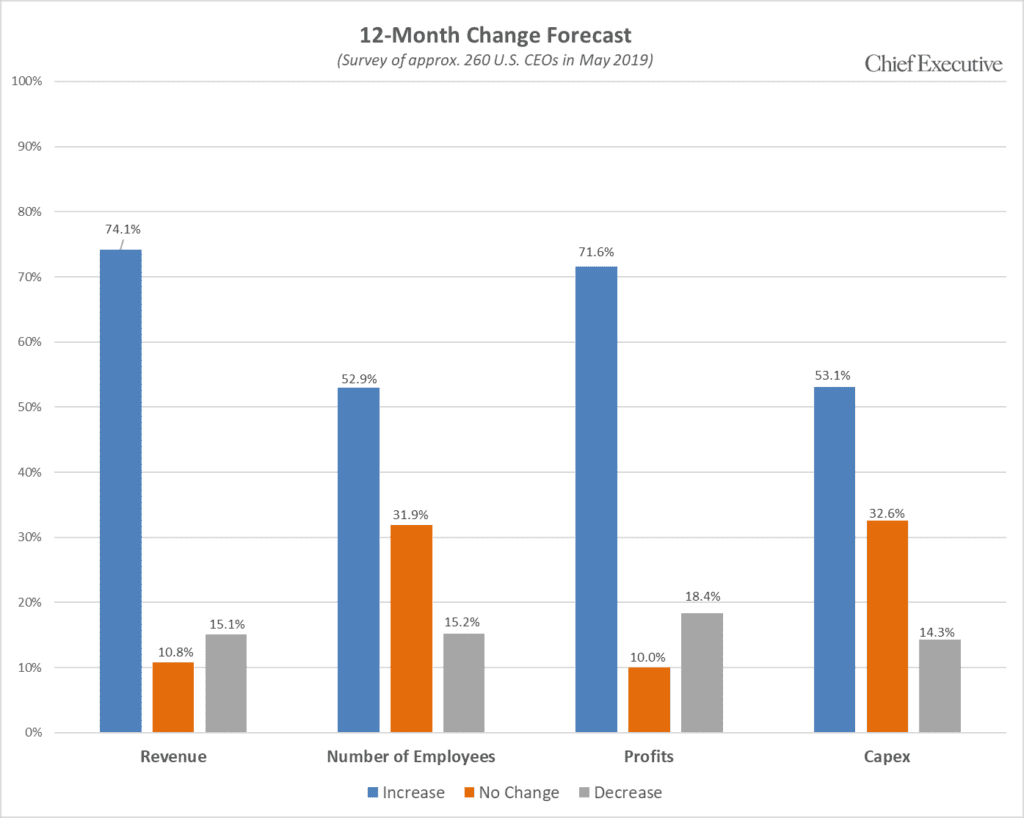

Despite the overall optimism, the proportion of CEOs anticipating increases in revenue, capital expenditures and headcount over the next 12 months fell in May. At this time, 74% anticipate revenues to be up by this time next year, compared to 79% the month prior; 53% expect to add to their workforce over the next 12 months vs. 54% in April; and 53% also plan to increase capex vs. 58% last month.

The only increase this month was expected profits, which 72% of CEOs (vs. 71% in April) expect to be higher at this time next year.

Still Lagging 2018

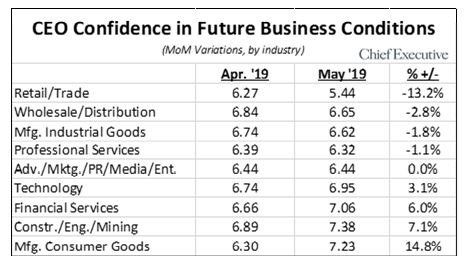

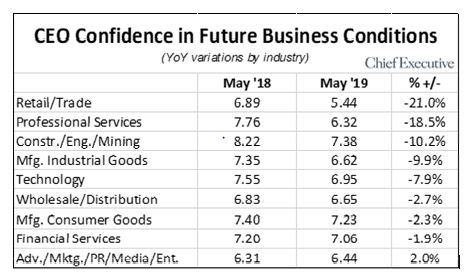

Still Lagging 2018When looking at confidence by industry, it isn’t surprising to see the retail/trade sector at the top of the list of least confident CEOs, having lost 13% in May alone and 21% year-over-year. Tariffs, disruption of international trade, interest rates, excess of supply over demand and taxes on out-of-state sales all figure among the reasons CEOs in that sector say they have downgraded their outlook this month.

There has been an uptick in confidence in other industries, however, particularly in consumer goods manufacturing—up 15% since April. Lower taxes, fewer regulations, robust economic conditions, and growing consumer and business optimism are some of the factors CEOs say are boosting their confidence in the future.

Nevertheless, CEO confidence levels across nearly every sector—except media—are lower than they were this time last year by a considerable margin. Professional services, construction and industrial manufacturing rank among those with double-digit losses in confidence.

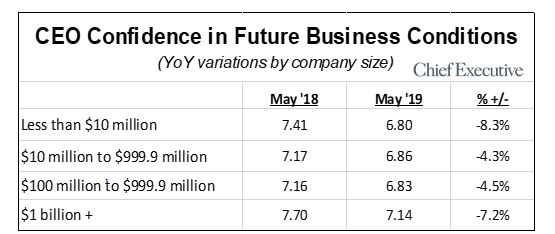

We observe a similar scenario when looking at company size (by revenues). CEO confidence in future business conditions is up across all ranges this month, with the biggest surge coming from the upper middle-market range, where confidence has increased 2% since January.

Nevertheless, on a year-over-year basis, there is still a lot of ground to cover to rebuild confidence, particularly among small and large companies. At large organizations, CEOs tell us that although the new tax law and regulatory relief are supporting their outlook, the talent shortage created by low unemployment levels remains a challenging factor.

For their small counterparts, the trade issues and the political uncertainty caused by the upcoming election are the main reasons CEOs say they are not as confident as they could otherwise be in this climate.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across corporate America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. The results are used as key indicators by media outlets throughout the world.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.