May Poll Finds CEO Optimism At Lowest Level In Almost 6 Years

Another month, another sagging reading for Chief Executive’s CEO Confidence Index, as the nation’s business leaders stare down what they see as a growing—and unceasing—series of headwinds facing the economy, with little optimism Washington can help.

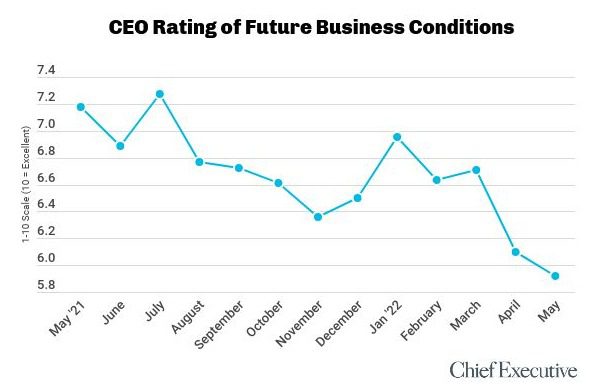

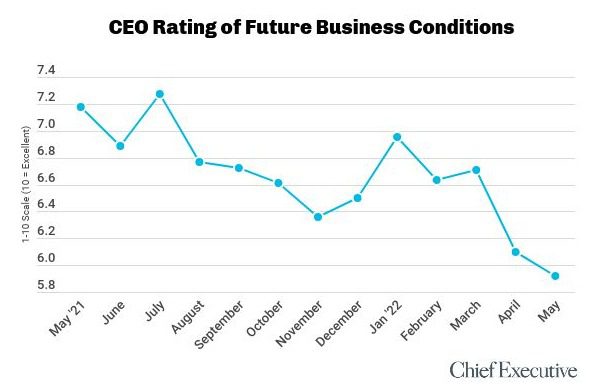

Our May poll of 163 U.S. CEOs, polled May 3-5, found their read on of future business conditions at its lowest level in almost 6 years. The Confidence Index fell by 3 percentage points in May—after a 9 percent drop in April. Their current 5.9/10 rating of future business conditions is 18 percent lower than where it was at this time last year, and on par with the final, chaotic days of the Clinton—Trump election brawl.

CEOs’ rating of current business conditions fell by another 3 percent this month, down to 6.4/10—the lowest level since March 2021, right before states began lifting Covid-19 mandates and vaccinations became widely available.

“Inflation, soon recession,” says Brian Engel, Chair of Strategic International, a small industrial manufacturing company. “Even with a new Congress, we are imprisoned by an administration for another 2 1/2 years of bad policies.” He expects conditions will remain at the 4/10 rating he’s given them currently, labeled at “weak.”

George Bosselman, President at NBII, a business consulting firm ranging from risk to management to law, agrees that business conditions will deteriorate to a 4/10 or “weak” over the coming year, down from his 6/10 rating of current conditions. He reasons that the current environment is “wearing down the consumer buying power”.

Many CEOs also point out the destabilization that the War in Ukraine brings to the global economy. With prices for utilities soaring in Europe and elsewhere, the effects on the supply chain have been damaging for many.

“Rising interest rates, supply chain disruptions, availability of skilled labor, uncertainty in the global economic situation, especially fallout from war with Russia and Ukraine,” lists one CEO of a lumber wholesale/distribution company as his reasons for rating business conditions 12 months out as a 5/10, down from his 9/10 rating of current conditions.

Nonetheless, a smaller proportion of CEOs expect conditions to deteriorate over the next 12 months, down to 46 percent from 50 percent in April, and the predictions of decline are hardly unanimous among those we polled.

The proportion of CEOs expecting conditions to improve remain unchanged since last month, at 27 percent. Now, equal proportions of CEOs expect either an improvement in business conditions or no change.

“Spending is still up, money is available at relatively low rates, inflation will drive efficiencies sure, but things will stabilize,” says Tad Bohannon, CEO at Central Arkansas Water. He expects business conditions to remain the same, at an 8/10 now and in the future.

Gary Minor, Executive Director at 21st Century Leadership Institute, a professional services firm, explains why he believes that conditions will improve from a 7/10 to a 9/10 over the next 12 months, “These are good unemployment numbers, there has been only slight dip in consumer spending despite the highest inflation in decades, and Putin’s destabilization will be over soon.”

For the fifth month in a row, the proportion of CEOs expecting an increase in profits over the course of the next year fell—down 3 percent this month—now at 58 percent. The proportion of CEOs expecting increases in revenues also fell for the fourth consecutive month in May, down 6 percent, now at 70 percent of CEOs. Both proportions are the lowest we’ve seen since November 2020.

The percentage of CEOs planning to increase their capital expenditures has also decreased, down 5 percent since April to 53 percent.

After two months of double digit drops in the proportion of CEOs planning to increase hiring, the percentage is up by 8.2 percent in May. Now, 60 percent of CEOs plan to add to their headcount over the course of the next 12 months, compared to only 55 percent in April.

Ratings for future business conditions varied widely by industry this month, with CEOs in financial services giving conditions the highest rating at a 6.3/10, up 4 percent since April.

“There was plenty of liquidity in 2020 & 2021, the US treasury and the administration printed $6 trillion. High equity reserves, corporate and individual savings. The wealth transfer for the next 10 to 15 years will be in trillions. There will be a return to reasonable IRR/yields to investment,” says George Gelis, President at Surge Financial Group, Inc. He rates future business conditions as a 9/10.

CEOs in real estate who rate future conditions as the lowest of the bunch, giving them a 4/10, are worried about inflation and supply chain issues, as well as a lack of available talent.

One CEO in real estate says, “There is poor productivity due to remote work and hybrid work. All companies have had to expand hiring needs with limited real revenue growth and inefficiencies,” to explain why he rates future conditions as a 3/10.

The rating of CEOs in professional services dropped by 14 percent month over month, due to continued inflation and dampening demand because of higher prices. CEOs in industrial manufacturing also suffered a blow to their optimism, with their rating falling by 7.5 percent since April. They have been navigating rising energy prices, the race for talent and global supply chain disruptions.

“The demand for our product is very strong but the supply chain problems and labor shortage issues are hurting our overall business. Inflation will reduce consumer purchases, so I expect that to hurt our business moving forward into the next 6-12 months,” says the CEO of a food equipment manufacturing company. He rates future conditions as a 4/10, down from the 5/10 he rates current conditions.

When examining CEO optimism by size, it’s clear that the smallest and largest companies are growing the most concerned over the state of business in the future. CEOs’ ratings in companies with less than $10 million in revenues dropped by 8 percent this month and those in companies with over $1 billion in revenues dropped by 9 percent.

Small company CEOs are saying that slight decrease in demand is driven by uncertainties in the future of the economy.

As for large companies, the CEO of a billion-dollar manufacturing firm puts the reasons why he expects deterioration plainly, saying, “The big three: Inflation, interest, disruptions.”

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.